2017 RANKING & REVIEWS

TOP BEST AUTO INSURANCE COMPANIES

Finding the Best Auto Insurance Companies, and What You Should Consider When You Compare Auto Insurance

There are so many auto insurance companies available today, ranging from online auto insurance to companies specifically focusing on providing affordable auto insurance and conveniences like free auto insurance quotes.

With so many options for auto insurance companies available, how do consumers choose the right one for their needs?

The following auto insurance comparisons are designed to help consumers do that, but first, it’s essential to provide a general overview as to what they should be searching for as they shop for the right auto insurance companies.

The most important consideration when looking for online auto insurance or the best auto insurance companies is the level and type of coverage they provide.

There are different types of auto insurance coverage, which include everything from liability and personal injury to comprehensive, collision, and uninsured/underinsured coverage. You’ll need to think not only about your personal requirements here, but also what your state requires, since each varies.

Award Emblem: Top 10 Auto Insurance Companies

Another consideration to keep in mind as you compare auto insurance is whether a provider is an agent, a broker or a direct provider.

Most of the auto insurance online companies are direct providers, which means customers are saving money since no agent or broker is acting as the middle man.

Next to keep in mind as you explore affordable auto insurance and compare auto insurance quotes is customer service. Consumers can look at consumer complaint ratios to research providers and see how many dissatisfied customers have reported issues with the company recently.

Finally, as you begin to compare auto insurance, think about affordable auto insurance. You’ll need to compare auto insurance quotes and try to find the least expensive option that also meets all of your needs.

Although auto insurance companies may publish their standard rates on their website, these may not be the rates you’re actually eligible for, so free auto insurance quotes can be critical to have before you decide on a provider.

See Also: Best Life Insurance Rates & Charts | Tips to Get the Best Life, Term, and Whole Life Rates

AdvisoryHQ’s Top Ranked Best Auto Insurance Companies

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for the auto insurance companies)

Related:

- Permission to Use Your FREE Award Emblems

- Promoting Your “Top Ranking” Award Emblem and Recognition

- Can Anyone Request a Review of Auto Insurance Companies?

- Do the Best Auto Insurance Companies Have a Say in Their Review & Ranking?

- Can the Top 10 Auto Insurance Companies Request Corrections & Additions to Their Reviews?

Best Rated Top 10 Auto Insurance Companies:

Firms | Contact Info/Websites |

| AAA | http://www.aaa.com/PPInternational/International.html?referer=www.aaa.com |

| AllState | https://www.allstate.com/ |

| Esurance | https://www.esurance.com/ |

| GEICO | https://www.geico.com/ |

| Liberty Mutual | https://www.libertymutual.com/ |

| Nationwide | https://www.nationwide.com/ |

| Progressive | https://www.progressive.com/ |

| State Farm | https://www.statefarm.com/ |

| The Hartford | https://www.thehartford.com/ |

| USAA | https://www.usaa.com/inet/pages/auto_insurance_main?akredirect=true |

Table: Top 10 Auto Insurance Companies | above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Methodology for Selecting the Top 10 Auto Insurance Companies

The process used to compare auto insurance providers, including online auto insurance and affordable auto insurance companies, is based on the AdvisoryHQ signature ranking methodology, which utilizes a top-down approach.

We started by researching all of the major auto insurance providers and resources where consumers can buy auto insurance online. We then compared each of these auto insurance companies to a set of carefully defined, consumer-centric criteria.

That criteria allowed us to strategically compare auto insurance and create a baseline for auto insurance comparisons. Based on that criteria and the needs of the average consumer, we compiled a list of the top 10 auto insurance companies and the best places to buy auto insurance online.

Detailed Review— 10 Top Auto Insurance Companies

After carefully considering each of the best auto insurance companies and places to buy auto insurance online we created the following list of the top 10 auto insurance companies.

As you continue reading, you’ll find detailed reviews for each of our picks, as well as specifics of some of the factors we used in our decision-making process, all of which are part of these in-depth auto insurance comparisons.

Don’t Miss: Top Best Life Insurance Companies | Ranking | Term Life & Whole Life Insurance Comparison

AAA Review

AAA is included on this list of auto insurance comparisons and low auto insurance providers for a number of reasons.

In general, AAA was founded more than 100 years ago to promote rights for drivers and passengers as well as more fair laws and safer vehicles. Since its establishment, AAA has grown to include more than 50 million members regarding membership services like roadside assistance.

AAA has also grown to include a full range of services related to travel, which include low auto insurance, financial and banking services, and other travel benefits.

Key Factors That Enabled This to Rank as One of the Top Auto Insurance Companies

As part of the process to compare auto insurance, find the lowest auto insurance rates and create comprehensive auto insurance comparisons, the following are some reasons AAA ranked well and was included on this list.

AAA Triple Check

AAA is not just a leader when it comes to providing low auto insurance, but they also work to be innovators in the affordable auto insurance industry, so they’re often introducing new products and services not available from many other auto insurance companies.

One of these is called the AAA Triple Check. This is a policy review designed to help consumers know whether they have the right policy for them. AAA’s expert agents do a review of consumers’ current auto insurance policy from any company.

The review is free, and as part of the process, AAA assesses charges in the life of the driver, such as new vehicles or the addition of new drivers. Then, AAA provides auto insurance comparisons and discounts showing the consumer how AAA insurance will work best for them.

Image source: Big Stock

Discounts and Rewards

AAA provides affordable auto insurance to their members, and as part of that membership, consumers have access to a wide variety of perks, benefits, and discounts.

Consumers can save on things like auto repairs and service, dining, travel, shopping, and many other purchases. There are also opportunities for members to save on the cost of buying and financing a car, car rentals, and more.

Some of the most popular AAA perks and discounts categories include automotive, entertainment, food and cooking, shopping, pets, restaurants, services, and travel.

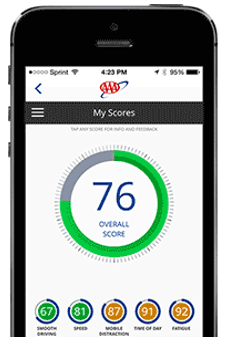

AAADrive

Another industry-leading innovation from AAA is called AAADrive, which is a tool within the AAA mobile app that is designed to help consumers save money and be better drivers. This app monitors users’ driving habits and gives them a performance-based score. The better they drive, the better their score will be.

When a AAA auto insurance customer signs up for this app, they’ll be eligible for a discount on their insurance premiums.

There is a 10% automatic savings on premiums just for enrolling, and there’s a 15% premium discount if a customer enrolls all of their family members on their policy. Then, based on the drivers’ AAADrive scores, they could qualify for a discount of up to 30% at renewal.

Source: AAA Drive

Insurance Options

AAA is included on this list of the best places to find low auto insurance for many reasons, including their dedication to helping customers find not just any policy, but the right policy and coverage for their needs, along with the optimal auto insurance rates. Also part of the insurance products available include the following:

- Multiple product discounts with qualifying home or life insurance coverage through AAA

- Multiple car discounts when there are two or more qualifying household cars insured through AAA

- Customers are rewarded with discounts based on their education and occupation

- AAA offers discounts for approved anti-theft prevention devices

- There are discounts available for safe drivers and good students

- AAA also features discounts for paying premiums on time and in full

Allstate Review

A leading provider of affordable auto insurance, Allstate also offers a full range of other insurance products including homeowners’, renters’, condo, motorcycle, business, and life insurance. The Allstate Corporation is the largest publicly held personal lines property and casualty insurer in the United States. The company serves the insurance needs of more than 16 million households and was founded in 1931.

Allstate is listed on the New York Stock Exchange, and as of the end of the year in 2015 had nearly $104.7 billion in assets.

Key Factors That Led Us to Rank This as One of the Top 10 Auto Insurance Companies

When creating auto insurance comparisons and highlighting affordable auto insurance providers, the following are reasons Allstate was included on this list.

Local Agents

Every consumer is unique, and while some people may be looking for online auto insurance and companies that only offer auto insurance online, others may prefer to be able to connect with someone local and who they can meet with face-to-face. This is something Allstate offers.

When a consumer gets an affordable auto insurance policy from Allstate or works to compare auto insurance quotes from this company, they’re connected with a local agent.

This expert local agent can help uncover discounts, help consumers better understand their policy and coverages, and also point them in the direction of new tools and resources.

Allstate customers also have the advantage of building a personal relationship with their agent, so they always have a point person they can reach out to whether they have an issue or a question.

Tools and Calculators

Allstate is not only an affordable auto insurance provider and one of the resources for the most competitive auto insurance rates. This full-service insurance company also offers a variety of tools and resources designed to help customers and consumers make smart financial decisions.

Some of their auto-related tools and calculators include:

- “When To Buy a New Car”

- “Should I Lease or Buy a Car”

- “Auto Loan Calculator and Comparison”

- “Should I Use a Home Equity Loan to Buy a Car”

- “Car Payment Calculator”

- “Paying Cash or Financing”

- “Car Loan Calculator”

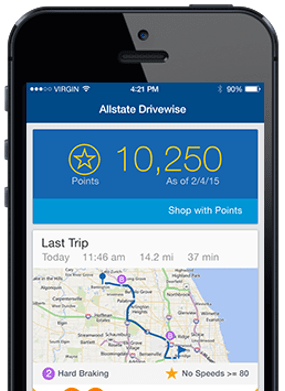

Drivewise

Drivewise is a signature Allstate program designed to reward drivers and customers for having safe driving behaviors. Participants in this program receive an ongoing discount on their auto premium for staying active in Drivewise. Additionally, they can earn cash back after their first 50 trips and every six months after that period, based on their driving behaviors.

Source: Allstate Drivewise

Participants in this program also receive 10,000 Allstate Rewards points just for starting with Drivewise.

Some of the reasons a customer may be rewarded in Drivewise include maintaining safe speeds and avoiding speeds over 80mph, driving at safe hours and avoiding late night trips, and making safe stops without hard braking.

Claim Satisfaction Guarantee

The Claim Satisfaction Guarantee is one of the many policy features available from Allstate, a leader among auto insurance companies. This guarantee is also one of the key reasons Allstate ranked well in terms of these auto insurance comparisons.

With this promise, if a customer isn’t happy with their auto claim, Allstate says they will give them a refund with no questions asked.

If an Allstate customer resides in a state where this guarantee is available, and they have a car accident after the date the guarantee became available in their state, and Allstate pays the claim but the customer isn’t happy, they send a letter within 180 days of the accident explaining why.

Then, Allstate gives them their money back, which includes up to a six-month credit on car insurance premiums for the car involved in the accident.

Related: Average Life Insurance Cost | Average Cost of Whole Life and Term Life Insurance

Esurance Review

Esurance is one of the most well-known providers of online auto insurance products and services and is a great tool to not only buy auto insurance online but also conveniently and quickly compare auto insurance. Esurance pairs state-of-the-art technology and a user-friendly platform to help insurance customers every step of the way, from when they initially compare auto insurance quotes to when they’re making claims.

Esurance has more than 3,000 nationwide employees, 17 offices around the U.S., and offers products and services to residents of 43 states. There are also five million vehicles insured by Esurance to date.

Key Factors That Enabled This to Rank as One of the Top Auto Insurance Companies

Esurance is part of this list of auto insurance comparisons and the best resources for auto insurance online for the following reasons.

CoverageMyWay

An exclusive offering from Esurance, one of the leading providers of auto insurance online and a top resource to buy auto insurance online, is CoverageMyWay. CoverageMyWay helps customers make smarter decisions and takes the guesswork out of the process to compare auto insurance quotes and find low auto insurance.

CoverageMyWay utilizes algorithms and technology to prioritize coverage and help customers find the options that make the most sense for them.

Free auto insurance quotes are provided in a way that’s personalized and based on an individual’s given information. CoverageMyWay is automated and built directly into the process Esurance uses to deliver free auto insurance quotes to consumers.

Policy Discounts

Esurance is a provider of online auto insurance as well as a leader in terms of offering affordable auto insurance. Customers can not only quickly compare auto insurance quotes using Esurance, but there are also a number of discounts available to help drivers save even more money on their policy, and many of these discounts are personalized to the individual customer.

Some of the discounts available when customers use Esurance to find auto insurance online include:

- Fast 5 Discount: To qualify for this, customers simply have to start to compare auto insurance quotes at esurance.com, and it can save them up to five percent on their first-term premium

- Multi-policy discount: This is available when a customer bundles an Esurance policy in addition to their auto coverage

- Paid-in-full discount: When customers of Esurance pay their premium in a lump sum instead of monthly intervals, they could save up to 10 percent on their premium

Mobile App

Offered by Esurance, one of the best places to find auto insurance rates, auto insurance online, and personalized free auto insurance quotes, is the Esurance mobile app. With the mobile app, customers of this leading place to buy auto insurance online can view their insurance ID card and keep it conveniently stored. They can also manage all of the information on their policies, check their payment schedule, make fast and secure payments, add a new car by scanning the VIN, or edit the details of an existing car.

Users of the mobile app can also file a claim, schedule a vehicle inspection, reserve a rental car, and track the process of their claim.

There are also tools available through the app that let users find roadside assistance and even parking near their location.

E-Star Direct Repair Program

When a driver has an accident, they then have to decide who will do the repairs on their vehicle. That is why Esurance offers the E-Star Network, with access to RepairView. The E-Star network includes more than 1,000 of the most reputable vehicle repair shops, so after a customer of Esurance files a claim, their claims rep will help them find a nearby E-Star shop.

Once a policyholder decides on a repair shop, their claims adjustor will have a conference call between the policyholder and the shop to schedule an inspection.

When an Esurance customer chooses an E-Star repair facility, they then have access to online repair monitoring through RepairView. This service includes daily photos of the pairs in progress, a 10-step repair process that’s detailed, repair status updates, and direct contact options with the shop.

Popular Article: New York Life Insurance Reviews | Is NY Life a Reliable Company? (Ratings, Pros & Cons)

GEICO Review

GEICO, a leader among auto insurance companies providing low auto insurance rates and free auto insurance quotes, prides itself on delivering a combination of great service and competitive pricing. GEICO has been working to help customers compare auto insurance quotes and find affordable auto insurance for more than 75 years.

According to GEICO, new car insurance customers report an average savings of more than $500 a year when they switch to GEICO, and the company has been the fastest-growing car insurance provider for more than a decade.

Key Factors That Allowed This to Rank as One of the Top Auto Insurance Companies

During the process to create these auto insurance comparisons and provide consumers with a guide to finding low auto insurance coverage, the following details highlight why GEICO was included on this list.

Driver Affiliations

One of the number one ways GEICO excels when a consumer starts to compare auto insurance is because of their dedication to offering affordable auto insurance. There are many ways consumers can gain extra discounts on GEICO’s already affordable auto insurance coverage, and one route is through driver affiliations.

For example, GEICO offers specific benefits to policyholders who are part of the U.S. military. Deployed forces could be eligible for discounts of up to 25%. Other discounts include membership in more than 500 groups and employers, and federal employees also receive special discounts.

Handling of Claims

For many consumers when they’re making auto insurance comparisons and looking for the best auto insurance companies, how that company handles claims is incredibly important.

Just the phrase “insurance claims” can fill customers with dread, because they expect them to be a hassle, but GEICO works to alleviate this stress for customers by providing claims they describe as being streamlined and stress-free.

GEICO often even settles claims in as little as 48 hours. Customers can file their claim online or call a representative.

GEICO Mobile App

The GEICO mobile app is well-rated among customers according to Keynote’s 2016 Mobile Insurance Scorecard. The GEICO Mobile app includes features like digital ID cards, access to roadside assistance, and the ability to chat with a GEICO agent from anywhere.

App users can access their policies at their fingertips, pay and manage their bills, and receive their free auto insurance quotes if they buy a new car or get rid of an old one. They can also submit their claims, stay informed about repairs, or pull up not only current quotes but also previous ones.

Read More: Northwestern Mutual Reviews | What you Need to know about Northwestern

Liberty Mutual Review

Liberty Mutual is an insurance company that offers not only competitive auto insurance rates but also a full range of other insurance products and services for individuals, their families, and business owners. Liberty Mutual strives to operate with integrity, treat customers with dignity and respect, and to deliver an innovative and continuously improving customer experience.

As one of the leading resources for low auto insurance rates, Liberty Mutual has a history of more than 100 years of helping people protect what they build and own.

Key Factors That Enabled Us to Rank This as One of the Top 10 Auto Insurance Companies

During the process of identifying the best auto insurance companies and creating in-depth auto insurance comparisons, the following are some reasons Liberty Mutual stood out among the competition.

Simple Quote Process

Liberty Mutual is a leader in many ways, including how they provide opportunities for consumers to receive free auto insurance quotes and access information about auto insurance online before making a decision. Whether a consumer has purchased a new car or wants to switch insurance providers, Liberty Mutual strives to offer a quote process that’s fast, secure and simple.

There are only a few bits of information a consumer might need to compare auto insurance quotes using the online platform provided by Liberty Mutual, and this includes their current policy, driving record information, driver’s license number, and car information.

If a consumer needs help during the auto insurance online quote process, they can use the Liberty Mutual online help center, real-time chat feature, or call a local agent.

Milestone Discounts

As well as striving to offer some of the simplest free auto insurance quotes and tools to effectively compare auto insurance quotes, Liberty Mutual also offers a range of unique discounts on their auto insurance rates.

For example, customers of Liberty Mutual can take advantage of milestone discounts, which provide discounts on coverage for people at certain points in their life. These milestone discounts include:

- Teen driver discount

- Good student discount

- New graduate discount

- Newly married discount

- New move discount

- Newly retired discount

Teen Driver Coverage

For many consumers, a significant area of stress can come when it’s time to compare auto insurance options and compare auto insurance quotes for their teen driver. Liberty Mutual specializes in teen drivers’ coverage. They offer features and benefits designed to suit the needs of teen drivers and their families including 24-hour Roadside Assistance, 24-Hour Claims Assistance, New Car Replacement, and a Lifetime Repair Guarantee.

There are also teen-specific discounts available to families, and many of these are designed to reward safe, responsible drivers. For example, there are discounts available for teens who complete a Liberty Mutual driver training program.

Teens can also sign the Teen Driving Contract that establishes family driving rules, and discounts are offered for this. If a teen has responsible behavior that earns them good grades, they also can be eligible for certain discounts on auto insurance.

Coverage Compass

Coverage Compass is a signature tool offered by Liberty Mutual, allowing policyholders to manage their auto insurance online. This online auto insurance management tool lets policyholders see their coverage within existing policies, learn about potential coverage gaps, and explore additional options they might be eligbile for.

It breaks insurance policies down into three categories: not covered, covered, and covered with more options available.

This interactive tool then provides details and options to obtain free auto insurance quotes for the products and services that may be needed.

Free Wealth & Finance Software - Get Yours Now ►

Nationwide Review

Nationwide is one of the leading auto insurance companies in the country, also offering motorcycle insurance, life insurance, homeowners’ insurance, small business insurance, and more. Nationwide began as a small mutual auto insurer in 1925, and since that time has grown to one of the largest insurance and financial services providers in the world.

Today, Nationwide is one of the best resources for affordable auto insurance with tools to compare auto insurance rates and manage auto insurance online and is also a Fortune 100 Company.

Key Factors Leading Us to Rank This as One of the Best Auto Insurance Companies

As part of the in-depth process required to create these auto insurance comparisons and identify the best auto insurance companies, the following are some notable reasons Nationwide was ranked in the top 10.

Vanishing Deductible

Vanishing Deductible is an optional feature available to Nationwide policyholders designed to help them earn $100 off their deductible for each year of safe driving, up to $500. The name comes from the fact that with a safe driving record, policyholders could have their deductible completely “vanish.”

If someone participates in this offering and then does have an accident, their deductible wouldn’t go all the way back up to the maximum. Instead, it would reset the reward to a certain level, so they’d still have savings.

This is a way to reward policyholders for good driving and safe decision-making and is one of the reasons so many consumers opt to work with Nationwide after they compare auto insurance providers and auto insurance rates.

On Your Side Review

On Your Side Reviews are an offering from Nationwide that ensure consumers have confidence that they’re getting the best possible opportunities to protect the things and people they care about in their lives. This is a scheduled review and insurance assessment that helps consumers get answers to common questions and make sure they fully understand their policy and its benefits.

The benefits of this free insurance assessment include the ability to determine the right protection and options on a personal level at the right price, and to discuss recent or upcoming life events that could impact coverage. It can also be used to identify more affordable auto insurance opportunities and discounts.

The On Your Side Review is available to Nationwide policyholders every year or when there’s a change in their life, such as a marriage, birth, or a new home purchase.

SmartRide Discount

A signature offering from this provider of affordable auto insurance and online auto insurance tools, the SmartRide Program rewards safe driving. This usage-based program provides personalized feedback to participants, which helps them make smart, safe driving decisions.

When a Nationwide policyholder signs up for SmartRide, they earn an instant 5% discount. Then, depending on the safety level of their driving, they can receive even higher discounts of up to 40%.

To begin the SmartRide program, drivers receive a small device when they sign up, which they plug into their car and then drive as normal. Program participants then visit the online auto insurance portal on the Nationwide site to track their discounts and received personalized driving feedback. At the end of the program, the driver sends back their device, and they then receive a locked-in discount at the time of their next policy renewal.

Source: SmartRide Discount

On Your Side Claims Service

According to Nationwide’s research, along with competitive auto insurance rates, 9 out of 10 customers would recommend them to a friend or family member because of their improved claims experience.

The trademarked On Your Side Claims Service includes a written guarantee on repairs when the policyholder chooses a repair shop from the On Your Side Auto Repair Network. All repairs include a written guarantee for as long as the policyholder owns or leases that car.

The On Your Side Auto Repair Network includes only pre-screened and pre-qualified repair shops, and claims can quickly and conveniently be filed online, by agent, by phone, or through the Nationwide mobile app.

Related: How to Refinance Auto Loans with Bad Credit | This Year’s Guide | Bad Credit Auto Refinance

Free Budgeting Software for AdvisoryHQ Readers - Get It Now!

Progressive Review

One of the nation’s top-rated auto insurance companies and portals to shop for auto insurance online, Progressive is ideal for busy customers who want a combination of excellent auto insurance rates and customer service. Progressive was started in 1937 and focuses on being one of the leaders among auto insurance companies because of their competitive pricing and innovation.

Customers can purchase auto insurance online, by phone or through a network of independent agents. Progressive is headquartered in Ohio and has more than 25,000 employees who work in 450 offices throughout the country.

Key Factors That Enabled This to Rank as One of the Top Auto Insurance Companies

When creating auto insurance comparisons, the following were some of the reasons Progressive is part of this ranking of the best online auto insurance providers and affordable auto insurance companies.

Name Your Price Tool

Along with being one of the simplest companies from which to buy auto insurance online or in person, Progressive is part of this list of auto insurance comparisons because of their unique pricing tools like the Name Your Price Tool. This goes beyond just getting free auto insurance quotes and instead lets consumers determine what they want to pay and then receive a customized list of coverage options.

This eliminates the need to look for discounts, calculate rates, or search through various coverage options.

Instead, customers can go to this online auto insurance portal, name the auto insurance rates they want to pay, and they’re quickly presented with optimal options.

Coverage

When a consumer goes to the Progressive website to compare auto insurance coverage, they can use the car insurance estimator, designed to help them determine the perfect package for their needs. Guidance is provided with the idea that full coverage isn’t always the best option. Customers can also use the Coverage Checker tool during their quote to see any areas they might be getting too much or too little coverage when they buy auto insurance online.

Some of the coverage options available from Progressive, one of the best places to buy auto insurance online and receive free auto insurance quotes, include:

- Liability including bodily injury and property damage liability coverage

- Medical payments for any post-accident medical care

- Not-at-fault medical care including uninsured/underinsured bodily injury coverage

- Collision

- Comprehensive coverage

- Loan/lease payoff coverage also called gap insurance

- Rental reimbursement

- Uninsured motorist property damage

- Custom parts and equipment value

Discounts

Progressive is one of the best resources to buy auto insurance online, compare auto insurance quotes, and ultimately to get some of the most affordable auto insurance coverage. One of the reasons they’re such an affordable auto insurance provider is because of their selection of available discounts.

According to Progressive, 95% of their customers earn at least one discount, and uniquely, there is no limit to how many discounts a customer can earn.

Discounts also don’t change the actual coverage a policyholder has. Instead, they’re just straightforward pricing discounts that don’t take away any coverage or increase deductibles.

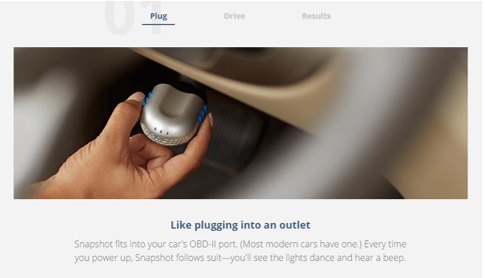

Snapshot

Essential in compiling these auto insurance comparisons was how many innovative options they offer. Progressive excelled in this area for many reasons, including their provision of the Snapshot tool, which is dubbed the “fair way to pay for car insurance.”

Snapshot is built on the idea that insurance should be based, at least partially, on how the policyholder actually drives. Snapshot offers policyholders the opportunity to save on car insurance because of their safe habits.

Source: Snapshot

This online auto insurance provider sends program participants the Snapshot device, which plugs into a car’s port. Then, policyholders drive as they normally would, and for each trip, the Snapshot records information, such as any hard brakes a driver might make.

Snapshot sends the information to the online auto insurance portal of Progressive, where policyholders can track their driving and receive feedback on how to be a safer driver.

Don’t Miss: Ameriprise Insurance Reviews | Is Ameriprise’s Home & Auto Insurance Worth Using?

Free Wealth Management for AdvisoryHQ Readers

State Farm Review

State Farm was established in 1922 as a provider of auto insurance coverage. Since that time, it’s grown to include the servicing of 82 million policies and accounts, which include not only auto insurance but also business, life, health, and long-term care insurance.

State Farm is a stable, reliable company and is ranked number 41 on the Fortune 500 list. State Farm also delivers personalized service thanks to their 65,000 nationwide employees and 18,000 agents.

Key Factors That Led Us to Rank This as One of 2016’s Top Auto Insurance Companies

State Farm was included on this list of auto insurance comparisons for many reasons, including the following.

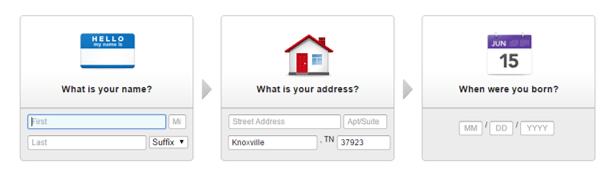

Online Auto Insurance Quotes

When creating these auto insurance comparisons, convenience and the ability to access free auto insurance quotes was a key bit of criteria. While much of what State Farm does is delivered through in-person meetings between policyholders and agents, the company does also provide free auto insurance quotes online.

Consumers start the process to get auto insurance online quotes by entering their zip code. They’re then directed to a simple platform where they can fill out personal information, and that is matched against public records to save time and ensure consumers receive an accurate quote while answering as few questions as possible.

Source: State Farm Online Auto Insurance Quotes

Ratings

As part of this creation of this list of auto insurance comparisons, ratings from third-party outlets were relevant. State Farm Auto Insurance rates very well financially and in terms of financial strength. State Farm Mutual Auto Insurance Company is rated as one of the best providers of affordable auto insurance, with high ratings for both strength and claims paying ability.

A.M. Best’s gave State Farm auto insurance an A++, which is the highest possible rating. State Farm received the A++ because of their superior financial condition and operation performance.

Standard & Poor’s gave State Farm an AA, which is a very high rating and was based on their ability to pay claims.

Steer Clear

When looking at auto insurance online, consumers will see that many of the best auto insurance companies will have exclusive programs designed to reward safe drivers. State Farm goes a step beyond this with their Steer Clear offering, which is a driver discount program for safe, licensed drivers under the age of 25.

Along with being under the age of 25, to participate in the Steer Clear program a driver should have had no at-fault accidents or violations during the past three years. They then complete the program in one of three easy, convenient ways.

They can work with their State Farm agent to complete the program, visit the auto insurance online portal of State Farm, or download the Steer Clear Mobile App.

Loyalty Discounts

In addition to offering a wide variety of safe driving discounts to eligible policyholders, State Farm was also included on this list of auto insurance comparisons because of their loyal customer discounts.

If a policyholder has two or more vehicles insured by State Farm that are part of their household and owned by relatives, that policyholder may be eligible to save as much as 20%.

For those policyholders who also have homeowners’, renters’, condo, or life insurance in addition to their State Farm vehicle policies, there are options to save up to 17%.

Free Money Management Software

The Hartford Review

The Hartford is one of the country’s leading auto insurance companies, and it ranks well on this list of auto insurance comparisons. In addition to providing some of the most competitive auto insurance rates, Hartford offers business insurance, homeowners insurance and employee benefits.

The Hartford has a reputation as one of the leading auto insurance companies and overall insurance providers that spans more than 200 years, and they strive to offer integrity and value to customers, employees, shareholders, and the community.

Key Factors Considered When Ranking This as One of the Top Auto Insurance Companies

When creating this comprehensive list of auto insurance comparisons and top auto insurance companies, the following are primary reasons Hartford ranked well.

Advantage Plus Program

The Advantage Plus Program is a signature offering available from Hartford that strives to offer competitive auto insurance rates and many other perks for policyholders.

The Advantage Plus package includes the following, which many consumers find valuable as they compare auto insurance and research auto insurance online:

- First accident forgiveness

- Disappearing deductible

- One deductible if a claim is filed involving loss of two vehicles covered by an insurance policy from Hartford

- Waiver of deductibles for a not-at-fault accident

- $100 deductible waiver

Standard Rewards

Even if a policyholder with Hartford doesn’t participate in the Advantage Plus Program, there are many standard advantages to joining the AARP Auto Insurance Program offered by this leading provider of low auto insurance rates.

Standard benefits include Lifetime Renewability which means coverage is renewed as long as the policyholder is able to drive.

There is also 12-month rate protection, RecoverCare which provides assistance after an accident, and new car replacement coverage. The Hartford also offers a 24/7 claims hotline.

Discounts

The Hartford, a provider of the AARP Auto Insurance Program, offers the opportunity for consumers to not only get free auto insurance quotes but also take advantage of diverse discounts.

These discounts include the following:

- Bundle insurance savings is offered for consumers who have their car and home insurance with AARP Auto and Home Insurance from Hartford

- Anti-theft device discounts are available to policyholders who have vehicles equipped with active or passive anti-theft devices

- When a policyholder of Hartford completes an approved defensive driver course, they’ll get a three-year discount on their insurance premium

- If a policyholder has drivers on their policy under 21 years old who complete an approved training course, the policyholder can receive a credit on their premium

Easy Claim Filing

To create the most accurate and in-depth auto insurance comparisons, it was important to look at not only the best auto insurance rates and coverage, but also how auto insurance companies handle claims. The Hartford excels in this area, among many others.

With AARP Auto Insurance from Hartford, the claims process is straightforward and streamlined, and this is one of the areas policyholders give the highest marks to.

After an accident, a policyholder can reach the company by visiting their online auto insurance site or by phone. Representatives can provide assistance 24/7. Then, an expert professional claims representative is assigned to the case, and once it’s reported, policyholders can contact their representative anytime, or check the status of their claim online.

Services that can be used by policyholders following an accident and claim include access to the Auto Repair Network, glass coverage, and rental car services.

USAA Review

USAA serves the insurance and financial needs of military members and their families through not only insurance products but also banking, investment, and retirement products, and has done so since 1922. USAA serves active military and former military members; their families, including widows, widowers, and un-remarried former spouses of USAA members; and cadets and midshipmen at U.S. service academies.

USAA strives to be a financial and insurance services provider that understand the unique, distinctive needs of the people it serves since they are an organization founded by military members for military members.

Key Factors That Led to Our Ranking of This as One of the Top 10 Auto Insurance Companies

The areas USAA excels in that are most relevant to creating in-depth auto insurance comparisons are listed below.

Customer Service

As consumers start to compare auto insurance quotes and research auto insurance online, they’re likely to see that what sets the best auto insurance companies apart is often customer service. USAA ranks very well regarding customer service and satisfaction in large part because they offer targeted service to members of the military community and their families, so they understand their distinctive needs.

USAA works to consistently provide service that’s also fast and efficient regarding claims, and according to Forrester Research, USAA ranks as one of the top auto insurance companies for customer advocacy.

Membership Savings

USAA members receive a variety of discounts to help them have low auto insurance rates. Some of these membership-specific discounts and savings opportunities include:

- Family Discount: When a policyholder continues coverage started by their parents with USAA, they can save up to 10% on their own policy

- Bundle and Save: Members saved more than $448 million when they bundled auto and home insurance with USAA in 2015

- Length of Membership Savings: To reduce premiums and pay low auto insurance rates, members of USAA get increased discounts for the length of time they have coverage with the organization

- Military Installation Discount: When vehicles are stored on-base, the policyholder can save up to 15% on comprehensive coverage

USAA Auto Circle

In addition to being one of the leading auto insurance companies on this list of auto insurance comparisons because of their opportunities to help members save money and enjoy competitive low auto insurance rates, USAA is also unique because of their Auto Circle program.

Participants can find, finance, and insure their next vehicle all through USAA.

USAA will work to provide them with the best loan options and some of the best auto insurance rates. Members have also saved an average of $3,443 off MSRP when they make a purchase through the USAA Car Buying Service.

Additionally, when policyholders use the free, flexible payment options available from USAA, they can make insurance payments based on their military pay schedule.

Perks

Often when a consumer starts to compare auto insurance quotes and search for the best auto insurance companies, perks and advantages may be a deciding factor and also a way to distinguish one company from another.

USAA offers members and policyholders a wide variety of perks that come with their insurance products, including easy access to manage policies online or from a mobile device.

Insurance policies feature roadside assistance including towing, gas delivery, and tire replacement, and the Guaranteed Renewal program ensures policyholders get continuous coverage as long as they can drive and meet basic requirements.

Popular Article: Online Auto Loans: How to Find the Best Car Loans Online | This Year’s Guide

Conclusion—The Top 10 Auto Insurance Companies

The process to select the best auto insurance companies often begins with searching free auto insurance quotes available online. Then, consumers will typically look at not only available auto insurance rates but also more in-depth factors that are essential to auto insurance comparisons.

Some of these factors considered by most consumers as they compare auto insurance include the types of and comprehensiveness of coverage offered, the peace of mind and reputation a company can deliver, and how accessible their policy is.

Each of the names on this ranking of the top auto insurance companies excels in these areas and many others. As part of the process to compare auto insurance and create this ranking and list of auto insurance comparisons, it was important to look well beyond just auto insurance rates and think about all of the many unique ways a top insurance company can provide value to the consumer.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.