Overview: How to Open a Business Bank Account

As a business owner, one of the most important elements which will allow your business to run smoothly is having good financial standing. A business bank account is a way to set that path.

Any good businessperson will look into how to open a business bank account.

It doesn’t matter if you’re a sole proprietor or an LLC – you need a proper business bank account to separate your personal finances from your business finances.

But what is needed to open a business checking account? And how do you open a business bank account? We’ll address these questions and more in our review of how to open a business bank account.

How to Open a Business Account Guide

Why You Need a Business Account Versus a Personal Account

Before we even get into how to open a business bank account, it’s important to understand why opening a small business bank account is necessary instead of using a personal bank account.

According to the Internal Revenue Service (IRS), it’s important to keep good financial records to help you “… monitor the progress of your business, prepare your financial statements, identify sources of income, keep track of deductible expenses, keep track of your basis in the property, prepare your tax returns, and support items reported on your tax returns.”

That being said, having one source of business banking records is much easier to sort and identify income and expenses than trying to sift through your personal records as well.

A business accountant should not be sifting through personal finances. Keeping your personal account separate will be helpful should your business be subjected to an audit, and it also limits your personal liabilities. While researching how to open a business account, you should find more indicators about keeping your personal account separated.

Another reason that opening a business checking account is a good idea, instead of using your personal account, is the potential of business account perks. We’ll discuss more of these perks before going into how to get a business bank account set up.

Those looking to see how to open a business account, know that business banking is a different ballgame compared to consumer banking. A business banking account manager has the expertise and knowledge regarding these types of accounts.

See Also: How to Get Free Business Accounts and Business Checking for Free

Additional Perks of Opening a Business Bank Account

As mentioned above, opening a small business bank account does have its rewards. Just as with a personal account, you can, of course, pay your business bills online via your smart devices and computer. For those of you interested in how to open a business account, having certain rewards will make or break your decision of which banking institution you wish to do business with.

To keep a good financial history and stay on track of things, automating your bill payments is a great idea, and your business bank account can be set up to do so. This could include things such as paying office utilities, your leased equipment, and Internet bills. Look for banks that offer these services and look for that information in the banks’ FAQs on how to open a business bank account.

Although there are other options as far as accepting debit and credit card payments, your business bank account could allow you to approve or decline these payments as well. This is a great way to ramp up your sales because customers can easily purchase from you. You’ll also find plenty of information out there on the Internet regarding more perks while digging deeper into how to open a business checking account.

ATM Accessibility for Small Business Bank Accounts

Another important factor, when learning how to open a business bank account, is the accessibility of ATMs in your area. In Roberg Tax Solutions’ funny but down-to-earth post of ATMs and the IRS: Why Your Business Shouldn’t Take Cash out of the ATM, it explains how you could get into serious trouble by taking money out of the ATM. While it is best to leave some of the ATM banking alone, you may need the option available for cash deposits.

As you can see in the above image, branch and ATM locations should be an important factor when deciding how to open a business bank account.

Don’t Miss: Everything You Need to Know About Creating a Professional Business Email Account

Where Do You Apply for Your Account?

As a business owner, you don’t have much time on your hands. You can’t send any employee out and tell him/her how to open a business bank account for you either. Most business checking accounts can be opened online or even via phone.

To ensure that you are opening the right account for your business, an in-person meeting with a business banking manager is best.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What Banks to Consider When Opening a Business Checking Account

When researching how to open a business account, you’ll find that there are thousands of banks across the United States. What bank is right for your business? There are many factors to consider, such as opening fees, accessibility of ATMs, trusted advisors readily available for you, and other products and services.

Investopedia identified four of the best checking accounts for small businesses as being:

- Bank of America – Bank of America has two main business checking account types which do have fees, but there are a few options for how to waive those fees. You can also integrate QuickBooks with both the Business Fundamentals and Business Advantage accounts. You can open a Business Savings Account with no additional fees. Look into your account type options on how to open a business checking account with Bank of America.

- Citi has four business checking account types: Checking Account, Streamlined Checking Account, Flexible Checking Account, and Interest Checking Account. For those opening a business checking account, Citi’s Streamlined Checking Account seems to offer a great value for small business owners, allowing 250 monthly transactions, overdraft protection, QuickBooks connection, and a debit card.

- Wells Fargo – When trying to figure out how to set up a business bank account, Wells Fargo has a simple checking account structure. To help your basic business needs, its business Choice is a great option. It only takes $50 to open this account.

- PNC Bank – PNC allows easy methods to open a business checking account for as little as $100. You can waive its $12 monthly maintenance fee by holding a balance of $1,500, or you can make eligible purchases on its business credit card. You can also check out its Business Checking Plus or Business Checking Preferred.

For more business checking accounts, NerdWallet has a listing of free business checking accounts by state. We were surprised to see some larger banks included, like:

- Navy Federal Credit Union

- U.S. Bank

- Huntington National Bank

- First National Bank of Omaha

Now that we’ve identified a few business banking options, it’s time to see what is needed to open a business checking account. We’ll start with the deposits and fees and then move on to the documentation needed for opening a small business bank account.

Related: Business Analyst Job Description

What Are the Costs Associated with Opening a Business Checking Account?

Each bank has different requirements on how to open a business account, and many of them offer free business checking accounts. For those wondering how to open a business checking account, there a few catches. One catch is keeping a specified minimum balance or being limited to a number of transactions.

You’ll find that, on average, you can expect to pay $8–$12 per month in fees. These fees are often waived by keeping a specific average monthly balance and maintaining a minimum monthly balance. Fees are also waived for using business debit cards, participating in specified services, and having combined assets at the particular bank.

In its Best Small Business Checking Account article, FitSmallBusiness outlines a few ways to achieve free business checking accounts.

To open an account, you may or may not need an initial deposit. However, for some of these, you’ll find that opening a business checking account can be done for as little as $25.

Wells Fargo requires a minimum opening deposit of $50 for all of its business checking accounts. PNC has low opening deposits starting at $100. First National Bank does not require a minimum deposit.

Initial Documentation Needed to Open an Account

What do I need to open a business bank account? That’s a major question that requires your banker’s help to answer. Having the proper documents available is also extremely important when opening a business checking account. Most local and national banks are going to ask for particular documents, which include two main documents:

- Authorization for Information and Certificate of Authority – This is used when opening a small business bank account. This document authorizes a financial institution to check your credit history.

- Certification Regarding Beneficial Owners of Legal Entity Customers – You’ll complete this document to certify the owners are operating as a legal entity.

These two documents help the federal government fight against money laundering as well as the funding of terrorism on U.S. soil. Your name, date of birth, and address are a few of the things verified on these forms.

Your Business Type Matters for Opening a Small Business Bank Account

For those looking to answer the question, “What do I need to open a business bank account?” it varies from bank to bank. Depending on the type of business you have, additional documents will be needed, such as your Social Security number and Tax Identification Number.

Different business types include:

- Sole proprietorship

- General partnership

- Limited partnership

- Corporation

- Professional corporation

- Unincorporated association

You may need to complete additional documentation showing your partnership agreements and registered name if you’re doing business under a different name. This is known as a “Doing Business As,” or DBA name.

Per the U.S. Small Business Administration (SBA), there may be stricter regulations when opening a business checking account online. It depends entirely on what type of business you have.

The SBA identifies the types of businesses in its How to Open a Small Business Bank Account article. “For example, if a company provides money services, including check cashing, issuing money orders, issuing store value cards, exchanging currency, or wiring funds in exchange for a fee, banks will not allow you to open an account online.”

Also “…telemarketing, precious metal dealers, gambling, and government entities” may require you to go into a bank before opening a business checking account.

Popular Article: Best Ways to Open a Business Checking Account Online

How to Set up a Business Bank Account

For those wondering how to open a business checking account, after identifying which bank you want to do business with, determining how to set up a business bank account is the next step. First, go to the bank’s website and complete its business checking account application.

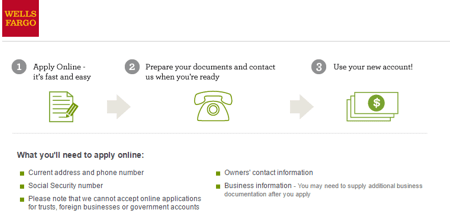

Keep in mind that some banks, such as Chase, require business checking account customers to come into a local branch. Other options, such as Wells Fargo’s Simple Business Checking Account, allow you to apply online. Wells Fargo identifies exactly what you’ll need to get started.

Simple Business Checking Account

While comparing your options regarding how to open a small business bank account, most processes begin online. PNC Bank allows you to start the application process online. A business banker will call you and ensure your application is completed accurately. Confirming that you are signed up for the right business-checking product also takes place.

Lastly, you’ll go into a local branch to complete the paperwork in person. You will notice while researching how to open a business checking account, that many banks use the same or similar process.

Once you do have your business checking account set up, take all your paperwork with you and place it in the safe of your business for access later on. The paperwork has the routing and account numbers listed.

Some banks issue business employee debit cards so you can easily track your employees’ spending habits. There is paperwork involved with additional information regarding how to open a business checking account.

Finally, if an initial deposit is required, be sure to submit that. Some banks allow you to use a credit card to start the initial deposit.

After successfully learning how to how to open a business account, either online or in-person, you’ll need to meet any additional requirements to keep the account open or avoid monthly maintenance fees.

Read More: Best Small Business Loans for Women

Problems You’ll Incur Opening a Business Checking Account

You must complete your checks and balances before opening a business checking account. An established Tax Identification Number (TIN) is needed. A TIN is required to prevent the use of personal Social Security numbers for business purposes.

You’ll also need an Employer Identification Number (EIN) if you have a business. An EIN is also required for businesses with employees.

A business license is required with the names of the business and its owners listed on it. A business license makes you accountable for all actions and keeps track of expenses for tax purposes.

Your business checking account application can be denied if you’re missing any of these documents. Create a checklist on how to open a business checking account to ensure you have all your documentation.

In a Nutshell – How to Get a Business Bank Account

We’ve identified how to get a business bank account, and we’ve also identified what is needed to open a business checking account. With various online options and in your local community, there is no reason why your business should not have a business bank account established.

Image Sources:

- https://pixabay.com/en/american-bills-business-cheque-1239040/

- https://www.wellsfargo.com/biz/checking/simple

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.