Guide: Top 7 Ways to Apply for a Start-Up Small Business Loan

If you are looking into how to get a business loan for your small business, it is important to start preparing before you start looking. This article will help explain the steps for getting a business loan so you can better prepare for your business’s financial future.

Securing funding for small businesses can be the maker or breaker of their futures. Some rush into starting a business with no business lending and inevitably fail because they did not have a solid financial ground to stand on. Others look for fast business loans to get a business up and running without a solid business plan.

Source: BPlans

Either scenario can lead to business failure. It is important to have set goals and a solid business plan before you begin looking into how to get business loans. Without a plan, there is no way for you to know how much you need when applying for a business loan.

Therefore, take the following steps that teach you how to apply for a business loan by being thoroughly prepared and understanding what you need for your business and from your funding.

See Also: Top Lenders for Veterans | Best Personal and Small Business Loans For Veterans

Bootstrap or Small Business Loan?

There are two main types of financing for small businesses: Start-up business loans and bootstrapping. Which one is better for your business? Deciding this is something you should do before learning how to apply for a small business loan.

Bootstrapping your business is the process of funding it without the need for business start-up loans. You can bootstrap your business in a number of ways—really, anything that leads to cutting back on expenses and creating your own funding can be considered bootstrapping.

For example, crowdsourcing is a way small businesses can raise money without getting into debt with funding for small businesses. Or, you can consider using a home office rather than paying for an office space until your business grows. Either way, you are funding your business without creating debt.

But, bootstrapping a business can take a long time, especially if you had little to no funds to get you started. Getting a business loan is a good option for those who do not have a lot of people to help financially, have little money saved, or want to get their business started more quickly.

If you feel that start-up business loans might be the choice for you, let’s look into how to apply for a business loan.

How to Apply for a Small Business Loan

Learning how to get business loans is not tricky, but it can take some time and careful planning. And it should take very careful planning. After all, you will want to make sure your business lending will be enough to cover your immediate costs while also providing some for the future.

Do you have set goals for your business? Do you have a detailed business plan? Do you know how much funding for small businesses costs or how much time the process takes? Before applying for a business loan, read through the following 7 steps that will get you from start to finish of the business start-up loans process.

1. Develop a Business Plan

Before learning how to get business loans, you need to know exactly what you want for your business. You should have a detailed business plan in place before you begin the process.

Source: BPlan

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What does a business plan need to stand out when getting a business loan? A good, concise business plan should detail your objective for the business and your plan for it for at least 3 to 5 years in the future. You should also include the following important information:

- Summary: This should include a summary of your business and your goals. Make this stand out for better chances of fast business loans.

- Company description: Include information about your company niche and what makes your business unique.

- Market analysis: This section includes information about your competitors within your niche and how successful this niche has proven to be. When learning how to get a business loan, you should know that it is important for lenders to know about your competition.

- Organization structure: Will your business have high management and several employees, or just a few employees? This will also have information about ownership of the company.

- Product/service information: Whether you are selling products or offering services, you should detail what you offer in your business plan.

- Marketing: How do you plan on marketing your business? Do some research on marketing potential in your niche and outline your ideas.

- Potential funding needs: This area is especially important if you are learning how to apply for a small business loan. Lenders will want to see your financial needs and how you plan on using the money.

- Financial projections: When applying for a business loan, lenders will want to see how much revenue your business can potentially have so they can get a better idea of your ability to repay.

When you present a detailed business plan to a potential lender, you not only seem more professional, but you will also stand a better chance at getting a business loan.

Don’t Miss: Affirm Reviews | What Is Affirm and Is It Safe to Use? (Affirm.com Loan Reviews)

2. Determine Eligibility for Startup Business Loans

As with any loan, start-up business loans have eligibility requirements that you must meet. If you research and find some business loans you are interested in, you should look into how to apply for a business loan with that particular financial institution.

Small business administration (SBA) loans, for example, have certain requirements that would make them a less-than-ideal option for start-up business loans. For SBA loans, you need to have been in business at least 2 years, have a profitable business, and usually have a 10% down payment.

How to get a business loan when you are a small, start-up business? Most small business loans still require a good credit score and some revenue that you can prove. Double-check the requirements first before getting too far into the qualification process to save yourself time.

Related: Avant Reviews—Get All the Facts Before Getting an Avant Loan

3. Gather Your Information for Business Start-Up Loans

You will see when researching how to get a business loan that you will inevitably need a lot of information to provide prospective lenders, more than personal loan lenders typically request. This is, in part, due to business lending being higher amounts than personal lending, and lenders want to ensure that your business will have enough cash flow to fund the loan.

Source: GB Times

Before getting a business loan, gather your necessary information and organize it to streamline the process as much as possible. Most start-up business loans will require some, if not all, of the following information:

- Business licenses, if applicable

- Personal and business tax information

- Personal and business bank statements

- Income statement and revenue information

- Detailed financial projections

Come prepared when getting a business loan and bring even more information, if you have it, than the minimum. This will show lenders that you know how to get a business loan and that you are serious about doing so.

4. Research Financial Institutions for Business Lending

Sometimes, looking within your community is the best way to find funding for small businesses. Small, local banks are usually more willing to assist small-business owners with getting a business loan than larger banks are.

But, do you know how to get a business loan with a particular bank? What are the things you should look for when researching potential lenders? If you are interested in a SBA loan, you can specifically search for SBA-preferred lenders that offer SBA loan options.

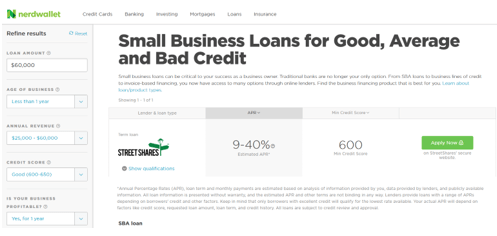

Image Source: How to Get a Business Loan

However, if you do not qualify for an SBA loan and, instead, need start-up business loans or small business loans, consider using a tool like NerdWallet’s Small Business Loans finder. Here, you can input some important business information, like how profitable your business has been and how long you have been in business, and compare start-up business loans based on your funding needs. The tool takes your needed loan amount and credit score in mind when it gives you your results.

From here, you can learn more about each lender and find out how to get a business loan through them by visiting their website.

5. Consider the Help of a Small Business Association

If you require assistance with how to get a business loan or just want an extra set of resources, consider using a small business association for help. Whether you are interested in an SBA loan or getting a business loan for your new business, there are several small business associations that can help guide you through the process.

Small Business Development Centers (SBDCs) offer several free services to help you succeed in your small business endeavors. If you are having trouble qualifying for startup business loans, for example, a SBDC might provide free consultations to help you understand what you can do to get approved or point you in the direction of a lender that can help you.

America’s SBDC website provides a SBDC office locator for you to find a location near you.

Popular Article: PersonalLoans.com Reviews—Get All the Facts before Using PersonalLoans.com

6. Provide Collateral for Fast Business Loans

Getting a business loan may require you to provide something for collateral, especially if you are a brand-new business with no revenue looking for fast business loans. Before looking into how to get a business loan from a specific lender, you should come prepared with potential assets to negotiate as collateral.

For business, collateral can be anything from some of your inventory to equipment to your business location. Lenders want something of value to back up their funding in case your business fails to make enough profit to repay start-up business loans.

If you are not sure if your lender requires collateral, it is best to come prepared with a plan for collateral anyway. This will show your lender that you have every intention of paying your loan and you are serious about getting a business loan.

7. Complete the Necessary Paperwork

Once you learn how to get a business loan and make it through the qualification process, it is time to complete your loan paperwork. This can be time-consuming, so make sure you set aside a period of distraction-free time to focus on your paperwork.

If you are applying for an SBA loan, you are required to complete several forms specific to SBA loans, such as a Statement of Personal History and a Personal Financial Statement.

Your start-up business loans lender may also require paperwork specific to your loan and the lender. Make sure you quickly contact the lender if you are confused about any of your paperwork, and be readily available to the lender should it need any more information from you during the paperwork process.

Free Wealth & Finance Software - Get Yours Now ►

Conclusion

Getting a business loan can be a lengthy process, but it is worth the wait if you do not have the ability to bootstrap your business. Before you research how to get a business loan, ensure that you prepare your paperwork and business plan so you will be ready to meet with potential lenders when the time comes.

This article, “How to Get a Business Loan | 7 Ways to Apply for a Start-Up Small Business Loan,” provided the steps you should take to find a potential loan for your business. We hope it will help guide you through the business loan process. Please contact us with any questions and comments!

Read More: OnDeck vs. Kabbage Comparison & Ranking (Kabbage Competitors)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.