2017 RANKING & REVIEWS

TOP RANKING BEST ONLINE BANKS

Ranking the Top 10 Best Online Banks | What Is Online Banking?

Online banks are an alternative to brick-and-mortar financial institutions. Consumers can open and maintain checking and savings accounts without every having to step foot in a physical bank branch.

Banking online in a digital environment allows customers who are comfortable with technology to manage their finances digital and gain access to advantages not enjoyed at conventional financial institutions.

Award Emblem: Top 10 Best Online Banks

Why are online-only banks so popular?

One of the big reasons is that online banks provide higher interest rates on products like savings accounts. Working with top online banks allows customers to pay fewer fees than they might otherwise be required to do. This is possible because of the lower overhead costs of online banks.

This is making online banks an increasingly appealing option. Even for consumers who are wary of mixing money and tech, the tempting rates on some of these online savings accounts are enough to make them reconsider.

Consumers are also moving toward the online bank model because of its convenience. Rather than being burdened by having to make it to a branch by a certain hour, many services can be completed online at any time.

Of course, even the best online banks aren’t without their potential flaws. The top online banks have put a lot of focus in recent years on making sure their customers remain safe in the cyber world, and their money and private information are protected. Working with online-only banks can also make it challenging to do some financial tasks, such as withdrawing cash.

Finally, while top online banks do have many advantages, they’re not necessarily the best option if customer service and a human approach are an integral part of a positive banking experience for you.

If you’re considering banking online, it’s important to weigh the facts and find the best online banks for your needs. The following ranking is a list of the best online-only banks, and it highlights not only what these banks are, but why they excel.

AdvisoryHQ’s List of the Top 10 Best Online Banks

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that online bank)

- Ally Bank

- American Express Bank

- Bank5 Connect

- Bank of Internet USA

- Capital One 360

- Discover Online Bank

- First Internet Bank

- iGOBanking

- Simple Bank

- Synchrony Bank

Click here for 2016’s Top 10 Best Online Banks

Top 10 Best Online Banks | Brief Comparison

Top Online Banks | Highlighted Features |

Ally Bank | Interest Checking Account |

American Express Bank | High Yield Savings |

Bank5 Connect | Online Bill Pay |

Bank of Internet USA | FinanceWorks |

Capital One 360 | 360 Savings |

Discover Online Bank | Rewards Checking |

First Internet Bank | The Smart Option Student Loan |

iGOBanking | Online CDs |

Simple Bank | Safe-to-Spend |

Synchrony Bank | Money Market Accounts |

Table: Top 10 Best Online Banks | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Online Banks

Below, please find the detailed review of each firm on our list of online banks. We have highlighted some of the factors that allowed these online banking institutions to score so high in our selection ranking.

See Also: The Best Bank For Students This Year | PNC vs Bank of America vs U.S. Bank Student Banking

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Ally Bank Review

Ally is probably one of the most well-known names in the world of banking online. They’ve not only been innovative and pioneering in terms of online-only banks, but they have also won awards and frequently been recognized by media outlets such as MONEY magazine for being the best online bank.

Ally Bank works to provide customers with a simple and straightforward approach to banking, and a smarter overall experience. Ally also has more than $66 billion in customer deposits. Even without any branches, this top online bank also manages to excel regarding customer service.

Image Source: Top Online Banks

Key Factors That Led Us to Rank This as One of Our Top 10 Online Bank

Distinctive features offered by Ally that led to its inclusion on this list of online banks are cited below.

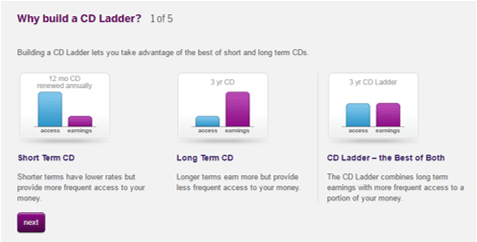

CD Ladder

One of the signature product offerings from this top online bank that allows them to frequently be named as one of the best online banks for savings are the CD Ladders. With a CD Ladder, consumers can maximize both short- and long-term CDs.

The advantages of a short-term CD include more access to money, although the downside is lower rates. With a long-term CD, there is usually the opportunity to earn more, but it’s harder to access money.

A CD Ladder combines the pros, providing long-term earning potential, with better access to at least a portion of the money you’ve deposited.

Source: Ally Bank

Online Savings Accounts

For customers who want to explore banking online and the best online banks offering basic savings accounts providing more flexibility and liquidity, Ally is excellent in this area as well.

The Ally Online Savings Account is a top-rated product. It is one of the reasons Ally is often named as one of the best online banks for savings.

This account currently has an annual percentage yield of 1.00% on all balance tiers and no monthly maintenance fees. It allows the customer to earn a higher rate than they would with most other savings accounts. This online savings account includes features such as eCheck Deposit for remote check deposit and interest that’s compounded daily. The FDIC insures deposits.

It’s easy to move money around as well. Customers with this online savings account can move funds between Ally accounts, transfer between Ally accounts and non-Ally accounts, and schedule transfers up to a year in advance.

Interest Checking Account

Ally isn’t just one of the best online banks for savings. They feature online checking accounts that earn interest for the account holder as well. With an Interest Checking Account from this leader among online-only banks, customers get the following features and benefits:

- No monthly maintenance fee

- 24/7 live customer service

- Customers can use any Allpoint ATM in the U.S. for free, and there are reimbursements up to $10 per statement cycle for fees charged at other ATMs throughout the country

- Use eCheck Deposit to make remote deposits

- Send money using Popmoney

- Online and mobile banking are free to use

- Includes a debit MasterCard and standard checks

Rewards Credit Card

Ally is an excellent option for online checking and savings accounts. But it is also a great online bank to turn to for credit cards. Their signature credit card is the Ally CashBack Credit Card, which is designed to be smart and simple as well as secure.

This card has no annual fee, and users can earn unlimited rewards while they shop, including 2% cash back at gas stations and grocery stores.

Customers can receive a 10% Ally Deposit Bonus when they deposit their cash rewards into an eligible Ally Bank account, and they can get a $100 bonus for making $500 in eligible purchases during the first three billing cycles.

This card can also be added to Apple Pay and Samsung Pay.

American Express Bank Review

American Express is well-known for their credit card offerings, but they also offer online banking services. They are particularly known for being one of the best online banks for savings.

American Express boasts an incredibly strong reputation as one of the leading global services companies in the world. They are ranked #88 on Fortune’s 500 ranking, and they have assets of $161 billion.

American Express has more than 117 million credit cards in use and annual revenue of $32.8 billion in 2015. All of these statistics demonstrate the ability of this company to provide well-established, secure services as an online bank.

Key Factors That Enabled This to Rank as a Top Online Bank

American Express was included on this list of the best online banks for the following reasons.

Simple Account Opening

One thing that could potentially deter consumers from considering these top online banks as an option is that they might not understand how the process works to open the account.

American Express strives to make this as simple and straightforward as possible. This simplicity and straightforward approach is a big part of why American Express is included on this list as one of the best online banks for savings.

To begin, customers gather their account information, such as their Social Security number, address, and date of birth. They should also have their current account and routing numbers.

High-Yield Savings

The primary service offering available from American Express, in terms of banking online, is their signature high-yield savings account.

This online savings account includes a variable rate that’s competitively higher than brick-and-mortar banks, although high-yield savings accounts are limited to a maximum of six withdrawals per statement cycle. Interest accrued on high-yield savings accounts from American Express is compounded daily and posted to the account monthly.

If customers are interested in opening one of these online savings accounts at this top online bank, they can do so quickly, and they can also use American Express calculators to get an idea of how much their savings will grow over a set period of time.

CDs

American Express is also one of the online banks on this list that offers CDs, which provides the opportunity to lock in rates and earn interest on idle money.

CDs from this top online bank offer the chance to lock in a rate for a one-time deposit, although they have less flexibility than a high-yield savings account.

Terms are flexible and range from 6 months up to 60 months, with current interest rates going up to 1.70% for customers of this top online bank who choose the 60-month option.

Interest is credited to CDs on a monthly basis, and it remains in the account earning compounded interest until it matures. Other options for the interest include automatic transfers each month from a CD to a high-yield savings account, automatic transfers to a linked account every month, or a check mailed monthly, quarterly, or annually.

Account Benefits

Regardless of whether a customer chooses to go with a CD or a high-yield savings account with American Express, there are standard benefits available to holders of both of these online banking accounts accounts.

These benefits include:

- No monthly fees or minimums, along with the competitive rates offered by this leader among the top online banks

- There is no need to completely switch banks because American Express accounts can easily be linked with existing bank accounts

- 24/7 account access is available, as is comprehensive customer support

- Accounts are insured to at least $250,000 per depositor by the FDIC

Don’t Miss: The Best Banks for College Students This Year | Chase vs Wells vs Bank of America

Bank5 Connect Review

As one of the most well-known online banks, Bank5 Connect is a division of BankFive, which is based in Fall River, Massachusetts. Although it is part of a brick-and-mortar banking company, it’s one of the top online-only banks. The BankFive name has been around for 160 years, however, so there is a sense of stability and a strong reputation that comes with this financial institution.

Bank5 Connect offers all of the accounts and services found at conventional banks, including online checking and savings accounts as well as CDs.

Key Factors That Led to Our Ranking of This as One of the Top Online Banks

Leading reasons Bank5 Connect was included on this list of the top online banks and best online bank account providers are below.

Resources and Education

Despite its growing prevalence, a lot of people still want an answer to the simple question “What is online banking?” In addition to delivering some of the best online bank account options, Bank5 Connect also offers a plethora of resources that explain all of their services in detail.

Their website is direct and clear, and wherever a consumer clicks, they’re going to find an explanation for what a product is and what they’re getting if they select it.

This top online bank even covers the fundamentals, such as showing how to make deposits and how to move money in and out of Bank5 accounts.

Obtaining Cash

Along with wanting an answer to the question “what is online banking?” many consumers also begin to wonder how to get cash when they are banking online.

This is simple with this online bank. Customers can use any ATM that’s part of the SUM network — free of charge. If a customer of this top online bank does use an ATM outside of the SUM Network and they’re subject to a fee, Bank5 Connect will reimburse them up to $15 per month.

Online Bill Pay

According to this online bank, online bill pay is one of their most popular services. If customers choose, they can set up their Bank5 Connect account to pay their monthly bills without having to write or mail checks.

Online Bill Pay is a feature that allows customers to pay individual bills on the date they choose, and the money is immediately transferred. For convenience, it’s also possible to set up recurring payments.

Using bill pay from this top online bank ensures customers can stay organized and ahead of all their payments, without ending up missing payments or having to pay late fees.

Moving Money

As with everything at this best online bank, moving money is simplified, as is making a deposit. Customers can go through the 5Online or Bank5 Connect mobile app to make deposits.

Customers can use external funds transfers to move money from non-Bank5 Connect accounts into a new Bank5 Connect account with a few clicks. They can also transfer money by phone or mail.

Bank5 Connect also offers access to Pay People, which is a person-to-person payment tool. This lets customers of this best online bank send money to friends and family, and it’s as fast and easy as sending them a text or email. All you need is an email address or phone number.

Bank of Internet USA Review

Bank of Internet USA offers a simple, smart way to bank and meet your financial goals with minimal effort. Based on an innovative branchless banking concept, Bank of Internet USA passes on overhead savings to customers and delivers affordable financial products and solutions.

Bank of Internet USA has one of the strongest reputations in the industry because in addition to being one of the best online banks, they are also one of the oldest.

Key Factors That Enabled This to Rank as One of the Top Online Banks

In terms of comparing Bank of Internet to other online-only banks, the following are some reasons it’s included in this ranking of the best online banks.

Flexibility

When consumers are contemplating the question, “What is online banking?” they often realize one of the biggest perks of this type of financial institution is the overall convenience and flexibility. Bank of Internet USA particularly excels in this area.

If customers of this top online bank need to move money, they can transfer funds between accounts at any time. This is one of the best online-only banks because they also make it easy for customers to transfer money between external institutions.

Transfers can be set up manually or scheduled regularly.

Mortgages

When consumers are comparing and searching for the best online bank, they may want lending products, and Bank of Internet specializes in low mortgage rates and top-quality service.

Bank of Internet features options for buying a first home, refinancing an existing mortgage, utilizing the equity already in a home and more. This top online bank also has customizable mortgage products, including portfolio loans, jumbo loans, conforming loans, and government loans.

The branchless model of Bank of Internet USA lets people enjoy some of the industry’s lowest available mortgage interest rates. Additionally, this online bank is a preferred lender for Costco Members, so there are exclusive deals available to these borrowers.

Rewards Checking

The problem so many consumers have with conventional banks and what makes them turn instead to the best online-only banks is the lack of interest-bearing checking account options available. Bank of Internet has several available options, including Rewards Checking, with earnings up to 1.25% APY.

This account is full of value, because, in addition to a very competitive interest rate, it also includes banking tools, unlimited domestic reimbursements for ATM usage, and cash back purchase rewards.

This online checking account has no monthly maintenance fee, no minimum monthly balance, and there are no overdraft or non-sufficient funds fees.

The purchase rewards program lets customers make their everyday purchases using their Visa debit card, and then they can log onto Bank of Internet and start redeeming their offers and receiving cash back, deposited into their account at the end of the next month.

Free FinanceWorks

Some online bank account holders of Bank of Internet USA have access to FinanceWorks, which is a free service available to customers to help them better manage their finances. This tool centralizes all of a user’s accounts in one location and lets them see everything from one manageable dashboard.

Setup is easy. Rather than having to remember many URLs or log into a lot of sites, everything is right there so the user can track checking, savings, credit cards, loans, and investment accounts.

It also breaks down how much is being spent in particular categories, including utilities, shopping, travel, rent, and dining out. Users of this online banking tool can create customized spending goals in each category to stay on track and meet their overall financial objectives.

Related: Best Online Savings Accounts | Ranking, Rates & Features

Capital One 360 Review

Capital One 360 is a solution offering banking online, including online checking and savings accounts that are fee-free and interest-bearing. Capital One 360 is accessible not only online and through a mobile banking app, but uniquely, there are also 18 Capital One Cafes across the country, offering the potential for face-to-face service if necessary.

Capital One 360 is part of the Capital One Financial Corporation, which has more than $357 billion in assets and is headquartered in McLean, Virginia. Capital One serves the needs of not only individual consumers, but also small businesses and commercial clients.

Key Factors That Led Us to Rank This as One of the Top Online Banks

Reasons Capital One 360 is ranked as one of the best online bank options for consumers are listed below.

360 Checking

360 Checking is one of the best online bank account options available to consumers. There are no fees to use this checking account, and that fee-free model is one of the things many customers find most appealing about online banks. Also, 360 Checking offers online and mobile account management options, and there are no hidden fees or minimum account requirements either.

360 Checking earns interest on everyday money kept in the account, and it includes a free MasterCard Debit Card.

Additionally, this account from this top online bank includes access to 40,000 fee-free Allpoint ATMs.

Overdraft Protection

Capital One 360 features overdraft protection, which is another reason they have some of the best online bank account options available. One overdraft protection option is a Free Savings Transfer. This free option takes funds directly from a 360 Savings account and pays the overdraft.

Customers who have one of these best online bank account options can also decide to apply for an Overdraft Line of Credit. With this option, the customer pays only interest on the amount they borrow.

This means customers will pay some interest, but it is usually a much lower amount than what they would pay if they had conventional bank overdraft fees.

Online Investing

As well as featuring some of the best online bank account options available, Capital One 360 is also ranked as one of the country’s best online-only banks because of their investment products and services.

Capital One Investing is part of the Capital One 360 online bank platform, and it gives customers the opportunity to find the investments that work for them and create an online account.

Customers can make instant transfers between online Capital One Investing and 360 banking accounts, and all of their balances are conveniently shown on one page. You only have to sign into one account to see both.

There is no minimum to open a Capital One Investing account, and transfers to and from Capital One 360 accounts are free.

360 Savings

Often ranked and recognized as a best online bank account by notable media outlets and financial journalists, 360 Savings is an account designed to feature simplicity and ease-of-use paired with value.

There are no fees or minimum balance requirements to open or maintain this account, and the everyday interest rate is currently 0.75% APY.

Customers can open multiple savings accounts and name them before using the Automatic Savings Plan to decide how they’ll save their money, without any effort.

Along with the automatic savings plan and multiple account options, some of the other features that come with this best online bank account include the My Savings Goal program, which is a way to track and celebrate meeting savings milestones.

Discover Online Bank Review

A top online bank, Discover works to offer the unique benefits that come with online-only banks, but also a level of convenience and accessibility that is typically only seen with brick-and-mortar financial institutions.

The Discover name certainly isn’t new in the financial world. The company was the first to introduce a cash rewards credit card, and they offer a full line-up of banking services.

These online banking services include Discover-branded credit cards, student and personal loans, mortgages, deposit accounts, and more. Discover also operates PULSE, which is one of the top ATM and debit networks in the country.

Key Factors That Enabled This to Rank as a Top Online Bank

When researching and comparing online banks to identify the names that could be included as a best online bank, the following are some factors that set Discover apart.

Customer Service

As mentioned in the introduction of this ranking and review of the best online-only banks, customer service is something that can be lacking when you opt to work with an online bank. Discover is unique because they strive to offer not only the best online bank account options, but they also back their products up with excellent, personalized customer service.

Discover offers a team of responsive and helpful U.S.-based Banking Specialists who can be reached anytime a customer has a question or concern. Customers say that every time they call the Banking Specialists they’re treated professionally, and all assistance is helpful and relevant.

Customer service is one of the primary reasons Discover is named a leading online bank.

Transparent Fees

Discover Online Bank is one of the best online banks for savings, and they also excel because they charge very few fees. The fees that they do charge are completely transparent and upfront, so consumers know what they’ll be paying and why.

The free services available from Discover Online Bank include ATM usage in the U.S., replacement debit cards, check reorders, and account closures.

The only fees charged by Discover Online Bank are for returned deposits, stop payments, excessive withdrawals, and outgoing wire transfers. Discover Online Bank does also charge a fee for insufficient funds.

Pay Bills

When reading about the best online banks, something you’ll frequently hear from consumers is that they want a company that makes it easy for them to not only save more money and spend less on fees, but also to pay their bills efficiently.

Discover Online Bank features a bill pay service that is efficient and easy to use. This makes it nearly effortless to get bills paid and on time.

Customers can add and manage all of their payees, determine when the bill will be paid, schedule it ahead of time or automate payments, determine what account it will come from, and even pay their credit card bills at the same time.

This complete bill pay service is one of the reasons Discover was included as a top online bank on this ranking and review.

Rewards Checking

Discover Online Bank is one of the best online banks for savings, but they also have some of the best online bank account options in terms of checking as well. Discover Online Bank rewards customers for doing their checking business with them, and these rewards can add up quickly.

Some of the rewards that come with Discover checking accounts include:

- $0.10 earned for making a debit card purchase

- $0.10 for paying a bill online

- $0.10 for every check that clears

This can add up to as much as $120 cash back per year. Then, customers of this best online bank can cash in their rewards, and they’ll be given money directly into their account. If the customer uses a Discover card, they can add their cash back checking rewards to their Cashback Bonus with their card as well.

Also, there are no fees to use Discover checking accounts.

Popular Article: Best Private Banks | Ranking | Top Private Wealth Management Banks

Free Wealth & Finance Software - Get Yours Now ►

First Internet Bank Review

First Internet Bank is a high-technology financial institution and online bank that still works to deliver the personalized service and attention consumers enjoy with a brick-and-mortar bank. First Internet Bank was founded in 1999 and now serves the needs of customers in all 50 states, even while having no branch locations.

The fact that First Internet Bank has no branches allows them to offer better rates to the consumer, because of the low overhead. It’s part of the parent company First Internet Bancorp, which trades on NASDAQ.

Key Factors That Enabled Us to Rank This as One of the Top Online Banks

When comparing online-only banks, below are some reasons First Internet was ranked as one of the best online banks.

Full-Service

While some of the names on this list of the best online banks may be the best online banks for savings accounts exclusively, First Internet is unique. This online bank features a full selection of services, comparable to what you would find at any of the big name financial institutions.

For example, First Internet Bank is one of the few online-only banks that offers not only personal services but business options as well.

Deposit accounts including checking and savings online accounts are available, as well as personal mortgage products.

First Internet is not only a pick for a best online bank in general, but it is unique in the variety of options customers have when they work with them.

Interest Checking

First Internet Bank strives to provide what they call “checking accounts that work.” This means that they provide the features and functionalities consumers need for everyday spending, but they earn interest as well.

Core features of online interest checking accounts from First Internet Bank include online and mobile banking, a debit card, optional overdraft protection, and free e-statements. First Internet Bank also features free electronic statements.

An online interest checking account can be opened with as little as $100, and interest is earned when an average daily balance of $500 or more is maintained. If that average daily balance is maintained, this also allows the account holder to avoid a monthly maintenance fee, and this particular account includes an ATM surcharge rebate of up to $10 per month.

Credit Cards

When you think of online banking services, you may not think they offer credit cards, but this is one of the many products available to customers of First Internet.

First Internet offers credit cards with competitive interest rates and no annual fees. They also have a card with a cashback offer. This card includes an introductory rate for balance transfers, and it pays 3% for gas transactions and 1% for all other purchases.

Along with these perks, all of the cards available from First Internet can be managed through online and mobile banking, real-time credit card payments can be made online, and the cards can be used with Apple Pay.

Student Loans

First Internet Bank is one of the best online bank because of how comprehensive their online banking services are. One of these great services is The Smart Option Student Loan. This student loan is for individuals who are or will be attending a degree-granting institution, and it features flexible repayment options and competitive interest rates.

The Smart Option Student Loan includes in-school repayment options and a choice of competitive fixed and variable interest rates. There are no prepayment penalties or origination fees, and interest rate reductions and awards are potentially available.

Additionally, creditworthy borrowers will receive rewards on their rate.

iGOBanking Review

A well-respected option for banking online, iGOBanking features the tagline “Real Simple, Real Smart”. As one of the leading online-only banks, iGOBanking is the online division of Flushing Bank. Personal banking services include savings options such as money markets and CDs.

Also available to customers interested in banking online with iGOBanking are retirement accounts and checking accounts that include debit cards and access to thousands of ATMs.

Key Factors Leading Us to Rank This as a Top Online Bank

When comparing iGOBanking to other online-only banks and top online banks, below are some reasons it excels.

Flexible Deposit

The best online banks offer flexible and convenient options for depositing checks, and with iGOBanking, there is the Flexible Deposit tool, which is free and easy to use.

Customers can use their mobile device desktop scanner or PC to deposit checks remotely.

Deposits are processed within two business days, and this makes it possible for customers to bank from anywhere and at any time.

High-Interest Checking

iGO Checking high-yield checking accounts are often ranked as a top rated online bank account because they provide competitive interest rates and other appealing benefits. They feature liquidity and accessibility to money, as well as security.

These high-yield accounts include the Bill Pay and Presentment tool, a MasterCard iGOdebit card, and accessibility to more than 43,000 ATMs that are part of the AllPoint network.

With the Bill Pay and Presentment feature, there is no limit on the number of bills that can be paid, including both businesses and individuals. This also shows billing details, like the minimum payment that’s due and the payment due date.

Also available for use with high-interest online checking accounts is a MasterCard debit card accepted anywhere MasterCard is accepted.

iGoSavings

One of the best online banks for savings, the signature account available from iGOBanking is a high-interest account that doesn’t require a large initial deposit to start earning from the money in the account. This account has no fees and no minimum requirements, is FDIC insured, and there are no monthly maintenance charges.

Currently, it features a 1.00% APY, and this account can be opened online by answering a few simple questions.

Other savings options available from this pick for one of the top online banks include money markets and online CDs, although the basic savings account does provide more accessibility to funds than those options.

Online CDs

For consumers who want the convenience of banking online, want the higher interest rates, and don’t require a lot of liquidity, this online bank features high-yield CDs. These are a safe way to invest over a pre-determined time period and receive guaranteed earnings. There is no fluctuation in rates, making investment almost effortless for the consumer.

CDs from iGOBanking can be managed online and automatically rolled over upon maturity. When a CD from this best online bank does mature, the terms can be adjusted, additional funds can be added, or a new CD can be opened.

Also, iGOBanking makes it easy to transfer matured CDs and interest into an existing online account you hold with iGOBanking.

Read More: Top Missouri Banks | Ranking | Finding The Best Bank in Missouri

Free Wealth Management for AdvisoryHQ Readers

Simple Bank Review

A top online bank, Simple is just what the name says. Ths online bank combines technology and innovation so that it’s easy to save money and ultimately make better financial decisions, in a way that’s convenient and well-suited to the modern world. This top online bank was created out of a sense of frustration with conventional banks.

A core principle at Simple is not profiting from customer confusion. Instead, there’s a focus on authenticity and a real passion for providing excellent financial services to customers.

Key Factors Considered When Ranking This as a Top Online Bank

After comparing options for banking online, the following are some of the specific reasons Simple was included on this list of the best online-only banks.

Security

Simple is an online bank that realizes how important security is to people, and that understanding is one big reason it’s ranked as one of the top online banks.

Some of the security features available when consumers do their banking online with Simple include:

- Two-factor authentication to change passwords and make transfers

- Fingerprint unlock for applicable iPhone and Android devices

- Funds are insured by FDIC

- Instant purchase notifications let you know you just spent money so you can verify

- There is a gold chip that’s part of the cards issued by Simple, and these chips include a single-use card which offers stringent protection against fraud

Safe-to-Spend

Something that makes Simple among the very best online banks are their unique features that help users stay on track with their financial goals and limitations. One of these features is called Safe-to-Spend.

Safe-to-Spend provides the opportunity to spend money spontaneously, without ruining your plans for your budget and bills.

This feature from this leader among online banks shows customers their total balance minus their scheduled bills and goals, and the remainder is their “safe-to-spend” money. It allows customers of this top online bank to worry less about their financial obligations and instead enjoy their lives more.

Source: Simple

No Fees

Frequently, one of the top concerns or frustrations people have with conventional banks are the high fees that are charged in less than transparent ways. Simple has a model that rebels against this, cementing it as one of the best resources for banking online.

Simple charges no fees, including no overdraft or monthly fees. They also don’t charge for maintenance or card replacement, and there are no minimum balance fees.

A few other things that are fee-free at this top online bank include ACH bank transfers and account closing.

The philosophy that guides much of what Simple does as one of the premier online-only banks is based on the belief that customers should keep their money.

Visualize Your Spending

One of the things that stood out about Simple, compared to even the other names on this specific ranking of online banks, is that they offer not just accounts, but practical tools that help people make smarter money-based decisions. One of the tools that makes this one of the best online banks for savings is a spending visualizer.

While banking online, customers can see where they’re spending and where they could make changes.

There are also options to search transactions and add photos, notes, and hashtags to purchases. Simple does a fantastic job of incorporating technology solutions into their banking offering.

Free Money Management Software

Synchrony Bank Review

Synchrony Bank has been recognized by media outlets like MONEY magazine, Kiplinger, and Bankrate.com for being one of the best online banks for savings products including high-yield savings and money market accounts. Synchrony bases its business model on the concept of innovation paired with customer service.

Synchrony Bank is part of the Synchrony Financial company, with an 84-year history in retail finance and banking. This top online bank offers consumers tools, technology, and service to manage their money and effectively handle their spending and savings.

Key Factors That Allowed This to Rank as One of the Best Online Banks

When considering the best online banks for savings and other services, the following list highlights reasons Synchrony was included in this ranking of the top online banks.

Loyalty Perks

Synchrony offers not just some of the best online bank account options, but also a unique program called “Synchrony Bank Perks.” With Synchrony Bank Perks, customers are rewarded for their balances and also how long they have been with this online bank.

The initial tier of the program begins with perks on deposits such as ATM fee reimbursements. It then moves up along a tiered ladder and can include travel rewards and discounts at worldwide hotels.

Rewards grow as the balance grows and more time is spent with this online-only bank.

You are automatically enrolled in the program when you sign up for a deposit account.

Money Market Accounts

Money market accounts from this online bank are designed to offer not only highly competitive award-winning rates, but flexibility as well, particularly compared to other savings options such as CDs. Withdrawals can easily be made online, by phone, by check, or using an ATM card.

There is no minimum balance requirement or monthly service fee to open one of these online money market accounts at this best online bank, and there is FDIC insurance up to $250,000 per depositor.

Money kept in a Synchrony money market can also be managed with the convenient online banking portal, or by calling a customer service representative.

IRAs

Something important that weighed heavily in the creation of this ranking of the top online banks and the places to find the best online bank account options was whether or not they offered distinctive products.

Synchrony is one of the few online banks on this list that offers not only savings accounts but also IRAs, also with competitive rates.

Customers can select between IRA CDs and IRA Money Market accounts. IRA CD rates come with terms from ranging from 3 months to 60 months. IR Money Market accounts come with tiered interest rates, depending on your balance.

Conclusion—The Top 10 Best Online Banks

Increasingly, the average consumer is looking for an alternative to the lack of transparency, high fees, and confines of banking with a conventional brick-and-mortar financial institution. They may find themselves wondering “what is online banking,” and once they begin delving into the fundamentals of banking online, they see it has many advantages.

When a consumer works with online-only banks that have a reputation for being the best online banks, they’re going to be able to benefit from things like low or no fees, high interest rates on savings accounts, and technologically-driven convenience.

The above list of the best online bank account providers, the best online banks for savings, and the overall best online banks, takes into account the key factors most consumers are searching for when they decide to move their finances online.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.