2017 RANKING OF THE TOP ONLINE LOAN LENDERS AND COMPANIES

Finding the Top 6 Best Online Loan Lenders and Companies

With the economy on the rise and interest rates remaining low, more and more people are taking advantage of online personal loans.

People seek personal online loans for a variety of different reasons: to consolidate debt, make a big purchase on something like a boat or ATV, fund a business venture or simply to get caught up on bills until the next pay day.

Many people prefer online loans because the online loan application process is fairly quick and simple to complete and is generally processed fast. Many online cash loans offer competitive interest rates and are unsecured, meaning that they do not require collateral in order to be funded.

Award Emblem: Top 6 Best Online Loan Lenders and Companies

With so many online loan lenders available, it can be difficult to gauge which online loans direct lender is the best one for you. We have taken the time to research providers of online loans and have created this list of the best online loan companies to help you narrow down your search.

This list of the top online loan lenders encompasses many types of online loans, including online personal loans and payday online loans as well as information regarding an online cash advance.

No matter what type of online loan you are looking for, our list will provide you with the best online loan sites offering the best online loans in the market today.

See Also: PersonalLoans.com Reviews – Get All the Facts Before Using PersonalLoans.com

List of the Top 6 Best Online Loan Lenders and Companies

List is sorted alphabetically (click any of the names above to go directly to the detailed review section for that firm/product)

Best Online Loan Lenders (Personal & Business Loan Companies)

Online Loan Company | Websites |

| Fundia | https://fundiacapital.com/ |

| Kabbage Working Capital | https://www.kabbage.com/ |

| PersonalLoans.com | https://personalloans.com/ |

| SoFi | https://www.sofi.com/ |

| TrustedPayDay | https://www.trustedpayday.com/ |

Table: Top Online Loan Lenders and Companies | above list is sorted alphabetically

Differences between Personal Online Loans and Payday Online Loans

There are some differences between online personal loans and payday online loans, also sometimes referred to as an online cash advance. Customers often have a different focus for the use of the funds when seeking loans from either type of these online loan lenders, and they may also have different credit requirements.

Online personal loans are generally larger than payday online loans and are paid back over several years. There are usually more stringent credit requirements for online personal loans.

Customers generally seek this type of loan in order to consolidate debt, pay off medical expenses, have it act as a small business loan or to fund necessary home repairs. Personal online loans are generally unsecured loans that do not require any collateral and rely heavily on credit history when determining eligibility.

Payday online loans, or an online cash advance, are generally for smaller amounts with much shorter terms than personal loans. This type of loan is easier for those with marginal or high-risk credit to qualify for and is generally intended as a quick fix to get the borrower through until his/her next payday.

Avoiding Scams with Online Loans

Image source: Big Stock

As when conducting any business over the Internet, it is important to be careful to avoid scams. While there is a wide range of credible and reputable online loan lenders vying for your business, there are also scam artists who may try to take advantage of you.

Be wary of any unsolicited loan offers received by email, snail mail or telephone. You should also be concerned if a lender does not seem interested in your credit history. Almost all legitimate lenders take credit history into consideration when processing a valid online loan application.

Check to be sure that any online loan lenders you are considering are registered to do business in your state. Never send money to an online loans direct lender before you have received your loan funds. Legitimate online loan lenders never ask for payments upfront and will always provide you with a due date for your first scheduled payment which is after the loan has been funded.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated firms, products, and services.

Detailed Review – Top Ranking Best Personal Online Loan Lenders

Below, please find a detailed review of each firm on our list of top online loan lenders. We have highlighted some of the factors that allowed these online loans direct lenders to score so high in our selection ranking.

Don’t Miss: Trusted Payday Review – Get All the Facts! (Payday Loan Reviews)

Check ’n Go Review

Founded as a family business in 1994 in Covington, Kentucky, today, Check ’n Go is a leader in payday online loans. In addition to being an online loans direct lender, Check ’n Go also operates more than 1,000 stores across 31 states and employs more than 3,200 people.

As one of the best online loan sites, Check ’n Go offers a full suite of financial services to satisfy consumers’ ever-changing needs. Products and services offered by the online cash loans site include instalment loans, payday loans, and prepaid MasterCards.

Key Factors That Enabled This Online Loans Direct Lender to Rank as one of the Best Online Loan Companies

Below are primary reasons we selected Check ’n Go to be rated as one of this year’s top providers of online loans.

Payday Online Loans

With its online payday loan program, Check ’n Go makes it easy for borrowers to get up to $500 conveniently and quickly. Its quick and easy online loan application process gets customers the money they need as soon as the next business day.

Advantages of a payday loan from Check ’n Go include:

- Customers can borrow from $100 to $500

- Secure and convenient online loan application

- Funds deposited the next business day following approval

- 24/7 customer support

This online loans direct lender currently offers its payday online loans to customers who reside in 18 states. Like most of the best online loan companies, Check ’n Go requires customers to provide proof of income, an approved form of ID, and a current bank account in order to be approved.

Installment Loans

With Check ’n Go’s installment loan program, it offers customers more options with greater loan amounts than a payday loan and more time to repay the loan. With a Check ’n Go installment loan, customers are able to enjoy the convenience of an online personal loan that is funded the following business day after approval.

Through Check n’ Go’s online personal loans, customers are able to apply online for an installment loan between $2,100 and $5,000 and have the funds deposited directly into their bank account as soon as the next business day.

Customers are able to pay back the loan on a personalized schedule over 4 to 8 months. Check ’n Go currently offers its personal online loans to U.S. residents who reside in the 11 states indicated on its website.

Refer-A-Friend Program

Check’n Go, one of the best online loan companies, rewards customers who refer their friends. Customers who successfully refer a friend for a loan with this online loans direct lender receive a $50 e-gift card in return.

The e-gift card can be redeemed at tangocard.com, a virtual gift card shopping mall that allows customers to purchase e-gift cards form online retailers such as Walmart, Amazon, Target, and iTunes.

Check ’n Go customers may refer up to 10 friends, allowing them the ability to earn up to $500 in rewards. It is important, however, to always make sure that friends who are referred understand the way that Check ’n Go online cash advance options and personal loans work as well as the high interest that comes with them.

Related: Federal Student Loan Forgiveness | How to Get Rid of Your Federal Loan

Fundia Capital Review

Founded in 2014, Fundia Capital is an online loans direct lender that specializes in providing funding for those looking to fund a business startup or expand an existing small business. It coins itself as a fast-growing commercial funding brokerage.

Since its start, Fundia has helped to secure millions of dollars in funding for its clients. These funds have been utilized as capital by entrepreneurs to start new companies or grow existing businesses.

Key Factors That Enabled This Online Loans Direct Lender to Rank as One of the Best Online Loan Companies

Below are primary reasons we selected Fundia Capital to be rated as one of this year’s top providers of online loans.

Business Credit Lines

A Fundia business credit line gives small businesses the security of working capital whenever they need it. Business owners are able to draw against their line of credit as often needed, giving them quick and easy access to the cash required for growing their business.

A Fundia business line of credit is unsecured, so it requires no collateral to open. This online loans direct lender also does not require that businesses provide any income documents, and they lend to startups.

Businesses can get approved for credit lines between $50,000 and $200,000. Borrowers who choose to take advantage of a Fundia business line of credit enjoy the following:

- Ability to draw against a line of credit as often as needed

- Pay only for funds used

- No early payment fees

- Accessible customer service

Businesses can use their funds to buy inventory, launch marketing campaigns, invest in equipment, hire staff or for whatever needs required in order to grow.

Stated Income Loan Program

Fundia is different from other lenders of online loans in that it does require any income documents when applying for a loan. Instead, it relies on the complete honesty of the applicant when processing the application.

This is very helpful for those seeking online loan lenders for startups that have not yet established a large amount in annual revenue. Despite having to provide proof, it is still very important that potential borrowers be honest when reporting their stated income as prospective banks will do their own investigations to verify the truth of the information provided.

This top online loans direct lender does have a personal credit score requirement of 680 or higher in order to qualify for funding. It prefers that the CEO of the business seeking funding have this score, but if not, then one of the business partners will need to possess a qualifying credit score.

Fast Online Loan Application Process

Fundia features an extremely fast online loan application process. With no documentation to provide, it takes most people only a few minutes to complete their online application.

It also features an extremely quick response time, with its advisors able to get back to a business with a decision in as little as 2 hours in many cases.

Kabbage Working Capital Review

Kabbage is an online financial technology company headquartered in Atlanta, Georgia. It is an online loans direct lender who caters to lending for small businesses. The company was originally established in 2009 as a platform for lending to online businesses but expanded its lending product offerings to include brick-and-mortar businesses in 2014.

Today, Kabbage has provided $2 billion in funding to more than 75,000 small business customers. The innovative online loan lender was recently named to Inc.’s list of the country’s 500 fastest-growing private companies.

Key Factors That Enabled This Online Loans Direct Lender to Rank as One of the Best Online Loan Companies

Below are primary reasons we selected Kabbage Working Capital to be rated as one of this year’s top providers of online loans.

Loan Types

Kabbage offers a wide range of online loan types to suit the financial needs of businesses of a variety of sizes.

Businesses seeking funding from this top online loans direct lender are able to apply for the following loan types:

- SBA loans

- Working capital

- Lines of credit

- Online loans

- Small business credit cards

- Merchant online cash advance

- Revolving credit

- Business loans

- Peer-to-peer loans

- Professional loans

- Factoring

- Micro loans

- Commercial lending loans

- Short-term business loans

- Equipment loans

- Inventory loans

- Payroll loans

With so many options available for funding, this online loans direct lender truly offers a product for every business.

Industry Loans

Kabbage offers a variety of specialized online loans that are specific to certain industries. These special loans are available to businesses who operate in the following industries:

- Retail

- Restaurant

- Construction

- Auto repair

- Trucking

- Beauty salon

- Medical/dental

- Wholesale

- Pawnshop

It also offers special interest loans to support businesses that are owned and operated by women and veterans.

Awards and Accolades

Kabbage has coined itself as being the number one provider of working capital online. With the buzz surrounding this fast-growing online loans direct lender, it is not hard to believe.

This provider of online loans has been recognized on the following lists:

- Inc.’s 500 fastest-growing private companies in America – 2015

- Forbes’s America’s 100 most promising companies – 2014 and 2105

- Forbes’s 20 amazing companies founded during the financial crisis – 2014

- Fast Company’s most innovative companies in finance – 2013

- Pymnts.com’s best B2B innovation – 2013

- BTN’s top 10 innovators – 2012

- Red Herring’s top 100 private companies in America – 2012

- VentureBeat’s cloudbeat innovation showdown – 2012

- Pymnts.com’s most innovative company – 2012

Popular Article: Blue Trust Loans Review – What You Should Know! (Loan Reviews)

PersonalLoans.com Review

PersonalLoans.com is a loan matching service that can be utilized by potential borrowers to get matched with personal online loans through their network of lenders. Through its online loans matching service, qualified customers are able to choose from a list of lenders where they can borrow a loan of between $1,000 and $35,000 depending on qualifications.

PersonalLoans.com gives potential borrowers the ability to shop for online loans from the comfort of their own home, office or on their mobile device. It helps match people with online loan lenders to provide many different loan types with a variety of loan amounts and terms for potential borrowers to choose from.

Key Factors That Enabled This Online Loans Lender to Rank as One of the Best Online Loan Companies

Below are primary reasons we selected PersonalLoans.com to be rated as one of this year’s top providers of online loans.

Simple Online Loan Request Process

PersonalLoans.com offers a simple and straightforward online loan request process designed to match potential borrowers with lenders from their network offering the best online loans.

Customers fill out the simple loan request form found on the website, including the amount of money they wish to borrow, their credit type, and the reason for the loan. The form also requires basic personal information related to banking and income that will be used in determining which online loans they may be eligible for.

Shortly after submitting the loan request, customers are notified of which affiliate lenders have approved their loan request and are redirected to the loan agreement of the lender(s). Once a customer is matched with a lender, he/she then deals directly with that lender in completing the loan process and having the loan funded.

Once the loan process has been completed with an online loans direct lender, most customers will have their loan funded within one to five business days.

Variety of Loan Types

PersonalLoans.com works with a variety of online loan lenders who offer many different types of loans. This loan matching service can match potential borrowers with lenders of three different types of loans:

- Peer-to-peer loans

- Personal installment loans

- Bank personal loans

Peer-to-peer lenders connect borrowers to investors who are willing to fund loans rather than actually funding the loans themselves. This means that with this type of personal online loan, borrowers borrow directly from a person or company instead of a bank. Once a deal is made repayments will be made directly to the investor who funded the loan.

Installment loan lenders are generall finance companies that specialize in issuing installment personal loans. The length of the repayment term and APR of these types of loans are determined by credit score and repayment history and can also vary from state to state according to state laws.

Bank loans are loans provided and funded by a bank. These loans typically require higher income levels than many installment or peer-to-peer loans do and may have stricter eligibility requirements.

By working with a large number of lenders who specialize in a variety of lending types, PersonalLoans.com makes it easier for potential borrowers to be matched for the best online loans for their particular circumstances.

Reputable Lenders

PersonalLoans.com is dedicated to facilitating responsible lending. As such, it works hard to protect consumers from unfair and illegal practices in the online personal loans industry.

In an effort to protect consumers, it only works with lenders that meet the following criteria:

- Reputable and follow responsible lending practices

- Licensed in their respective state(s) to lend cash to consumers in the form of personal/installment loans

- Provide clear terms and conditions in regard to interest rates, requirements of repayment, and repercussions of late or missed payments

Read More: Affirm Reviews | What Is Affirm and Is It Safe to Use? (Affirm.com Loan Reviews)

SoFi Review

Founded in 2011 and standing for Social Finance, Inc., SoFi is a marketplace lender providing student loan refinancing, mortgages, and parent and personal loans. It is a non-bank alternative with a unique approach to lending that is focused on providing online loans at better rates than those offered by most traditional lenders.

In early 2016, SoFi stopped using the FICO credit score for its underwriting process for all of its products. Instead, it analyzes forward-looking factors to decide a prospective borrower’s potential to be able to repay the loan. Also, in early 2016, the online loan lender surpassed $7 billion in outstanding loans.

Key Factors That Enabled This Online Loans Direct Lender to Rank as One of the Best Online Loan Companies

Below are primary reasons we selected SoFi to be rated as one of this year’s top providers of online loans.

Student Loan Refinancing

For many Americans, taking on a large amount of debt in order to pay for secondary education is unavoidable. Keeping up with high student loan payments after graduation can become a struggle.

SoFi is one of the best online loan sites that offer student loan refinancing at very competitive rates to help graduates lower than payments, pay off their student loan debt faster, and find relief.

Features of this online loan lender’s student refinancing program include the following:

- Low fixed and variable rates

- No application or origination fees

- One of the few lenders who can consolidate and refinance both federal and private loans

- Simple online loan application

- Customer support available seven days a week via phone, email, chat, and social media

- Unemployment protections in case of job loss

- Access to career support

- Access to wealth advisors

Online Personal Loans

SoFi is an online loans direct lender who offers online personal loans at extremely competitive rates. Its personal online loans are ideal for those looking to consolidate high-interest debt or make a large purchase.

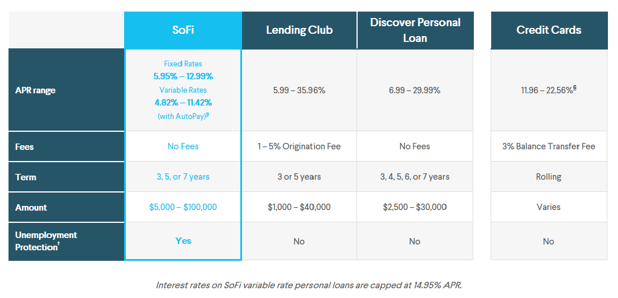

Interest rates for SoFi’s personal loans are very competitive when compared to other leading online loan lenders’ APRs as can be seen in the chart below.

Source: SoFi Personal Loans

Benefits of online personal loans offered by SoFi include:

- Personal loans available from $5,000–$100,000

- Simple online loan application

- Access to live customer support 7 days a week

- No origination fees or prepayment penalties

- Loan payments may temporarily be paused in the case of job loss

Mortgages

Since its inception in 2011, SoFi has added mortgages to its list of online lending products available to consumers. One of the biggest perks of its mortgage program is that it allows borrowers to obtain mortgages with as little as 10% down without requiring private mortgage insurance (PMI).

Most mainstream lenders require PMI be added to all mortgages with less than 20% down, so being able to forgo that extra cost with SoFi can be very advantageous to many potential homeowners.

Features of this best online loan site’s mortgage products are the following:

- As little as 10% down with no mortgage insurance requirement

- Easy pre-qualification process

- Full underwriting is done at the preapproval stage

- Flexible debt-to-income limits

- No application, origination or other lender fees

- Fast financing leading to quick closings

Related: Best Bad Credit Business Loan Lenders | Get Startup Business Loans with Bad Credit

Free Wealth & Finance Software - Get Yours Now ►

TrustedPayDay Review

TrustedPayDay is not an online loan lender itself but rather is a service that matches potential borrowers with lenders who may be willing to provide these borrowers with a payday loan based on their individual circumstances and requirements. The company strives to match borrowers with lenders that offer the best online loans.

TrustedPayDay operates as a broker in order to try and find the best deals for potential borrowers. The company helps potential borrowers receive online personal loans for things such as medical bills, planning a vacation, paying unexpected bills or for living expenses.

Key Factors That Enabled This Online Loans Lender to Rank as One of the Best Online Loan Companies

Below are primary reasons we selected TrustedPayDay to be rated as one of this year’s top providers of online loans.

Access to More Than 70 Lenders

TrustedPayDay works with over 70 different lenders of short-term online cash advance loans. The loan matching service that it provides can save potential borrowers a lot of time by allowing them to be preapproved for multiple online cash loans from many different lenders at many different rates and terms.

Having many different lenders to choose from allows the borrower to choose the loan that offers the best rate and terms for their individual circumstances. It is important to note, however, that TrustedPayDay.com will not be the actual provider of the online cash loans nor will it choose the final loan. Instead, the decision will be made directly by the lender that the borrower has chosen to work with.

Customer Service

TrustedPayDay encourages potential borrowers to contact the company at any time if they have questions about the services provided. It provides several contact methods to choose from in the contact us section of its website, including by email, telephone or snail mail.

As one of the best online loan companies, customer service is available an impressive 24 hours a day, 7 days a week. It also provides a frequently asked questions section on the website that provides answers to many general questions about how payday loans work.

It is important to remember that any questions you may have about a specific loan offer from an online loans direct lender that you have been matched with should be directed to that lender.

Easy Eligibility Requirements

Compared to long-term online personal loans, the eligibility requirements for short-term online cash advances, such as those that customers are provided access to through TrustedPayDay, tend to have much more lenient eligibility requirements.

Most of the online loans direct lenders that TrustedPayDay works with require that potential borrowers be at least 18 years old and live in a U.S. state that allows the lending of payday loans.

Each lender will have his/her own requirements regarding employment, income, and credit score, but they tend to be lenient in order to also provide loans to customers who have poor, little or no credit.

Conclusion – Top 6 Best Online Loan Lenders and Companies

We have reviewed many different types of providers of online loans in this article. The best online loan companies reviewed include those who offer the option of an online cash advance as well as online personal loans, online cash loans, payday online loans, and online business loans. We have also reviewed two companies that provide services that match potential borrowers with an online loans direct lender that can best meet their needs.

Image source: Big Stock

When considering online loan lenders, it is important to carefully weigh the pros and cons associated with taking out a loan. Always make sure to read the fine print and diligently review the terms and conditions associated with an offered loan before accepting. Also, verify that the site’s form is safe and secure before filling out an online loan application.

Furthermore, it is important to always verify what the APR is on a loan offer as many short-term loans, such as payday loans and cash advances, come with high-interest rates. You may want to consider other options if taking on a large amount of interest is not best for your current financial situation.

While this list provides the best online loan sites offering some of the best online loans on the web today, only you can decide if a personal online loan is a right choice for you.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.