Overview: Betterment Fees and Pricing | All You Need to Know About Betterment Costs

Choosing how and where to invest your money can be one of the toughest choices you make. Maybe you’re new to the process and overwhelmed at the options available to you. Maybe you’re not sure that you make enough money to make investing worthwhile.

Or maybe you’re concerned about the fees that come with trusting someone with your hard earned money.

The good news is that no matter your financial situation, you can still invest well, and it may not cost as much as you think.

Betterment is a financial planning company that offers a holistic approach to managing your finances. Their website states best what they can do for their customers:

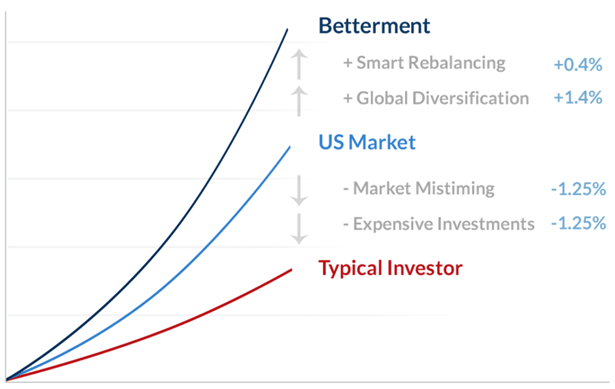

The Betterment portfolio is designed to achieve optimal returns at every level of risk. Through diversification, automated rebalancing, better behavior, and lower fees, Betterment customers can expect 4.30% higher returns than a typical DIY investor.

In layman’s terms: no matter who you are or how much money you have, your wealth will grow faster with Betterment than if you did it on your own. Consider that over time, the costs will be paid off by how much of a return you make on your investment with Betterment.

Image Source: Betterment.com

But exactly how much does Betterment cost, and what are some of the Betterment fees? The answers are simple, and the benefits are ample.

See Also: Top Robo-Advisors (Reviews) | A Changing Trend in the Robo-Investment Field

How Much Does Betterment Cost?

The first thing to know about Betterment is that it won’t cost you a dime to learn from them all about finances; Betterment offers clients and non-clients alike access to free education. Their Resources section provides lots of insights on all things personal finance, including advice about whether to save, invest, or pay off debt or niche information like the nuances of tax loss harvesting.

They also provide white papers and in-depth looks at various areas of finance, including stock allocation advice. These are of course filled with charts and graphs so that even if you’re a visual learner, you’ll be able to find the answers you’re looking for somewhere on their site.

Another of the Betterment cost-free offerings are calculators that will help you determine how much money you can expect in different life circumstances. For example, if you are wondering how much you’ll make via Social Security in retirement, there’s a calculator for that. Another tool helps you determine what’s best for you: a 401(k), IRA, or both.

Making sound financial decisions will always require you to understand what your portfolio is comprised of. This will also help you appreciate the full range of benefits included in the Betterment cost.

What Are Basic Betterment Fees?

Image Source: Betterment.com

But how much does Betterment cost?

Of course, anytime someone is handling an aspect of your life, there will be costs involved. With Betterment, costs are determined by how much money you invest with them. There are three general tiers of costs, but the costs change.

For example, if your account has about $5,000 in it, the Betterment fees will be only $1 monthly at a 0.35% annual price. However, there are still other fees involved in their structure. These prices are contingent upon a $100/monthly auto-deposit. If you choose not to deposit that amount automatically, then your monthly price will go up to $3. Their auto-deposits are set up so that the money will be withdrawn “the first business day after your paycheck is deposited to keep your spending and saving money separate.”

Their higher tier offerings only cost 0.15% maintenance fees; the more you invest, the less you pay in Betterment fees by percentage.

Don’t Miss: Best Online Financial Advisors (Human Advisor, Robo-Advisor, and Hybrid)

What Are Other Betterment Fees?

In addition to monthly maintenance, there are other Betterment fees to consider. Their site breaks these down in their FAQ section. Here’s what they explain:

For those clients with pricing 0.15% to 0.35%, every three months Betterment charges 0.0375% to 0.0875% based on your average balance for the period. If you withdraw all of your money before the end of the quarter you are charged a prorated fee only for the days your money was managed by Betterment.

In other words, what you are charged in monthly fees isn’t necessarily 0.15% or 0.35%; those numbers are instead what you are charged quarterly. Your money is yours to keep, though, no matter what, so if you choose to not invest with Betterment anymore, you can take your money out at any time.

For example, if you invested your money in January, and you want to take it out before the fiscal quarter concludes at the end of March, then you will only be charged for the days that that Betterment managed your funds.

The fee structure doesn’t change between pricing tiers. No matter if you have $20 or $200,000 invested with Betterment, your money is yours to withdraw whenever, and you’ll only incur Betterment fees for the time they worked to grow your money.

What’s a Breakdown of Betterment Pricing?

Now that you understand the fee structure, let’s break down a very simple way to learn about overall Betterment pricing. They have three main categories that people can fall into; the first have account amounts ranging from $1 to $10,000. Following that, the middle pricing tier is $10,000-$100,000. The largest tier of investing is anything over $100,000.

Here’s a simple table to break down how Betterment pricing works:

ACCOUNT BALANCE | $0-$10,000 | $10,000-$100,000 | $100,000+ |

| Annual Fee | 0.35% | 0.25% | 0.15% |

| Monthly Fee | $3 | N/A | N/A |

You’ll notice that monthly fees are not offered for the upper two tiers, nor is there a requirement that you must deposit a certain amount of money monthly. This is because with accounts this size, there’s enough money to make it worth their time to find great investments for you.

With that said, even if you only have $20 in your account, they’ll still make great investment choices for you, but it may take more work on their end, and that’s why the monthly fee is proportionately higher than if you agreed to the $100 auto-deposit option.

Also, don’t forget that if you fall into the second or third pricing tier, you can still withdraw your money at any time with no Betterment fees, and they’ll only charge you a prorated amount for the number of days that your money was invested with them.

Related: Betterment vs. Wealthfront vs. Vanguard – Ranking & Review

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Other Benefits Do You Get from Betterment Pricing?

In addition to the wide variety of resources available to you, Betterment pricing gets you lots of other perks, too. They have been called the “Apple of finance” thanks to their easy-to-use interface and user experience. There’s also a Betterment app which is available on all devices, including tablets and iPads. This means that no matter where you’re traveling, you can always check on how your investments are doing.

This interface also allows you to see how your overall financial situation is and gives your real time projections about ways to make your money work for you. You can test what level of stocks and bonds your portfolio can tolerate and whether you’re too conservative and can invest more money elsewhere.

Through their sliding bar technology, you’ll be able to see how each type of investment change will not only make your portfolio more moderate, conservative, or risky, but you’ll also be able to see how your money is going to be affected by taxes. This will help you plan how much you can afford to invest, especially when tax season comes around.

In that respect, this is a way that, despite Betterment fees, they’ll help manage your funds down the road.

Image Source: Betterment.com

Betterment also offers end-to-end investing, which they simply explain as:

By handling every part of the investment process we provide the best possible experience to customers. This means some of the fastest cash transfers in the industry, tax forms available at the earliest possible date, and tighter security because of less exposure to third-party risk.

So, by paying the monthly Betterment fee, you’re able to get lots of data and support that will help you make the smartest financial decision possible.

Conclusion About Betterment Fees

Unless you make a living following the stock market and trading, investing may seem like a chore to you. But it’s a very important part of making sure that you’re financially prepared for retirement so that you’re able to live out your golden years exactly the way that you want to.

The problem is that there are so many investment firms out there, how do you know if Betterment is the one? Well, you don’t know that. However, what’s clear is that Betterment pricing allows an investor with any size bank account to start preparing for his or her future. Betterment fees allow that to happen with a minimal cost to you.

Popular Article: Best Online Investment Companies | Review and Ranking for Online Investing

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.