Intro: Best Retirement Planning Software Apps & Investment Management Software for 2017

Planning for retirement is certainly no easy task– but finding the best retirement planning software apps can certainly go a long way in creating an efficient, stress-free process.

With hundreds of retirement planner software and investment management software programs on the market today, few people have the time–or the patience– to sort through even a fraction of these retirement software options.

Thankfully, here at AdvisoryHQ, we’ve put forth extensive research into identifying the top retirement planner software, so that you don’t have to.

But exactly how did the AdvisoryHQ research team identify, research, and finalize this year’s list of the top retirement planning software?

We started out with a larger list of over 31 retirement planning tools, free retirement planning software, and retirement apps.

We reviewed a wide range of retirement planning apps, including Quicken, RichOrPoor, RetireEasy, Personal Capital, Betterment, and more.

After applying our series of expert selection factors (like sophisticated calculation capabilities, advanced interface, ease of use, mobile capabilities, security, budgeting, personal finance, retirement planning features, cost, and maintenance), the team was able to narrow the list down to the top retirement planning software apps listed and reviewed below.

Our hope is that, after reading through our comparison review of the best retirement planning software, your process of planning for retirement can become a little less stressful and much more beneficial.

Comparison Review List

The list below is sorted alphabetically (click any of the names below to go directly to the detailed review section):

High Level Comparison Table

Table: The above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Personal Capital Review

Personal Capital is an online retirement planning software designed to help people who are nearing retirement. More than just saving for retirement, Personal Capital seeks to help its customers engage in sound overall money management.

Personal Capital has sought to revolutionize the online personal finance sector by streamlining and simplifying the process from the consumer’s end. One way it does this is by integrating state-of-the-art technology and software into its online portal.

The end result is a sleek and intuitive process that can help anyone get a firm grasp on his/her planning for retirement.

To date, Personal Capital has registered 1.3 million users to its site. This has resulted in over $312 billion in tracked accounts and $4 billion in AUM (assets under management).

The innovators behind Personal Capital felt that, by marrying leading tech with fiduciary, client-focused advice, they could reach more people through a blend of affordability, accessibility, and trustworthiness.

The great thing about Personal Capital – and one of the most important things we liked about the firm – is its free retirement planning software.

This investment management software helps both pre-retirement and middle-aged customers who need to start planning for this next phase of their lives.

Personal Capital offers a wealth of tools to help you analyze the current state of your finances. From there, you are better able to calculate how much to save in order to retire comfortably.

Not only that, but Personal Capital’s tools assist you in determining how you can go about building your nest egg, and if that’s all you need, then Personal Capital’s retirement planning software is 100% free.

However, let’s say you want Personal Capital to build your portfolio, implement it, and manage it for you. And by “manage,” you want them to monitor your investments and provide you with updated account and investment performance reporting.

Well, the great news is that the investment management software from Personal Capital can do that, too.

To that end, Personal Capital provides investment advisory to clients with a minimum of $25,000 in investable assets. It also has its Private Client services which cater to investors with $1 million or more to invest.

A Team-Based Approach to Innovation

Personal Capital is overseen by an executive team that boasts decades of investment planning and wealth management experience.

In addition to its experience, the firm has a panel of experts that help make Personal Capital the number one provider of retirement planning tools.

To ensure that Personal Capital continues to provide the best retirement planning software, it established a Board of Advisors that includes Shlomo Benartzi, a famous behavioral economist, and Harry Markowitz, a Nobel Prize winner in Economic Sciences and the creator of modern portfolio theory.

The executive team, together with this high-caliber panel of advisors, constantly seeks ways to innovate. This can mean exploring how to make its personal retirement planning software more accessible to needy consumers.

Or it might translate into working with Personal Capital’s software team to improve the online customer experience through enhanced support or streamlined operations.

No matter the details, we liked that Personal Capital is always bettering its customer care, services, and strategy.

Setting up Your Dashboard Is Easy & Fast

Industry Recognition

One of the biggest signs of Personal Capital’s success can be found in the recognition it has received from experts within the industry.

For example, TIME magazine rated Personal Capital as one of the 50 best websites in 2012. TIME describes this list as its “annual salute to sites and services that keep you entertained and informed, save you time and money – and maybe even change your life.”

In 2015, CNBC put Personal Capital on its Disruptor 50 list. This ranking designates Personal Capital as one of a select grouping of “private startups revolutionizing the business landscape.”

The kudos don’t stop there, however. Personal Capital’s retirement planning tools have been featured and positively reviewed in such prestigious media as:

- The Wall Street Journal

- Mashable

- Forbes.com

- TechCrunch

- Macworld

- Bloomberg Businessweek

- Yahoo! Finance

- Reuters

- The New York Times

See Also: Best iPhone Budgeting Apps | Ranking | Budget Apps for iPhone

Fiduciary Approach for Free or for a Flat Fee

Costs associated with Personal Capital vary and are contingent on the extent to which you utilize its services.

For example, you pay nothing for its free retirement planning software. However, a fee-only structure is applied to Personal Capital’s comprehensive financial planning and wealth management advisory services.

If all you need is Personal Capital’s Retirement Planner, Cash Flow, and Net Worth Analyzer, Fee Analyzer or Investment Checkup tool, you pay nothing.

And by “nothing,” we mean nothing. Personal Capital won’t hit you with surprise costs or hidden fees buried in the fine print. It does this because it approaches customer service from a fiduciary perspective.

As a result, Personal Capital advisors don’t upsell you, push products or services you don’t need or line their pockets with commissions, incentives, kickbacks or bonuses. They want to see you reach your financial goals, and to achieve this, they make available their suite of financial planning tools.

However, this conflict-free guidance isn’t limited to customers who take advantage of the firm’s retirement software. Indeed, this commitment to the fiduciary standard extends to investment clients, as well.

Personal Capital evidences this, in part, by its open fee structure. To clients who invest through the firm, it assigns a percentage of AUM (assets under management), whether the clients are Private Clients or otherwise.

In keeping with its fiduciary operating philosophy, it does not assign extra fees, hidden commissions or anything that would introduce a conflict of interest into its services.

Personal Capital’s fee schedule looks like this:

Making Your Financial Planning as Cost-Effective as Possible

It’s not in the best interests of most brokers, brokerages or financial advisors to compare their fees with that of competitors. Why is that?

The answer is simple: You’ll see how their costs stack up to other firms, and, chances are, they aren’t the most affordable for you, the client.

That’s what makes Personal Capital stand out as the best retirement planning software available.

Through its Fee Analyzer tool, you’ll gain access to powerful metrics that evaluate your investments, retirement accounts, and mutual funds. If you’re paying more than needed, Personal Capital will tell you.

This includes uncovering hidden fees – an unfortunate practice of many financial institutions today. You may be charged hidden custodial fees, 12b-1 fees or inactivity fees while planning for retirement.

According to The Wall Street Journal, most investors aren’t aware that such fees are being levied on their accounts. As of the article’s publishing date, investors were paying nearly $10 billion in these types of fees every year.

Do the math, and these fees can put a pretty big dent into your savings. Personal Capital doesn’t want this for you. It isn’t interested in leaching extra fees from your investments as this would work at cross-purposes with its stated fiduciary principles.

Is Your Net Worth Greater Than You Think?

Instead, Personal Capital helps you see how the hidden fees in your own accounts may be working against your retirement goals. This includes every possible fee type – account opening fees, service fees, maintenance fees, trading fees, taxes, management fees, and expense ratio fees on your mutual funds.

Don’t Miss: Best Budget Apps | Is Level Money Safe? Level Money Review

Powerful Suite of Free Services

Personal Capital offers a wide range of free services, all to help you gain a better understanding of your financial health and needs.

Below is a list of Personal Capital’s retirement planning software, providing free retirement planning tools for anyone who needs to use it:

Cash Flow & Net Worth Analyzer

Personal Capital focuses on your net worth. This provides the clearest picture of financial health and the best foundation for consulting on how to maximize your retirement planning.

To accomplish this, Personal Capital links all your accounts – mortgage, credit cards, investment accounts, and more – on your Personal Capital Dashboard. From there, you enjoy access to weekly, monthly or yearly reports that detail your spending and transactions.

Not only that but by focusing on the “big picture” of net worth, Personal Capital helps you avoid focusing on the ups and downs inherent in market performance.

Fee Analyzer

As mentioned previously, Personal Capital is transparent and open with each client.

To this end, it offers its Fee Analyzer tool to help you scour your existing investments for those hidden fees and costs that could be sapping money from your future.

Recommendations for reducing or eliminating these fees are also offered with this tool.

Investment Checkup

If you’ve ever wondered whether your portfolio is maximized for optimal returns, then the Investment Checkup tool is for you. The tool evaluates your investments before recommending adjustments that will meet your long-term goals.

Investment Checkup holds up your current asset allocation with the ideal allocation to show your potential savings and returns. The comprehensive nature of this tool allows your portfolio to operate as tax-efficiently as possible within your appropriate risk tolerance.

To top off this multifaceted retirement planning tool, Personal Capital allows you to compare the past performances of your old and revamped portfolios.

Your Portfolio Deserves a Second Opinion!

Retirement Planner

This is Personal Capital’s main attraction. The free Retirement Planner tool helps you see how your expenditures affect your retirement goals. These expenditures can be unforeseen circumstances, such as illness, property damage, loss of income, and the like.

This retirement planning tool also factors in life milestones, including funding your children’s education, having a baby or buying a new home. You can maximize your savings by adjusting how you spend money and staying on track to meet your retirement goals.

Perhaps best of all, your retirement plan is tailored to you and your specific needs. In addition, you have the support of live financial advisors to assist as needed.

Private Client Services

It only makes sense that the more money you make, the harder it can become to track your own finances. This is especially true for investors who possess a significant amount of money to invest.

In order to provide its high-net-worth clients with exceptional attention and care, Personal Capital offers its Private Client service. This service is built for investors with at least $1 million in investable assets.

The perks of being a Private Client include:

- Direct Access: Questions and concerns are funneled directly to a Certified Financial Planner. Contact him/her at any time of the day, at night or on weekends, and you can expect a quick response.

- Elite Conference Calls: Personal Capital invites you to its Investment Committee conference calls held every quarter. These calls are exclusive to Private Clients and allow you to communicate openly with Personal Capital’s key portfolio executives.

- Selective Investment Opportunities: Additional investments are made available to Private Clients. These include angel, private equity or venture capital investments. Your financial advisor will work with you to determine if these select opportunities mesh with your portfolio.

In addition to these services, Personal Capital can coordinate with your existing team of consultants.

As a top personal finance software, Personal Capital can also help set up lines of credit, check writing or debit card services from your account through its strategic partnership with Bank of New York Mellon. Trust planning services are available to Private Clients, as well.

For these services, Private Clients pay no additional fees, only the standard fee for advisory services. The fee structure for Private Clients is as follows:

- First $3 million: 0.79%

- Next $2 million: 0.69%

- Next $5 million: 0.59%

- Over $10 million: 0.49%

Discover What Hidden Fees Are Costing You!

The Personal Capital Investment Advisory Process

The setup process to utilize Personal Capital’s investment advisory services couldn’t be simpler: You create an account with your name, desired password, and telephone number.

Next, you answer a series of intake questions designed to provide Personal Capital with an accurate picture of your finances. From there, two licensed financial advisors are assigned to your new account.

Personal Capital advisors bring years of experience in assisting both institutions and affluent clients. You’re guaranteed to be in safe, knowledgeable hands from this point forward.

As an added level of customer care, your advisors have an open door policy, gladly fielding your questions and concerns at any time. They are available by phone, email or through an in-person meeting.

Your advisors then schedule a discovery meeting with you to discuss your long-term goals, retirement planning, lifestyle management, and risk tolerance, among other topics.

Free Analytics Tools Show Where You Stand

After getting the requisite information, your advisors collaborate with the Personal Capital Investment Team to craft your personalized investment strategy.

If, after reviewing your investment needs and goals, Personal Capital decides it is a good match for you, it will open an account in your name with Pershing, its third-party custodian.

From there, your advisors and the team at Personal Capital implement your investment strategy. They monitor and rebalance your investments, keeping you on target for your long-term goals as well as further minimizing taxes.

To achieve tax-efficiency, Personal Capital performs regular tax-loss harvesting and reallocates your investments to tax-deferred accounts.

Personal Capital buffers you against loss through a number of additional applications, including:

- Sector and style weighting

- Globally diversified investments

- Minimizing risk

Personal Capital Investment Principles

Another thing we liked about Personal Capital when we performed our retirement planning software reviews, was how stringent and disciplined it was in its approach to investing.

Personal Capital operates according to model portfolio theory. It optimizes your portfolio by orienting your assets around minimal risk and maximal yield.

Your advisors and the Personal Capital Investment Team do not select assets in isolation. Instead, they review how each asset will perform alongside every other investment in your account.

Personal Capital also balances your portfolio based on sector, style, and size of assets. Due to this, your investments aren’t monopolized by a handful of large corporations but are rather diversified across a much broader spectrum.

Furthermore, your ratio of stocks ranges from 70 to 100. According to Personal Capital, this range has been proven to minimize stock risk.

To further maximize your returns, Personal Capital hones your investments into six specific asset classes. These include US stocks & bonds; alternatives, such as commodities and ETFs; international stocks & bonds; and cash for liquidity.

From there, your portfolio undergoes a daily review with subsequent rebalancing as warranted. Your advisors won’t adjust your portfolio until your high-level assets stray moderately from your target.

Likewise, securities are rebalanced when they separate from the target in excess of 0.5%.

Outperforming the Market

As it pertains to US equities, the Personal Capital strategy was put to hypothetical backtests. The result?

Personal Capital’s investment strategy outperformed the S&P 500 by 1.2% each year, all while experiencing lower volatility.

More information about Personal Capital’s investment approach can be found here.

“Creating Capital” Community Groups

The goal of investment advisory is to help investors manage their money more effectively. However, the spirit behind such advice is education, including educating investors on their investments and how they work.

It’s with this purpose in mind that the women at Personal Capital banded together to form Creating Capital. Creating Capital consists of women helping women learn the principles of sound money management and investment strategy.

Creating Capital was inspired by women at Personal Capital who met with each other once a month to review their finances. The mission grew from there, to the point now where Personal Capital and Creating Capital team up with women outside of the firm to organize what are called Capital Circles.

Creating Capital offers a free toolkit to the leaders who found their respective Capital Circles. They can download lesson plans, learn from experienced Personal Capital advisors, and network with other members.

From there, Circle leaders recruit members from their surrounding areas and meet to discuss finance and investing.

The members are challenged to thoroughly review their finances and grow their body of knowledge as it pertains to managing their money. Creating Capital posts lessons once a month on its site to facilitate further discussion within Capital Circles.

To learn more about Creating Capital or to start a Capital Circle in your community, visit the Creating Capital website.

Top-Notch Mobile Apps

Personal Capital makes it convenient for you to track your account details through the Personal Capital app. Apps are available for mobile phones, tablets, and personal computers.

With the Personal Capital app, you can receive real-time updates on all aspects of your finances. These include your investments, spending, allocations, current balance, sector weighting, and portfolio performance, to name a few.

The Personal Capital app has been featured and recognized by a number of reputable media outlets. These include:

- CNBC’s Disruptor 50 List for 2014 & 2015

- Forbes’ list of Best Online Tools to Track Your Investments

- iTunes’ App Store Staff Pick

- CNN’s list of Best 5 Free Apps to Invest Smarter

- Macworld’s Editor’s Choice for best free finance tracking app

Related: Best Quicken Alternatives | Ranking | Top Alternatives to Quicken

WealthTrace Review

WealthTrace is a fee-based retirement planning software that offers tiered retirement planning tools for both investors and advisors.

Whereas many financial advisors restrict their services to high-net-worth individuals, WealthTrace is available to the everyday investor, too.

This increases access to professional financial planning services, allowing it to improve the lives and futures of more people.

WealthTrace continues this trend by providing services to financial advisors, as well. By improving client experience and customer care, WealthTrace enables financial advisors to improve their advisory practices while helping to better manage clients’ money.

In effect, WealthTrace is the rising tide that lifts all boats.

Photo courtesy of: Best Retirement Planning Software

Four Tiers of Service

WealthTrace offers three tiers, or levels of access, to its personal retirement planning software. These tiers feature, but are not limited to, the following perks:

Basic

You receive unlimited use of WealthTrace’s retirement planning software for $189 your first year and $129 each year thereafter.

Your account is limited to one plan with email support, a live chat with a WealthTrace advisor, access to expert planning, and the option to upgrade to a multi-plan account.

Regular

This plan costs $209 for the first year and $149 annually thereafter.

Subscribers to this plan receive unlimited use, email and phone support, chat support, the option to upgrade to a multi-plan account, and access to planning assistance from a WealthTrace expert.

Advanced

Advanced plans cost $249 initially and are renewed at $199 annually.

This plan features unlimited use as well as email, phone, and chat support; the option to upgrade; access to expert planning; and a Monte Carlo analysis of your portfolio.

Advisor

The Advisor plan is geared toward financial advisors. It costs $799 annually and comes with unlimited plans for clients.

Advisors enjoy email, phone, and chat support, not to mention an online client portal, fact finder, model portfolios, and access to customized reports.

Tools for the Do-It-Yourself Investor

WealthTrace’s goal is to help the pick-yourself-up-by-the-bootstraps, do-it-yourself kind of personal investor. It wants its retirement planning software to empower such clients to feel in control, but not so in control that they have to go it completely alone.

WealthTrace hits the mark in this regard by structuring its retirement planning tools to walk you step-by-step through every financial variable.

Do you want to know if you’ll hit your retirement target date or if you’ll hit the target but run out of money? How much will you need to safely and comfortably retire for the rest of your life, anyway?

Mobile & Digital Access

You can find answers to these questions and more with WealthTrace personal retirement planning software. And since it wants to make it extra convenient for you, your plan is available no matter your digital medium, be it personal computer, smartphone or tablet.

On the topic of mobile access, you enjoy the freedom to adjust your financial data points at will and view results updated instantly.

Whether you change your target retirement date, cash flow needs, budgeting plan or more, WealthTrace software gives you answers on your phone, computer or tablet whenever you need.

Automatic Data Collating

Part of the power behind the WealthTrace software lies in the amount of information that it collates on your behalf. The average personal investor won’t be familiar enough with the federal tax code; for instance, to plug such data into a plan and understand the ramifications thereof.

However, WealthTrace software comes packaged with this information. You input what you can, and the program takes care of the rest. Tax considerations, minimum distributions, account types, and more are factored into your plan for you.

On the Advanced plan, you have the ability to run a Monte Carlo analysis on your financials. Detailed metrics help you see how your investments would stand up under a wide variety of economic hypotheticals.

In this way, WealthTrace software enables you to calibrate your plan to account for otherwise unforeseen circumstances that threaten to derail your retirement goals.

Investors under the Advanced plan also receive expert planning assistance. Thus, WealthTrace complements your autonomy with the knowledge and experience of its Chartered Financial Analyst. Think of it as you taking the wheel while letting WealthTrace act as your navigator from time to time.

Popular Article: Best Retirement Planning Software and Tools for Individuals

Help for Advisors, Too

As we mentioned before, WealthTrace seeks to help advisors as much as personal investors. WealthTrace demonstrates this commitment via the streamlined nature of its digital resources, including its website and online advisor portal.

Dynamic App

One of the most attractive elements of WealthTrace’s advisor plan is the minimal amount of training required for advisors to start using the WealthTrace advisor app.

WealthTrace prides itself on how intuitive its advisor interface has proven to be, allowing advisors to begin working with their clients right away without any delay.

For the advisor on-the-go, the mobile app provides essential monitoring abilities. Advisors no longer have to wait until they get back to the office to check a client’s portfolio.

Needless to say, this helps advisors provide faster, more efficient customer care.

Intuitive Advisor Software

WealthTrace estimates that its software can cut in half the time needed for advisors to construct financial plans. This is helped in part by how the software accounts for all the variables of a given client’s file.

Things like state taxes, federal taxes, Social Security guidelines, Roth IRA transfers, and more relevant data are preprogrammed into the system. Advisors have all the information they could possibly need literally at their fingertips.

In essence, it’s as if the advisor has an assistant that’s prepared each client’s file. We won’t say the software is automated because the advisor still has to do the work, but the program does, in fact, perform a lot of the heavy lifting.

The advisor software also helps finance professionals stay on top of their client accounts. Not just up to the minute – up to the second. If an advisor needs to tweak a client’s data, the program auto-calculates the results.

Join Personal Capital Now, It’s Free!

Access to Multiple Scenarios

WealthTrace’s advisor software doesn’t stop there. Advisors can also access multiple scenarios to then apply to client accounts.

Recession, high inflation, alternative asset allocation – nearly every type of hypothetical “stress test” can be run. This includes the ability to compare the performance of a client portfolio over any point in time.

Want to see how a client’s investments would have fared during the 2008 crash? How about after the dot-com bubble burst? This research assists advisors concerned about minimizing risk while maximizing returns as much as possible.

Customized Client Access

As if all these features weren’t enough, WealthTrace software for advisors lets you give your clients access to their own accounts. More than that, however, is the fact that you can customize their online experience for them.

Much of the information an advisor sees when viewing client accounts can confuse the average investor. To streamline the experience all the more, advisors can arrange a client-friendly portal that displays only the information that clients want to view.

Going even further, your clients can enjoy mobile access to their accounts at any time of the day or night.

Do you need your client or prospect to complete an online form? WealthTrace software utilizes a fact finder that can help them complete their forms with ease.

This takes some of the administrative duties off your shoulders. These features, along with the software’s overall ease of use and rapid onboarding, helps you put your attention where you want it to be: on the performance of your clients’ portfolios.

Multiple User Demos for Ease of Training & Use

Does the idea of planning your own financial future seem daunting in spite of WealthTrace’s intuitive retirement planner software?

We understand. After all, not everyone is tech- or investment-savvy. No matter how intuitive, streamlined or client-friendly a user interface might be, a learning curve naturally exists for each investor regardless of experience.

Free user demos are provided for just this purpose. For instance, are you a personal investor and need to map annual return? Want to plan your life insurance but don’t know how?

Or maybe you’re an advisor who wants to employ the software to create an annuity with guaranteed future income.

For these questions and more, WealthTrace hosts a wealth of demo videos and tutorials on its website. Nearly every software how-to is included on this page.

You also have the option of creating a sample retirement plan, reading sample reports, or viewing sample screenshots to better educate you on how WealthTrace works. These samples are available to both personal investors and advisors.

If you feel that you still need additional human assistance, demos and tutorials can always be supplemented with expert assistance under the Advanced plan.

Encrypted, Secure & Confidential

Another feature that put WealthTrace on our list of best retirement planning software is its commitment to securing your sensitive financial data.

All information transmitted through WealthTrace software is encrypted. Furthermore, no personal information is shared or sold to third parties unless at the client’s request.

Read More: Top Mint Alternatives | Best Personal Budget Software Alternatives to Mint

Betterment Review

Betterment is a financial advisor with a retirement planning software that ranks among the best of all the financial advisors we reviewed.

Founded by Jon Stein and Eli Broverman in 2010, Betterment makes the claim of being the first automated investing service. It services investors in all 50 states with concentrations in California, New York, and Texas.

Betterment has experienced explosive growth since its inception, to the point that it manages an excess of $5 billion in AUM (assets under management). What’s particularly impressive is that its AUM doubled between the period of January 2015 ($1.1 billion) and July 2015 ($2.5 billion).

Read on to see how Betterment’s superior client experience is fueling its growth, along with how it can provide you top-of-the-line retirement planning software.

The Optimized Betterment Portfolio

Doing business with typical financial advisory and retirement planning firms often doesn’t make for a satisfying experience.

Sometimes, it’s because your portfolio isn’t diversified enough, resulting in greater volatility than necessary. Or, sometimes, it owes to the hidden costs, commission-based fees or unnecessary products and services that have been foisted upon your plan.

Other times, your risk tolerance is too high and you accrue more losses than gains, or it’s too conservative, slowing your performance to a crawl.

Whatever the reason, your portfolio isn’t optimized. As a result, you experience less-than-desirable gains, and your future retirement is imperiled because of it.

Betterment understands these concerns and structures each client portfolio to counteract such financial malignancies.

Diversification, automatic balancing, and reduced fees, among other factors, have all helped Betterment clients achieve 2.9% higher average returns than standard robo-advisors.

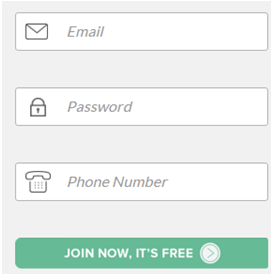

Among other methods, this feat is accomplished by Betterment’s Tax Loss Harvesting+. This automated service runs every day, scouring client accounts for losses and offsetting them with a similar investment.

According to Betterment, the average portfolio experiences the following gains and returns (assuming a $50,000 investment, 70% allocation of stocks, and $750 in twice-monthly incrementing deposits):

Photo courtesy of: Betterment

Betterment Tax Loss Harvesting+ regularly outperforms standard tax-loss harvesting methods by other advisors. Some perks of Betterment’s Tax Loss Harvesting+ service include:

- Daily automated harvesting

- No additional cost

- Reinvestment of every harvested dollar

- Strict avoidance of short-term capital gains tax

- Rebalancing

Betterment Fees

Betterment makes money from a fee-only structure of assets under management (AUM). Over the past few years, Betterment has made substantial updates to their fee structure, culminating in an affordable rate for all ranges of investors.

This annual fee is considerably cheaper on average compared to standard account fees at other advisory firms. As a result, investors save significantly more money over the life of their plan – money that can be invested or tucked away into savings.

Betterment’s fee structure is explained as follows:

- 0.25% Annual Management Fee: No minimum balance, tax-efficient investing features, automated portfolio management, & award-winning customer support

- 0.40% Annual Management Fee: $100,000 minimum balance, annual call with CFP professionals, and additional account monitoring

- 0.50% Annual Management Fee: $250,000 minimum balance, unlimited calls with CFP professionals, and additional account monitoring

In keeping with its fee-only structure, Betterment does not charge transaction fees, trade fees or rebalancing fees, regardless of the dollar amount invested.

Betterment RetireGuideTM

All Betterment accounts enjoy access to RetireGuideTM, which we have deemed to be among the best retirement planning software of any online financial advisory firm.

The Betterment RetireGuideTM helps you analyze the state of your financial health with an eye toward retirement. From there, the retirement software can help you answer a wide range of questions and concerns regarding your retirement.

For example, Betterment RetireGuideTM can address your “retirement gap.” The guide pinpoints how much savings you’ll have by your target retirement date. This number is then compared to the savings you’ll need to retire comfortably by your target.

If you’ll run out of money prior to your target date, RetireGuideTM lets you know. If, for instance, you’ll meet your target but expend your savings within 10 years, the guide will tell you this, too.

Some of the other questions and concerns that Betterment RetireGuideTM can answer include, but are not limited to, the following:

- Are you saving enough money?

- What’s the optimal date to retire?

- How will your retirement fare if you don’t increase your savings rate?

- How will relocation affect your retirement spending?

- What is the minimum on which you can comfortably live during retirement?

- Have you optimized your retirement planning by utilizing the right accounts?

- How can you make your investments more efficient in order to meet your retirement goals?

Related: Best Budget Apps | Ranking | Best Budget App Review

Free Wealth & Finance Software - Get Yours Now ►

Holistic, Flexible Retirement Planning Approach

When formulating a retirement plan, many investors and their advisors don’t consider the lifestyle details that influence their retirement goals.

For instance, the investor’s choice of where to live is a big contributor to his/her retirement gap. Instead of minimizing this data or skipping over it, Betterment factors it into your plan. It does this with every data point in your life, including your goals, dreams, and future objectives.

In this way, Betterment RetireGuideTM is as a retirement planning tool that takes a holistic approach to planning your retirement. No stone is left unturned, all for the purpose of making a comprehensive, fully-informed investment in your future.

To this end, the Betterment RetireGuideTM aggregates all of your financial data and accounts, whether held by Betterment or outside firms. This gives you a more accurate picture regarding your overall financial health and its possible implications for your retirement goals.

However, let’s say the market experiences prolonged volatility or unforeseen circumstances that affect your life and require you to dip into your savings.

In cases like these, your Betterment retirement plan can adjust to meet whatever life throws at you. It’s flexible and fluid, allowing for changes demanded by external variables as well as by your changing desires and goals.

With Betterment RetireGuideTM retirement planning software, you enjoy additional benefits beyond those detailed above. Some of these benefits include the following:

- Automated withdrawals

- Smart balancing of your account

- Deposits/withdrawals in one click

- Extended hours for deposits

- Weekend deposits trade immediately on Monday mornings

- Automated dividend reinvestment

- Tax management

- Option to roll over existing 401(k) or IRA into a Betterment portfolio

Fast, Easy Process

Retirement can be a scary thing for which to plan, but Betterment feels strongly that signing up for its retirement planner software shouldn’t be.

It has simplified the online sign-up process as much as possible. Under the Retirement section of its Services tab, you plug in your age, retirement status, and annual income.

On the next page, you’re given three priorities: Safety Net, Retirement, and General Investing. Clicking on the Retirement option displays Betterment’s suggestion for annual retirement income based on the three pieces of information entered on the introductory page.

Beneath your annual retirement figure, Betterment breaks down the allocation of stocks versus bonds. You also have the choice of refining your account type between taxable, traditional IRA, Roth IRA or SEP IRA.

Clicking even further into Betterment’s retirement planning process ushers you into a more detailed breakdown of asset allocation, including types and percentages. These percentages and allocations remain flexible, leaving you free to adjust both your target and your allocation later on in the process.

From there, you enter basic biographical information and a password to establish your Betterment account. You are then requested to verify your identity, input personal financial data, and submit.

Independent Advisor

We look for advisors that operate independently of parent organizations, affiliate partnerships or anybody that exerts undue outside influence on the firm’s decision-making processes.

We’re happy to report that Betterment is one of those companies. Its status as an independent financial advisor means that it doesn’t receive bonuses, commissions, kickbacks, incentives or any other “soft dollar” compensation for recommending certain assets.

Being independent, your Betterment advisor can recommend a wide range of investments that result in broadly diversified asset allocation. Some of these assets include:

- US total stock market

- US large-cap, mid-cap, and small-cap value stocks

- Emerging market stocks

- International developed stocks

- Short-term treasuries

- US high-quality/municipal bonds

- Inflation-protected bonds

- International bonds

- US corporate bonds

- Emerging markets bonds

Combining independence with global diversification gives Betterment the maneuverability to devise customized plans for each client.

Your Betterment advisor gets to know you, your financial standing, and your goals, all for the purpose of strategically allocating your assets around your unique needs.

Simply put, you can entrust Betterment with your money knowing it has your best interests in mind.

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Betterment Mobile App

In addition to its online portal, Betterment makes accessing your retirement planning tools even easier with the Betterment mobile app.

The Betterment mobile app allows you to:

- Access your account via a secure PIN

- Real-time review of your investment balances and returns

- Link checking accounts

- Manage your portfolio

- Deposit or withdraw money any time you need

- Check your investment goals

- Check your account activity

Security & Privacy Protection

Betterment protects your privacy in several different ways. Some of these include:

- Storing data behind secure monitored firewalls

- Storing data inside a secure, safeguarded facility

- Highest level of browser encryption

- Protecting personal data from third parties unless otherwise specified by you

Betterment installs fraud protection on your account in the unlikely event that your data gets hacked. The Betterment team works to rectify any losses associated with the unauthorized use of your data.

The suspicious activity must be reported to Betterment within 60 days to receive full consideration under the Electronic Fund Transfer Act.

Your account is further protected up to $500,000 through Betterment’s membership in SIPC (Securities Investor Protection Corporation). No matter what happens to Betterment as a firm, you still retain your securities.

Free Wealth Management for AdvisoryHQ Readers

Wealthminder Review

Wealthminder was founded by CEO Rich Ellinger with one mission: Bring more transparency and trust to the financial industry by making quality advice accessible to everyone.

He sought to accomplish this by constructing a smarter, more efficient self-service financial planning platform.

However, it should be noted that Wealthminder differs from the other retirement planning software providers on our list in that it’s not strictly an end-user retirement planning tool.

Instead, Wealthminder serves as a marketplace that matches investors with financial advisors and retirement planners. The process by which investors are courted by advisors is simple and follows in the next section.

The Wealthminder Process

First, you request quotes for the services you need. These services are chosen from a dropdown menu and include investment management, budgeting, insurance planning, debt reduction, and, of course, retirement planning.

After the category is selected, you choose from a second dropdown menu. This menu features frequently asked questions pertaining to your category. You select whichever question that best addresses your concerns.

Next, you input your zip code and hit enter. Your name and email are requested in order to send you advisor proposals. Once this information has been entered, you proceed to the next page.

Wealthminder then matches you with a list of advisors who provide customized services that correspond to your needs. These advisors submit proposals detailing how they can assist you as well as the cost for their services.

Once you’ve looked over the proposals, you make your selection. After that, you’re introduced to the advisor. Wealthminder manages your payment on your behalf once you are in communication with the advisor and ready to do business.

If it sounds like the process doesn’t take long to complete, that’s because it doesn’t. You can be matched and introduced to the advisor of your choosing within minutes if you so prefer.

In this way, Wealthminder makes it incredibly easy to find a professional to help you meet your financial goals, no matter what they may be.

Free Money Management Software

Services to Address All Your Financial Needs

Despite the fact that Wealthminder does not provide direct retirement planning software or retirement planning tools, it is still able to address a very broad range of consumer interests.

These interests include:

- Retirement planning

- Investment management

- Portfolio review

- Budgeting and saving

- Insurance planning

- Risk management

- Education funding

- Planning for major purchases

- Major life event planning

- 401(k) advice & miscellaneous employee benefits

- Debt reduction

- Estate planning

- Tax planning

- Comprehensive financial planning

Advisors Adhering to a Fiduciary Standard

WealthMinder could have built a network of advisors that covertly charge hidden fees to cover commissions, incentives or other kickback types of compensation, especially considering its role as a “middleman.”

After all, Wealthminder does nothing more than pair the two parties together. It would have every right to keep its nose out of the “how” and “what” of advisors’ fee structures.

However, that’s not how Wealthminder chose to operate. Instead, it cultivated a list of financial advisors committed to the fiduciary standard. This is one of the top reasons why WealthMinder made our list of the best free retirement planning software.

Since Wealthminder chose only fiduciaries, your best interests are always put first. This is true no matter what category of financial advisory you select.

As a result, you will always know upfront the fees you are being charged along with the scope of services to be delivered.

All advisors listed on Wealthminder follow these additional standards of professionalism:

- Offer fee-only work

- Maintain a clean record with the SEC

- Respond promptly and directly to communications

- Provide quality work

No hidden fees, no surprises. Just a transparent system that helps you succeed.

Conclusion: Selecting the Best Retirement Planning Software for You

So, in conclusion, which of these top retirement planning tools is the best one for you?

The best retirement planning software for you will depend on your needs.

Personal Capital is a game-changing option if you are looking for free retirement planning software that provides all the guidance benefits of a paid service.

Not only does Personal Capital offer comprehensive retirement planning software, but it also acts as a dynamic personal budget software and portfolio management software.

Similarly, while Betterment is not necessarily a free retirement planning software, it does provide plenty of free, wholly beneficial features for those who are looking for a sophisticated program to manage their retirement savings.

Whether you choose Personal Capital or Betterment as the best retirement planning software for your needs, you can rest assured that both of these software apps are highly intuitive.

Additionally, the ability to connect with an investment manager or an advisor through these retirement software platforms can go a long way in successfully planning for retirement.

60-Second Sign up – Personal Capital

Of course, it’s important to keep in mind that both Personal Capital and Betterment are examples of software apps, meaning that there is less personal interaction.

If you are looking for a platform that directly connects you with real-life advisors in your area, then you’ll want to consider Wealthminder.

With Wealthminder, users can easily connect with trusted advisors to schedule a face-to-face meeting, rather than signing up online with a personal finance software platform.

Of course, you can always find more information from our team of experts at AdvisoryHQ. For additional reviews, you can check out AdvisoryHQ’s list of the top rated financial advisors, wealth managers, and investment advisors.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.