2017 RANKING & REVIEWS

TOP RANKING BEST CREDIT UNIONS IN SACRAMENTO

Intro: Identifying and Ranking the Best Credit Unions in Sacramento, CA

What is it that makes a credit union unique from other banks and financial institutions?

There are many things, but perhaps the most important is the foundation of people helping people.

Many of the best credit unions in Sacramento were developed on that principle, and they’ve maintained a dedication to upholding it throughout the years. Since a credit union is owned and governed by its members, it’s always about what’s best for the people who matter most: those members.

With those advantages in mind, the following ranking of Sacramento credit unions puts the focus on the very best in the industry. These credit unions, located in and around the capital of California, have pioneered and excelled at what they do. This includes how members are treated, the level of education and guidance provided to members, and how much they’re willing to innovate to make sure they’re always delivering the very best to the people who bank there.

Award Emblem: Top 8 Best Credit Unions in Sacramento, California

These credit unions in Sacramento have been around for decades, represent stability and reliability, and are committed to continuously improving products, accessibility, and technology to remain at the leading edge of financial services well into the future.

AdvisoryHQ’s List of the Top 8 Best Credit Unions in Sacramento

- C.A.H.P. Credit Union

- California Community Credit Union

- First U.S. Community Credit Union

- Patelco Credit Union

- Sacramento Credit Union

- SAFE Credit Union

- The Golden 1 Credit Union

- Yolo Federal Credit Union

This list is sorted alphabetically (click any of the above names to go directly to the detailed review for that credit union).

What is a credit union?

Many consumers wonder what a credit union is, particularly in comparison to a standard bank.

Ultimately, a credit union is a financial institution that is similar in many ways to a bank, including the terms of services and products. There are differences as well, the primary difference being that a credit union operates as a not-for-profit organization. A credit union is owned by its members, whereas a bank, in the traditional sense of the word, belongs to a small group of people.

There is a sense of community and collaboration inherent in the structure of a credit union, with the idea being that members are all helping one another for the benefit of everyone.

Historically, credit unions were started when groups of employees at a particular company would get together to create an internal financial institution. This differs from a bank, where rather than being a member-owner, you’re a customer.

What are the advantages of joining a credit union in Sacramento?

There are significant advantages to joining a Sacramento credit union.

One of the benefits of joining a credit union, since they operate as not-for-profits, are that its members receive financial benefits, including higher interest rates on savings products, lower fees, and lower interest rates on mortgages and other loans.

Image Source: Best Credit Unions in Sacramento

Rather than operating with the sole goal of making a profit, a credit union can take any money they make and pass it on the customers. They have the ability to pass this money to their customers in the form of savings and financial perks.

Additionally, many credit union ATMs are fee-free, as are many of their accounts, which include checking, savings, and money market accounts.

How do you become a member of a credit union?

Since a credit union is a member-owned, not-for-profit financial institution, many hold requirements for membership:

- Many credit union memberships are based on a person’s employer. Like their historical roots, they are often sponsored by a company for its employees.

- Location can also be a factor in joining a credit union. For example, there might be a requirement that members must live in a particular county, or attend school in a particular area.

- Group memberships can be one of the ways people join a credit union, such as being alumni of a certain school or university, or being a participant in a homeowner’s association.

While credit unions frequently require members to meet at least one factor of the membership criteria, they tend to let family members join as well. So, if you have a relative who’s a member of an employer-sponsored credit union, you may also be eligible to join.

Top 8 Credit Unions in Sacramento, California

Credit Union | Location |

| C.A.H.P. Credit Union | Sacramento |

| California Community Credit Union | Sacramento |

| First U.S. Community Credit Union | Sacramento |

| Patelco Credit Union | Sacramento |

| Sacramento Credit Union | Sacramento |

| SAFE Credit Union | Sacramento |

| The Golden 1 Credit Union | Sacramento |

| Yolo Federal Credit Union | Sacramento |

Table: Top 8 Best Credit Unions in Sacramento | Above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

You may be asking how we selected from the many excellent financial institutions in Sacramento to create this top ranking list of credit unions in Sacramento. To begin, we conducted extensive and comprehensive research, all with the end-user in mind. That end-user is you, the consumer.

We then considered criteria like fees, convenience, branches, online banking, education materials, and the selection of available services. We used this criteria to develop a set of filters, all of which indicate the quality of service and overall value.

Then, we conducted a deep assessment of each credit union, which led to this compilation of the top ranked names throughout the Sacramento area.

Click here for a detailed explanation of our methodology: AdvisoryHQ’s Methodology for Selecting Top Banks and Credit Unions.

Detailed Review – Top Ranking Credit Unions in Sacramento, CA

After carefully considering Sacramento credit unions, we created the following list of the top 8. As you continue reading, you’ll find detailed reviews for each of our selections, as well as specific factors we used in our decision-making process.

See Also: Best Credit Unions in Georgia | Ranking | Comparison of the Top Georgia Banks

C.A.H.P. Credit Union Review

C.A.H.P. Credit Union was founded in the 1960s by a group of officers with the California Association of Highway Patrol as a financial institution that would serve their specific needs, as well as the needs of their families. C.A.H.P. was also created to reflect the values of the profession.

When this credit union in Sacramento was first founded, it had five members; that has since grown to include 14,000. Despite this growth, at its very core, this credit union is driven by adherence to ethics and the shared values of its strong principles.

Key Factors That Allowed This Credit Union to Rank as One of the Best Credit Unions in Sacramento

Below are key factors leading to the inclusion of C.A.H.P. Credit Union on this ranking of the best credit unions in Sacramento.

Checking Accounts

C.A.H.P offers different checking account options to serve the unique needs of members and their families. Regardless of which specific option is selected, they all offer some of the same benefits. These include:

- Free Visa Debit Card

- Free point-of-sale transactions

- Free online bill payment

- No per check fees

- Overdraft protection from linked savings accounts

- Account access available through eStatements, nationwide ATMs, online banking, and more

With the Free Checking option from this leader among Sacramento credit unions, members will enjoy no monthly service charge, no minimum balance requirement, and five free ATM withdrawals per month.

Online Banking

C.A.H.P. is a Sacramento credit union with online banking services, which ensures convenience and accessibility for all members. You can use @ccess-24, which is the members’ online banking portal, to check your accounts and maintain your finances at any time.

With online banking from C.A.H.P. Credit Union, members can check balances and account history, plus transfer funds between accounts and download transactions into money management programs.

Other features of the online banking portal include the ability to make payments to C.A.H.P. loans and credit cards, pay bills online, and receive free e-Statements.

Mobile Banking

C.A.H.P. Credit Union is dedicated to remaining technologically advanced to continually improve the accessibility members have to their accounts and banking products. Along with online banking, this credit union in Sacramento also offers a mobile app.

The mobile app is available from the Apple App or Google Play store. It allows users to do things like take a picture of checks for instant deposits or transfer money between accounts.

The C.A.H.P mobile app is also designed to help users locate the closest ATMs to their location. In the near future, the mobile app includes the capability to pay bills and transfer money externally.

Membership

While the C.A.H.P. Credit Union was initially designed to serve the needs of the California Association of Highway Patrolman, they have extended membership to select groups of people over the years, all of which are related to one another through their dedication to public safety.

The groups that are served by this leading credit union in Sacramento include:

- California Exposition State Fair Police Department

- California Highway Patrol

- California Homicide Investigators’ Association

- California Narcotic Canine Association

- Department of Justice, Association of Special Agents

- California Narcotic Officers’ Association

- Patton State Hospital Police Department

- PORAC (Peace Officers Research Association of California)

- Riverside Sheriff’s Association

- Sacramento County Deputy Sheriffs’ Association

- San Manuel Indian Nation, Department of Public Safety

- Union Pacific Police Department

- West Covina Police Department

- West Sacramento Police Department

Don’t Miss: Best Credit Unions In North Carolina | Ranking | Review of the Best North Carolina Credit Unions

California Community Credit Union Review

California Community Credit Union (CACCU) was first chartered in 1939 as the State Employment Employees Federal Credit Union. The original members were employees of the Department of Employment in Sacramento, along with their families. Since then, it has grown and become California Community Credit Union, and the criteria for membership has expanded as well.

CACCU is a full-service credit union with financial products such as checking and savings accounts and a variety of financing options.

Key Factors Considered When Ranking This Credit Union as a Top Sacramento Credit Union

The list below highlights important reasons California Community Credit Union was selected for this list of the best credit unions in Sacramento.

Free Checking

One of the primary concerns many consumers may have is the fees banks charge, simply for using their services and accessing their own money.

At California Community Credit Union, not only are fees as low as possible and much more competitive than what you find at most banks, but they have free options as well.

One of the popular free account options is Regular Free Checking. To use this account, you only need a Primary Savings Account and an initial deposit of $25. There is no minimum balance or monthly checking fee, and you receive access to free services including online banking, e-Statements, and bill payer.

You also receive free ATM access at more than 30,000 CO-OP network ATMs throughout North America.

Services

As a leader among credit unions in Sacramento and throughout California, California Community Credit Union offers not just financial products, but also many additional services to members. These services include:

- Insurance services: credit life/disability, mechanical repair coverage, guaranteed auto protection, accidental death and dismemberment insurance

- Eligibility for membership with Costco stores

- Low-cost money orders

- Automobile locations available through Clinton Leasing and Sales

- Wire transfers

- Cashier’s checks

- Online bill payer service available at no charge

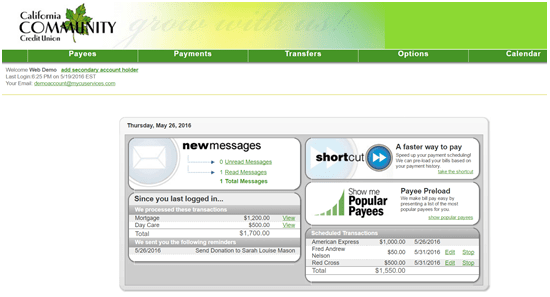

Electronic Bill Pay

An advantage and great convenience to joining California Community Credit Union is the availability to pay bills electronically. The Bill Payer program uses advanced technology with enhanced functionality.

Image Source: California Community Credit Union

Benefits of using this Bill Payer service include timely expedited payments, the option to complete account-to-account transfers, and much more.

To use Bill Payer, all you need is a checking account! This service is free to members as long as at least three bills per month are paid using Bill Payer.

Savings Options

California Community Credit Union doesn’t limit members when it comes to different types of account options, and this includes savings.

Members of this top credit union in Sacramento can choose from a range of savings account options and products. Many of these options have tiered interest rates, all of which have competitive interest rates. Some of the savings products available from CACCU include:

- Regular savings

- Term-Savings Certificates

- Money market accounts

- Individual Retirement Accounts, including Traditional and Roth IRA

- Junior Saver’s Account

- Vacation Account

- Santa’s Helper holiday account

Related: Top Credit Unions in London and Other UK Cities | Ranking | Review of the Credit Unions in the UK

First U.S. Community Credit Union Review

First U.S. Community Credit Union was founded in 1936 and since then has excelled as a leading community credit union, serving anyone who works or worships in Sacramento and many of the surrounding counties. First U.S. also serves the needs of employees in the State of California, among other groups.

The philosophy of First U.S. is “people helping people,” while the mission is the provision of value, service, and financial solutions to its members.

Key Factors Leading Us to Rank This Credit Union as a Top Sacramento Credit Union

The list below is representative of key reasons First U.S. Community Credit Union was selected as one of the best Sacramento credit unions.

Business Services

First U.S. holds the distinction of being the first Small Business Administration-approved credit union in the Sacramento area. This credit union is unique because it offers not only a full slate of personal banking products and services, but also works with businesses to help them through every phase, from start-up to expansion.

Services offered by this Sacramento credit union include business loans, business share accounts, Visa business credit cards, payment processing, business savings, money market accounts, and payroll services to name a few.

Debit Card Protection

To protect themselves against overdrafts, members have the opportunity to opt into various services that cover ATM and transaction overdrafts should they occur when using a First U.S. debit card.

If you choose to opt into these services, First U.S. will cover the amount due, which prevents the transaction from leading to an overdraft. Also available are free alerts, which can be sent to members to let them know when their account balance dips below a certain level. In addition to the free alerts, overdraft transfers can be set up from a savings or money market account, as well as a line of credit.

Other options to protect against the expense of overdrafts include signing up for overdraft transfers and using online banking to maintain constant access to account information.

The FUS Home Loan Center

Since one of the primary products offered by First U.S. are home loans and refinancing products with highly competitive interest rates, they’ve created the First U.S. Home Loan Center. This is an online resource that members can use to explore various topics. The areas of focus include refinancing and saving, home equity and home improving, and buying, selling, and saving.

In addition to financing-based solutions and guides, the Home Loan Center also offers members the opportunity to compare loans, view rates, look through MLS listings and connect with experienced local realtors.

Image Source: First U.S. Community Credit Union

Checking Accounts

There are several checking options available from First U.S. These options include the Better Than Free Account, which offers no monthly service charge, no minimum balance, and no direct deposit requirements. It also offers free checks, a free 1% cash back Visa debit card, two free non-First U.S./CO-OP network ATM transactions every month, and more.

Other options include money market and dividend checking, Student Access Checking, a Classic Checking account, and the Ultimate Account. The Ultimate Account includes the highest rates for checking funds, full-service access to accounts, and dividends paid any day during the month when the balance remains above $50,000.

Popular Article: Best Credit Unions in Pennsylvania | Ranking | Review of the Best Pennsylvania Credit Unions

Sacramento Credit Union Review

Sacramento Credit Union (SCU) is a state-chartered financial services cooperative that operates under stringent regulatory laws set forth by the National Credit Union Administration. SCU is governed by a Board of Directors who are also members, and each member has one vote regardless of their deposits at the credit union.

All people who live or regularly work in Sacramento, as well as El Dorado, Placer, Solano, Sutter, Yolo, and Yuba Counties can become members of Sacramento Credit Union.

Key Factors That Led Us to Rank This as a Top Sacramento Credit Union

Listed below are benefits of being a member of Sacramento Credit Union, which led to its inclusion on this ranking list.

Card Services

Sacramento Credit Union credit and debit cardholders have access to advanced technology and offerings that make transactions fast and easy while also providing added layers of security. Some of the card services include:

- Visa Checkout: With Visa Check Out, members can enjoy a simplified and faster way to do online checkouts, including paying with a single login from any device and guarding data behind many layers of security.

- Verified by Visa: This free service protects Visa cards with personal passwords to make them safer to use online.

- Apple Pay: With Apple Pay, SCU cardholders can use their iPhone 6 and iPhone 6 Plus to make purchases with the Passbook App.

Auto Loan Concierge Service

Sacramento Credit Union offers many different loan products, including auto loans. Along with low-rate, competitive loan terms, Sacramento Credit Union also operates Autoland.com, which is an auto buying concierge service.

Using Autoland lets users shop, compare, and buy vehicles from anywhere. They can compare thousands of cars using an online database, secure bids from competing dealerships, and calculate their loan amount based on price, options, and down payment.

It’s also possible to obtain an SCU loan directly on the Autoland.com website and even trade in your existing car through the site.

Free Music Checking

While Sacramento Credit Union offers a variation of checking account services and products, one of their unique and exclusive offerings is the Free Music Checking account.

This account carries no minimum balance requirements or monthly service fees. In addition, users can earn four iTunes downloads for each monthly qualification cycle.

Other benefits of the Free Music Checking account include free online BillPay and the ability to access your money online, at ATMs, and with a Visa Check Card. Another benefit contained within this service is free SCU and CO-OP ATM transactions. Along with all of the services and benefits listed above, this account also includes a debit card with the Verified by Visa security feature.

Online Bill Pay

Technology is essential to the offerings from Sacramento Credit Union, and this includes the availability of online bill pay.

Users can login to online banking in order to quickly and easily pay their bills, as well as conduct transactions with other people. Other features of using online bill pay include:

- Funds are withdrawn on the date your payment is owed

- Make/schedule several payments on the same or next day

- A user-friendly payment center is available to assist you in managing your payment activity

- Notification availability to remind you when a bill needs to be scheduled or when a bill has been paid

- Calendar feature to identify the earliest a payment can be scheduled

As an incentive to using online bill pay, members are enrolled in a drawing to win an entire month of paid bills or a gift card.

Free Wealth & Finance Software - Get Yours Now ►

To browse exclusive reviews of all top rated credit unions in Sacramento, please click on any of the links below.

- C.A.H.P. Credit Union

- California Community Credit Union

- First U.S. Community Credit Union

- Patelco Credit Union

- Sacramento Credit Union

- SAFE Credit Union

- The Golden 1 Credit Union

- Yolo Federal Credit Union

Conclusion—Top 8 Credit Unions in Sacramento, CA

Credit unions have a long history in the U.S. They were created with the idea of working together for the shared benefit of everyone involved, and that principle has remained essential to all of the products and services they provide.

The list above represents the very best credit unions in Sacramento. Each was thoroughly researched and compared before this ranking was created to ensure these credit unions offer top products, technology, customer service, and competitive rates.

Each of the Sacramento credit union locations on this ranking is a leader among all financial institutions and offers members the opportunity to access advantages they wouldn’t be able to enjoy by banking at another type of financial institution.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.