2017 Guide: 6 Best Ways for You to Find the Best Mortgage Amortization Calculator & Schedule

When you’re deciding on which mortgage to pick to finance your home purchase, it’s a good idea to calculate what your monthly payments will look like while you’re paying off the debt on your home.

You can speed up the process of calculating your periodic mortgage payments by using a mortgage amortization calculator (which is also referred to as a mortgage amortisation calculator). But how do you find a reliable mortgage calculator with amortization?

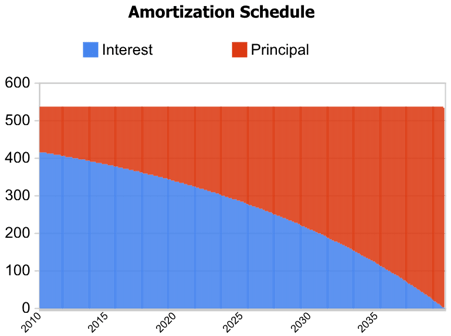

Image Source: Mortgage amortization chart

This guide for finding the best mortgage amortization calculator will help you determine the benefits of using one while also teaching you some tips on finding a reliable mortgage amortization calculator so that you can have a better understanding of what your monthly mortgage payment will look like.

Let’s discover how to find a mortgage amortization calculator and learn about the advantages of using a mortgage calculator with amortization.

See Also: The Best Home Equity Calculators & Equity Line of Credit Calculator Websites

What People Want to Know About Finding the Best Mortgage Amortization Calculator & Schedule

Finding out how to calculate monthly mortgage payments is a concern for many individuals looking for a mortgage amortization calculator.

Here are a few questions circling the Internet regarding finding a mortgage amortization calculator:

What can you do with a mortgage amortization chart?

Does a mortgage calculator with amortization schedule make it easy to see how much of your monthly mortgage is going toward the principle payment of the home?

- What is a mortgage calculator with amortization schedule?

- What does a mortgage amortization formula consist of?

- How do you find a mortgage amortization table?

- What are some tips for finding the best mortgage amortization table?

- What is included in a mortgage amortization schedule?

- How do you make a mortgage calculator amortization chart?

What Is a Mortgage Amortization Schedule?

If this is your first time looking for financing for your home, you may be wondering, “What is a mortgage amortization schedule?” This is understandable because the phrase can sound confusing if you’ve never heard of it before now.

To understand what a mortgage amortization schedule is used for, it’s best to understand what the phrase “mortgage amortization” means.

A simple way to think of a mortgage amortization is that it is a secured debt you are paying that is the total of an interest payment and a principal payment. This is different than an unamortized mortgage, which essentially is an interest-only loan that you pay interest for a set timeframe before you pay down on the principal of the house. Each time you pay toward the principal of your mortgage payment, you are building equity in your home so that you own the property.

A mortgage calculator with amortization makes it easy to pinpoint what to expect to pay at a given point in time. Not all mortgages are the same. If you decide to go for a fixed-rate 30-year mortgage, your payments may seem high if the current interest rates drop below the interest rate that you locked the home in on when you first purchased the home.

On the other hand, if you opt for a 15-year adjustable rate mortgage or ARM, your interest rate may appear low in the first year but higher in the next year. Therefore, it’s advisable reference a mortgage calculator amortization chart.

There are a number of line items that are included in a mortgage calculator amortization chart, but it will also depend on the source you use.

For example, the amortization schedule calculator provided by Bankrate uses the line items of mortgage amount, mortgage term in years or term in months, interest rate per year and mortgage start date to determine the monthly payments of your mortgage. On the other hand, Bloomberg’s mortgage calculator amortization chart also includes points as a line item to assess.

Don’t Miss: Average Accounting Costs & Accountant Fees | Detailed Review

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

The Benefits of Finding the Best Mortgage Amortization Calculator & Schedule

There are several benefits to using a mortgage calculator with amortization. Here are a few you can consider to see if using a mortgage calculator with amortization using is right for you:

- It’s easy to see how much of your payment will go toward the principal of your house.

Image Source: Amortization table mortgage

When you use a mortgage amortization table, you can quickly view how much of your monthly mortgage payment is going toward paying off the debt that you owe on your home versus how much you are paying toward the principal payment.

When you have a clear vision of what you are paying, you can make a better decision regarding whether or not the loan is worth taking on for the long haul.

A mortgage amortization table helps you to make these decisions quickly because you do not have to take a long time to calculate each payment by hand or with a basic calculator.

- Using an amortization mortgage calculator provides convenience.

Your life is busy enough as it is, but when you throw in shopping for mortgage payments, you are adding one more item to your to-do list.

However, if you opt to use an amortization mortgage calculator, you can take advantage of the convenient dashboards and clear calculations that an amortization mortgage calculator can provide. Also, you can save time on trying to calculate each one of the monthly mortgage payments.

- An amortization mortgage calculator can help you determine if you should refinance your home.

If you already own a home, a table can help you determine if it’s time to refinance your home for a better interest rate. The goal of homeownership should be to pay off your home as early as possible so you don’t have to pay so much in interest. However, not everyone has the luxury to do so.

- A mortgage calculator with amortization schedule helps you see the relationship between the interest rate and principal of your home loan.

When you use a mortgage calculator with amortization schedule, it’s easier to view how the principal of your loan and the interest rate relate to one another. A mortgage calculator amortization table demonstrates the relationship between the interest rate and loan principle by breaking down where the percentage of each mortgage payment goes. Each time you make a payment, it reduces the amount of interest you owe on the loan.

- A mortgage calculator amortization table shows how quickly you can reduce your interest payments.

When you use a mortgage calculator amortization table, you can quickly see how fast you can lessen the payments of interest that are part of your monthly mortgage payments. The other great factor about using a mortgage calculator amortization table is that it also shows a breakdown of the percentage going to the principal payment of the loan.

Unlike an amortization table mortgage, mortgages that are unamortized, such as interest-only mortgages, will not show your payment percentages because all of the payments for the mortgage are either satisfying the interest or the principal loan first.

Related: How to Calculate Income Tax – Complete Guide to Income Tax Calculations

6 Tips for Finding the Best Mortgage Amortization Calculator & Schedule

Tip #1: Make sure that the mortgage calculator with amortization clearly breaks down the mortgage payment by month.

It’s hard to view how much you should expect to pay each month if there is a set timeframe that is established.

That is why you want to make sure the mortgage calculator with amortization schedule clearly indicates the line items it is including in its mortgage amortization formula on a monthly basis.

When you do this, you can also jump to a specific point in time rather than having to reenter data one after the other to see another month’s loan principal or interest payment allocation.

Tip #2: Choose a mortgage calculator with amortization from a reputable resource.

Image Source: Amortization table mortgage

If the mortgage calculator with amortization table is crowded or buried under a multitude of advertisements, then your source may be more concerned about getting you to click on these ads than actually helping you understand the mortgage calculator amortization process.

Some reputable mortgage amortization calculators include the ones offered by Bankrate and Bloomberg. By these companies excluding the use of distracting advertisements on their mortgage amortization calculator pages, you can quickly calculate your payment allocations with ease.

Popular Article: FHA Mortgage Rates Today | Where to Find FHA Loan Daily Rates

Tip #3: Choose a source that offers a help guide for the mortgage amortization schedule.

The mortgage amortization schedule cannot be useful if you don’t know how to use it. That’s why it makes sense to see if the source that you use offers easy-to-understand instructions or at least an option to receive assistance with operating a mortgage calculator with amortization.

Tip #4: Use a source that breaks down the mortgage amortization formula.

It’s important to see how your source breaks down the mortgage amortization formula so you can make sure it includes the line items that you need to assess. Your mortgage amortization calculator should indicate whether or not it is using the principal loan amount, the mortgage interest rate, the month, the total interest, and the loan balance so you can have a clear picture of the total costs of your monthly mortgage payments.

Tip #5: Use mortgage amortization calculator charts.

When you use a mortgage amortization calculator that has a graph or chart that can visually break down your mortgage payments, it’s easier for you to see the relationship between the interest rate and the principal of the loan. Some mortgage amortization calculator charts differentiate between the interest and principal by using different colors, such as Bloomberg’s mortgage calculator amortization chart.

Tip #6: When all else fails, you can always make your own mortgage amortization calculator.

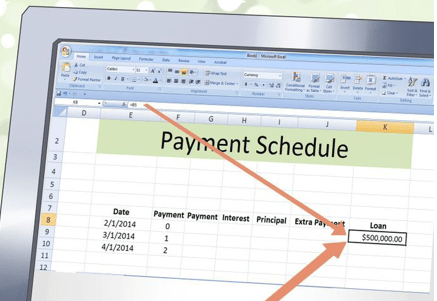

Image Source: Amortization table mortgage

If you can’t find the best mortgage amortization calculator or are short on time to find a reputable mortgage amortization calculator, you still have other options. Creating your own mortgage amortization calculator can save you time if you do it the right way. You can also make it simple so that you are only seeing the results of what you want to know, such as knowing how much of your monthly mortgage payment is going toward principal.

To create your own mortgage amortization schedule, you need to know the total periodic payments you will be making and the loan term. Once you know this, you can then multiply the periodic interest rate by the balance of the loan. Here are a few steps to make your own mortgage amortization schedule:

1. List your terms so that you can clearly see the known data. As an example, suppose your loan term is 30 years with a 3.5 percent fixed interest rate that is set up as a $1,300 monthly payment based on a $150,000 loan balance. That data that you know is the loan term, the fixed interest rate, and your total monthly mortgage payment.

2. Calculate the periodic interest rate. You can do this by multiplying your interest rate by 0.83333, or one-twelfth, as you are calculating for one month. In our example, you would get a periodic interest rate of about 0.00291667.

3. Calculate the interest allocation for your monthly mortgage. To do this, multiply your periodic interest rate by your loan balance. Based on a periodic interest rate of 0.00291667 (which represents how much of the annual interest rate you are paying for one out of twelve months) and our loan balance of $150,000, your interest allocation will come out to $437.50 ($150,000 x 0.00291667). That means $437.50 is going toward interest for the month out of your $1,300 monthly payment.

4. To calculate the allocated amount of your loan principal for that month, subtract the interest allocation from the periodic payment. Using the same example, your principal allocation for your first month’s mortgage payment will be $862.50 ($1300-$437.50).

5. To calculate the next month’s allocations for your interest and your loan principal, calculate the difference between the loan principal amount you paid for that month and the loan balance. You will get the new balance less the principal you paid, and then you can repeat steps 1-4 to calculate the next month’s allocation.

For instance, the difference between the loan balance of $150,000 and the principal paid of $862.50 in the first month of your monthly mortgage payments is $149,137.50 ($150,000-$862.50).

Read More: First-Time Home Buyer Programs | What You Need to Know About the Different Loan Programs

Free Wealth & Finance Software - Get Yours Now ►

Final Thoughts

If you’re looking for the best mortgage amortization calculator, then there are a few factors that you should consider. You want to make sure that the mortgage amortization calculator includes a mortgage amortization chart and a mortgage amortization table of the periodic payments so you can clearly visualize how quickly you are gaining equity in your home.

Image Source: Monthly Mortgage Payment

By having these tools, you will also be able to see how much of your monthly mortgage payment is going toward your loan principal versus interest. Also, consider the information that is being evaluated in the mortgage calculator with amortization table that you choose. You can also create your own mortgage amortization calculator by doing the calculations yourself. By following this guide, you can know how to find the mortgage amortization calculator that best suits your needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.