Intro: Identifying the Best Investment App for You (Stash vs Robinhood)

As more investors look for apps that provide on-the-go account maintenance and quick buying and selling, investing is becoming more accessible than ever.

Whether you are a new investor or a seasoned professional, it’s important to identify the best investment app to help you meet your unique financial goals.

If you’re looking for the best investment app, it’s easy to get overwhelmed—there are tons of new apps appearing every day to suit a wide range of needs.

Stash and Robinhood are two popular investment apps, and are certainly worth considering as the best investment app for you.

In our Stash vs Robinhood comparison, we’ll look at the basic structure, fees, advantages, and disadvantages of Robinhood vs Stash to help you decide if Robinhood or Stash could be the best investment app to help your finances grow.

See Also: Best Client Management Software Tools | Ranking & Review

Stash vs Robinhood | Investing Process

Choosing between Robinhood or Stash can be challenging, since both apps aim to make investing simple, convenient, and affordable.

Stash vs. Robinhood – Investing Process

However, there are a few differences to consider when comparing Stash vs Robinhood. In the sections below, we’ll look at Robinhood vs Stash to show you what to expect from the investing process with each best investment app.

Robinhood Process

Robinhood is a free trading app that is designed to make stock trading both accessible and affordable, eliminating costly trading commissions. After signing up online, users can download the app, link their bank account, and begin trading.

For traders comparing Robinhood vs Stash in terms of available securities, Robinhood has an incredibly wide range of investment options. There are over 5,000 securities available on Robinhood, which includes most equities and ETFs listed on major U.S. exchanges.

Although plans for a web-based app are currently in the works, users can only access their accounts via mobile app.

Aside from their basic membership, Robinhood also offers an enhanced membership, called Robinhood Gold. With this service, investors have access to extended-hours trading and are able to trade on margin, making it a good choice for experienced investors.

It does come with a flat monthly fee, and requires a minimum balance of $2,000.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

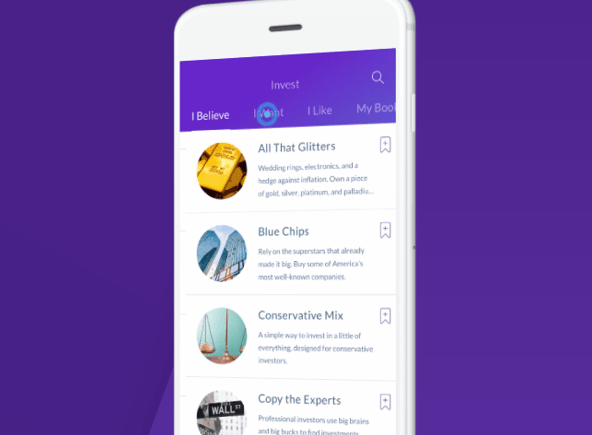

Stash Process

When comparing Stash vs Robinhood, some users may find that Stash provides a much more personalized experience.

The basic process behind this popular Robinhood competitor can be summed up in the following steps:

- Receive personalized recommendations based on financial goals and risk tolerance

- Choose from over 30 ETFs to create your own portfolio

- ETFs are categorized based on personal interests and values

The last bullet-point is what truly sets Stash apart when comparing Stash vs Robinhood—or any other investing app, for that matter.

Rather than list confusing financial jargon, this best investment app takes into consideration that not everyone is a financial expert. Instead, this Robinhood competitor gives each ETF a nickname based on the values and characteristics of the industries within it.

A few examples include:

- Clean & Green—Companies investing in renewable energy

- Delicious Dividends—Companies that consistently pay dividends

- Global Citizen—Over 7,000 assets across 40 countries

As a top Robinhood competitor, Stash allows for automatic or manual transfers to your investment account (the recommended amount is $5-$10 weekly).

Users can also access Stash Retire, which allows investments in Roth IRAs. With as little as $100, users can start building their retirement savings—or at the very least, until they turn 59 ½.

Don’t Miss: Best Financial Planning Software for Advisors | Review & Ranking

Stash vs Robinhood | Fees & Pricing

Part of finding the best investment app means finding an affordable way to help your money grow.

Below, we’ll compare Robinhood vs Stash to help you determine whether Robinhood or Stash has the best fee structure for you.

Robinhood Fees

Robinhood fees are straightforward—there are none. In addition to paying zero annual inactivity, or ACH transfer fees, users can do the following for free:

- Open an account

- Maintain an account

- Transfer funds

- Purchase stock

The only exception to Robinhood fees is through an upgrade to Robinhood Gold.

Robinhood or Stash?

For both membership levels, however, there are some fees that cannot be avoided, regardless of the brokerage used.

Although Robinhood does not impose its own fees, users can expect fees from the US Securities & Exchange Commission and FINRA for set orders (the full fee schedule can be found here).

Stash Fees

Both Robinhood and Stash have their own unique pricing structure, which may play a role in determining which app is the best investment app for you.

There are Stash fees for basic account maintenance: accounts under $5,000 have a fee of $1 per month, while those over $5,000 will have an annual fee of 0.25 percent.

PolicyGenius is quick to point out that paying $1 a month “only makes sense once you start contributing more and more money.” If you aren’t regularly investing money, that $1 fee can easily eat into your savings.

Our Stash vs Robinhood review did find a few Stash fees for additional transactions, like insufficient funds or paper statements, though the average user should rarely encounter these.

Additionally, all new users receive their first month free of charge, making it a best investment app for a no-risk trial.

Related: Best Financial Planning Software for Individuals (Ranking)

Stash vs Robinhood | Stash Reviews & Robinhood Reviews

A great way to choose between Robinhood or Stash is to look at reviews from actual users to see how each app performs.

In the sections below, we’ll look at Robinhood reviews and Stash reviews from iTunes and Google Play to look at Robinhood vs Stash from the user’s perspective.

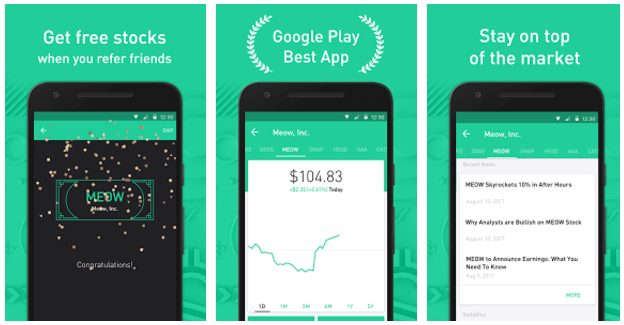

Robinhood Reviews

There are over 24,000 Robinhood reviews on iTunes, giving the app a total rating of 4.6 stars out of 5.

Best Investment App

With such high ratings, the majority of Robinhood reviews are positive, calling the app “a simple yet powerful investing platform” and “the best investing app there is.”

However, there are a few Robinhood reviews that suggest that the recent app update has not solved a few glitches, like inconsistent notifications and difficulty seeing ticker prices.

Robinhood reviews on Google Play are also overwhelmingly positive, with over 34,000 users giving a 4.6-star rating. One such positive review reads:

Trades are beyond easy and the information on stocks is just enough to get a feel for them without overwhelming. If your[sic] just starting out and looking into diy stock trading START HERE!

Stash Reviews

There are over 8,000 Stash reviews on iTunes, giving the app a total rating of 4.4 stars out of 5. Many reviewers point out that the Auto Stash feature is extremely helpful, depositing investment funds with zero effort.

It’s worth noting that even positive Stash reviews point out potential difficulties with the pricing structure, suggesting that other users should:

Make sure your investments yield more than the $1.00/month charge or you’ll be losing money. As a rule of thumb, this means you probably shouldn’t use the app with less than $100 in your stash.

Google Play has over 6,000 Stash reviews from users, giving the app a total rating of 4.1 stars out of 5. A good number of positive Stash reviews come from beginner investors looking for a convenient, simple way to start investing.

As with Stash reviews on iTunes, reviewers on Google Play are also quick to point out that users will have to invest larger amounts of money to make up for the $1 monthly fee.

Popular Article: Best Personal Accounting Software for Home Use

Stash vs Robinhood | Advantages & Disadvantages

In the sections below, we’ve outlined a few highlights of the unique benefits—and potential downfalls—of comparing Robinhood vs Stash.

Robinhood vs Stash—Advantages & Disadvantages

If you’re still on the fence between Stash vs Robinhood, you may want to consider the following advantages that come with using Robinhood:

- Commission-free trades

- Intuitive app for iTunes and Google Play

- Investments are protected up to $500,000

- No account minimum

- Margin accounts available through Robinhood Gold

Before deciding between Robinhood vs Stash, you may want to consider these potential disadvantages:

- Does not include research reports or analysis software

- Only available via mobile app—no desktop access

- No support for Quicken, Mint, or Personal Capital integration

- Cannot trade options, mutual funds, or bonds

Stash vs Robinhood—Advantages & Disadvantages

When comparing Stash vs Robinhood, investors should consider the following advantages:

- Less confusion due to the elimination of investment jargon

- Ability to choose investments based on values and personal interests

- Customized portfolios based on personas like The Activist and The Trendsetter

- First month without any Stash fees

- Start saving for retirement with Stash Retire

There are also a few potential disadvantages to consider when choosing between Stash vs Robinhood, including:

- Cannot invest in individual stocks or bonds

- Monthly fee can become expensive without regular deposits

- Stash fees apply for paper statements or insufficient funds

- Account is only accessible via mobile app

Read More: Best Banking Apps | Ranking of the Top Banking Apps

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Choosing Between Robinhood vs Stash

If you’re interested in finding the best investment app, you’re in luck. There are plenty of great apps on the market today that strive to make investing both accessible and affordable, even for less-experienced investors.

When it comes to choosing between Robinhood vs Stash, it’s important to ensure that your personal best investment app comes with all the features to set your investments up for success.

Ultimately, deciding whether Robinhood or Stash is right for you can be determined by examining what you need in an investment app.

Would having creative categorization make investing into a simpler, more engaging process? Do you want the option to contribute towards retirement savings accounts? Can you make regular deposits to offset the $1 monthly fee?

If so, you will want to choose Stash when deciding between Stash vs Robinhood.

Do you plan on making frequent trades? Are you willing to conduct your own research on securities before purchasing them? Would you like the option to upgrade to extended-hour trading and a margin account?

If these qualities are what you are looking for, Robinhood may be the best investment app for you.

Image sources:

- https://pixabay.com/en/money-home-coin-investment-2724241/

- https://www.stashinvest.com/

- https://play.google.com/store/apps/details?id=com.robinhood.android&hl=en

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.