Overview: 6 Tips to Conducting an Effective Mortgage Interest Rates Comparison

If you are fed up with trying to get your landlord to fix the leaky taps or feel that paying rent is like putting money down the drain, you might be thinking of becoming a homeowner and getting a mortgage.

All those TV ads from the banks make it look so dreamy, and a quick look at a mortgage calculator will get you excited about the prospects. But getting a mortgage is a tricky business.

Those images of happy couples unpacking boxes fade away as interest rates and paperwork start to become overwhelming.

AdvisoryHQ is here to answer all of the questions that have popped into your head. In this article, we will cover how to compare mortgage rates.

We will guide you through our top tips on mortgage comparison so that you will be able to find all the information you need to make a decision on the right mortgage for you.

In this article will we look at:

- The current mortgage market

- What you need to know about mortgage rates

- Is now a good time to get a mortgage?

- How can I find out about mortgage rates?

- Should I use a mortgage broker or go directly to a lender?

1. Understand the Current Mortgage Market Before You Compare Mortgages

Before we tell you the best ways to compare mortgage interest rates, let’s put mortgage comparison into context of the market as a whole.

You may have caught wind of the fact that housing prices are rising again after the housing bubble burst in 2006. But before you get on the bandwagon and start to compare mortgage rates, let us examine whether the market is actually healthy.

The U.S. housing market is a giant. It is worth $26 million, which is more than the entire stock market is worth. Who wouldn’t want to be a part of that? If you do a mortgage comparison between 2016 and 2008, when the price of houses plummeted, today certainly appears to be a more favorable time to get in on the game.

The market seems to be improving, and prices are starting to rise again. The number of people with negative equity debt relating to their mortgages has reduced to 10% from a high of 25%. You are being told when you compare mortgages that the government has introduced regulation to make the market safer for investors.

So why did reputed financial analyst giant The Economist describe the mortgage market as a “menace to the world’s biggest economy”? Because, they say, the market is unprofitable and undercapitalized.

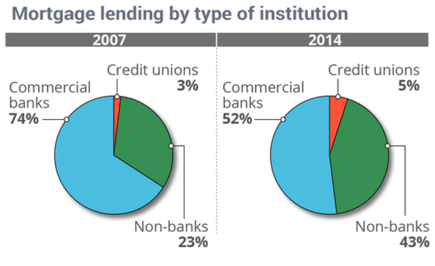

If you are doing a mortgage comparison between now and ten years ago, the regulations do mean that your position as a lender is safer. However, some analysts believe that banks are now afraid to lend because regulations are so strict. Statistics do prove that banks are getting out of the risky game of mortgages.

Source: MarketWatch

This information is not meant to scare but inform those of you in the midst of mortgage rates comparison, wondering about the numbers. What all of the above means, in terms of interest rates, is that there is a reduced competitiveness in the mortgage market; when the banks put in regulation to prevent unsustainable lending practices, they reduced profitability.

As we will discuss further below, in practical terms, when you compare mortgage interest rates, what you might find is that the best rates are no longer coming from banks, who once had the lion’s share of the mortgage market.

See Also: How To Get Rid Of PMI Mortgage Insurance | Ways to Getting Rid of PMI

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

2. Home Loan Interest Rate Comparison: Be Knowledgeable About Interest Rates

Mortgage Rates Comparison – What Is a Mortgage Rate?

It will help if you know what you are looking at when you compare mortgage interest rates. Mortgage rates – or mortgage interest rates – are the rates of interest charged on a mortgage.

In mortgage rates comparison, the lower the rate the better for borrowers, who want to pay less interest on their mortgage. So, if you get a mortgage for $100,000, the amount that you pay back to the bank over the lifetime of the mortgage is actually significantly higher than $100,000.

As we will discuss below, mortgage comparison will show that interest rates are low at the moment – but is it going to stay this way?

Don’t Miss: Wells Fargo Mortgage Reviews – Everything You Need to Know (Home Mortgage, Loans, Complaints, & Review)

Today’s Interest Rates

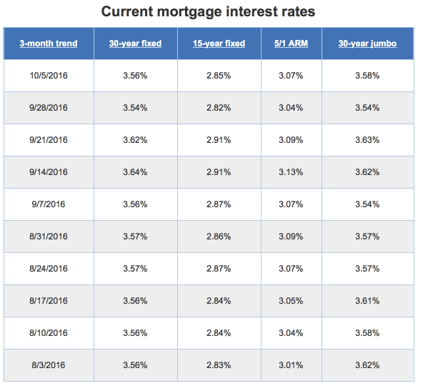

What does that all mean to you when you are doing mortgage interest rate comparison? Well, all the new regulations have led to the interest rates on an average 30-year mortgage hitting a historic low of approximately 3%. When you compare mortgage rates with other eras of up to 18%, this seems wonderful.

Source: www.zfgmortgage.com

The thing is that the stability of these low rates is uncertain. In other words, when you are doing a mortgage rates comparison and the numbers seem promising – these low rates might not be around for very long!

In September, there was a minor increase in mortgage rates, caused by a major sell off in the stock market, which caused the stocks in housing to go down, which has an effect on interest rates. To find out more, visit The Mortgage Reports.

Source: www.scottsdalerealestatearizona.com

So, is now a good time to get a mortgage or not? Some analysts say that the market is a dangerous beast and we should be looking at ways to make renting more attractive. But with interest rates lower than ever, and small jumps in mortgage rates causing sellers to reduce prices in order for a quick deal, you might be wondering if you should be trying to get a mortgage as quickly as possible.

Before your head explodes with the pressure of it all, take a step back and see first if you are eligible for a mortgage.

Related: Spot Loan Reviews – Get the Facts Before Using (Pros, Complaints, & Review)

3. Using Mortgage Comparison Sites

Compare Mortgage Rates with the National Average

When you set out to compare mortgage rates, there are plenty of places to start. A good marker in terms of mortgage rates comparison is the average national rate.

Some of the most popular sites you could visit for a mortgage comparison are BankRate, MarketWatch, and YCharts.

So, for example, here is a quick check on BankRate, as of this writing:

Source: BankRate

Down to Business: Compare Mortgage Interest Rates

The good news is that there are plenty of great tools out there to take the work out of mortgage rates comparison for you.

As with the majority of comparison sites, AdvisoryHQ recommends that you take the statistics given to you just as an indication of the possibilities. Think of sites offering mortgage rates comparison as a fantastic place to start.

One thing to bear in mind when you are looking through these sites is that although the mortgage rates comparison tools are legitimately helpful, the sites can be influenced by lenders to advertise their products.

Take for example, the small print on the Realtor website.

“The listings that appear on this page are from companies from which this website and Bankrate may receive compensation, which may impact how, where and in what order products appear. These listings do not include all companies or all available products. Neither Bankrate nor this website endorses or recommends any companies or products.”

But AdvisoryHQ has got your back! What we are saying here is that mortgage comparison sites are helpful and the mortgage rates comparison numbers are real, but they are not all encompassing. Just use them as a first glance when you compare mortgage rates. If you see a lender you think you might like, go straight to them to get the details.

Here are some easy to use sites:

- Money Supermarket: This site will compare mortgages by type.

- The Simple Dollar: The mortgage comparison offered is by area.

- Bankrate: This site will compare mortgage rates as well as provide general analysis of the market.

4. Compare Mortgages: Understand Who You Are Borrowing from

We have already touched on the fact that the traditional banks that once were the go-to institutions for mortgages are now withdrawing from the mortgage market.

So when you are looking for home loan interest rate comparisons, keep your mind wide open to other institutions that have mortgages to offer, including credit unions.

What is going on behind the scenes of mortgages is a complex world of lending. Mortgage rates comparison can differ according to who is doing the lending. While you are doing your research into home loan interest rate comparison, you may hear a few terms. Here is a breakdown of lenders:

- Mortgage Lender: The institution loaning the money to the borrower

- Mortgage Brokers: Work with lenders to negotiate terms for mortgages

- Wholesale Lenders: Do not work directly with consumers, but through brokers, banks, and credit unions

- Retail Lenders: Work directly with consumers

- Warehouse Lenders: Lend money to banks

- Mortgage Bankers: Borrow money from Warehouse Lenders

The plethora of lenders goes further, taking in portfolio lenders, hard moneylenders, direct lenders, and correspondent lenders. You can find out more about these types of lenders at Mortgage Loan.com.

5. Mortgage Comparison: Should I Use a Mortgage Broker?

Have advertisements for mortgage brokers been popping up while you have been on mortgage rates comparison sites? If so, you may have been wondering whether these types of brokers are sharks or whether they really can help you to compare mortgage rates and get a great deal.

Mortgage brokers are the middlemen who work between the lender and the borrower to get the best deals for everyone involved. They are still a popular choice for those delving into home loan interest rate comparison, with 10% of loans being facilitated by them.

Source: MortgageBrokerBC

A lot of people who turn to mortgage brokers have been turned down by their primary banks when they look for a home loan, or those who have a less than perfect profile for mortgage lenders.

Mortgage lenders are usually well-networked, can do a lot of the legwork in terms of doing a thorough mortgage comparison, and (in theory) offer you the best rate that they can get.

One reason that some people will steer away from brokers, even if their offer is good when they compare mortgage rates, is that they may take a whack in commission. Furthermore, some lenders do not work with brokers, limiting their ability to compare mortgages for you.

Popular Article: Should I Payoff My Mortgage Early? Prepayment Penalty Definition!

6. Mortgage Interest Rates Comparison: Should I Go Straight to the Lenders?

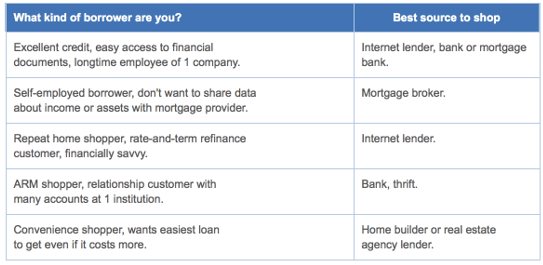

Whether or not going to a mortgage lender is the right thing for you depends on your circumstances. If you have a long-standing and positive relationship with your bank and you like what they have to offer, this could be the easiest option for you. It’s a one-stop shop.

If you do not mind doing a lot of research to make sure that you are getting an in-depth mortgage comparison, going to a number of lenders might seem manageable and logical.

There are lots of different lenders out there. Besides traditional brick-and-mortar banks, there are internet banks, mortgage banks, credit unions, and others. Bankrate has examined the right type of lender for different borrowers in the diagram below:

Source: Bankrate

If you have done as much mortgage comparison as you can handle but are still not sure who to go with, here are a few simple steps you can take:

- Ask friends and family about who their mortgage is with/for recommendations

- Look at reviews of banks and lenders

- Check if the lender or broker you are considering using is regulated/has the right credentials

- Read all the small print, for the whole process – make sure that low interest rates that got you roped in with one lender are retained throughout the signing process

Free Wealth & Finance Software - Get Yours Now ►

Round Up: Top Tips for Mortgage Interest Rates Comparison

This article may not have made you feel very confident about dipping your toe into the mortgage market, but it should! The only way to be confident about making an enormous decision like getting a home loan is to have a healthy understanding about the landscape in which mortgage brokers are operating and what affects the rates you are looking at.

There are lots of choices out there for you when it comes to mortgage rates comparison. With banks and lenders having useful websites, as well as comparison sites and brokers providing relevant information, it has never been easier to compare mortgage rates.

We are all still learning from the economic crash and the fallout from when the housing bubble burst. It is important that we understand what led to the crash and not follow the same pattern again.

When it comes to mortgage comparison, interest rates are low, but the risks are still high. That said, with analysts claiming rates will continue to rise, now may be the best time for you.

As always, AdvisoryHQ’s first recommendation is to read the small print. Whether you use a mortgage rates comparison site, a broker to take the work out of mortgage comparison, or you go directly to your own bank, avoid entering into a long-term agreement without reading everything.

Read More: Mortgage Broker—Full Review (Job Description, License, Finding the Best Mortgage Brokers Near You)

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.