Overview of USDA Mortgage Home Loans | What You Need to Know about USDA Rural Housing Program

Purchasing a home is a huge financial responsibility to take on, and obtaining a loan for a home is not easy when you don’t have ideal credit or are short on funds, such as a first-time home buyer or someone recovering from a financial loss.

Additionally, if you live in a rural area or have hopes to move to a quiet rural location that is not as well developed as your current suburb, town, village, or city, you may think it’s nearly impossible to get a home loan that will cover the cost of land and building expenses.

It’s understandable to be concerned since less than 20 percent of the U.S. population lives in rural areas, according to the 2010 U.S. Census.

Furthermore, it can be overwhelming to decide on what route to take when it’s your first time looking for a loan designed to finance a rural home.

Source: USDA Home Loan

However, the United States Department of Agriculture or USDA offers multiple USDA rural home loan programs that can help to alleviate the financial burden and stress that comes with the home buying process. But how do you find USDA mortgage loans?

This USDA mortgage home loans program guide aims to help reveal the different USDA mortgage loans for homes that individuals can take advantage of so that they have a better understanding of what’s needed to participate in a USDA rural development loan program for rural areas.

You’ll find out about key information regarding the USDA rural home loan eligibility requirements, including USDA mortgage program qualified income levels, the location qualifications based on USDA Rural Development guidelines, and how to find USDA homes using the USDA rural development map.

This guide will also discuss the benefits of obtaining a USDA rural housing loan. Let’s explore what the USDA Rural Development program is all about, the different USDA rural housing loans, and how to find them.

See Also: Guild Mortgage Reviews—What You Need to Know (Company Reviews & Complaints)

What People Want to Know about USDA Mortgage Home Loans Program

Here are a few concerns individuals have regarding USDA rural home loan eligibility:

- What is the USDA Rural Development all about, and what does it do?

- What are some USDA rural home loan requirements that I would need to fulfill to participate in a USDA loan program?

- How many USDA loan programs for homes are there?

- What types of USDA rural development loan programs are there?

- What is a USDA guaranteed loan?

- What are the benefits to participating in the USDA rural development loan program?

- What is a USDA direct loan?

- What are the USDA direct loan eligibility requirements?

What Is the USDA Rural Development Program?

The USDA Rural Development program manages a variety of programs that provide financial assistance for individuals and businesses that need funds for rural housing and development, whether it is to own a home or a business or to provide funds to homes or businesses.

More than 50 programs that provide financial assistance are operated by the USDA Rural Development program.

The USDA Rural Development program is also a part of the USDA.

USDA Home Loan Benefits:

Getting a USDA mortgage often comes with perks that you may overlook. In fact, there are several benefits associated with obtaining USDA loans for homes qualified as USDA homes and for USDA rural development. Here are a few advantages of getting a USDA mortgage:

There is often no down payment required with USDA mortgage loans.

Source: USDA Home Loan

This helps to alleviate the burden of getting a down payment. By not having to pay a down payment, this financial help can assist you with saving money that you can use to ensure that you can make future payments or use to buy other items for the property to help maintain or improve the property. These improvements can include such repairs or additions as kitchen tiles, ceiling fans, and roof repairs.

Don’t Miss: Lender Paid Mortgage Insurance | What You Need to Know about LPMI

USDA mortgage loans come with flexible guidelines for credit.

USDA loans for homes are designed to assist those with low credit scores that would have been turned down by banks. The USDA loans for homes assist those with little to no credit history.

These flexible guidelines can also allow the USDA rural housing applicants to use nontraditional forms of payment history, such as utility bills, cell phone bills, and rent as proof of payment history.

Terms for restrictions on the property can be more flexible than conventional loans when you get a USDA rural development loan.

Conventional homes often limit the types of homes you can fund. For example, it may not be easy finding funding for manufactured homes or modular homes.

However, the USDA rural development home loans have flexible terms that allow manufactured and modular homes to qualify as USDA housing so that it is easier to obtain a USDA rural development loan for home for these types of properties.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

USDA loans for homes usually provide interest rates that are below the current interest rates available on the housing market.

Due to the fact that USDA loans for homes are insured through the U.S. Department of Agriculture, loans for a USDA mortgage can offer a low interest rate for all approved USDA rural development loan applicants for homes.

An approved USDA loan applicant with good credit, bad credit, or one that pays a down payment will all have the same low interest rate. The USDA home loan interest rate is a flat rate that every approved USDA housing applicant can enjoy regardless of how good or bad their credit history is.

If you do not pay the minimum down payment to bypass private mortgage insurance or PMI, the PMI is often lower for USDA loans for homes in comparison to conventional loans.

USDA mortgage loans allow USDA home loan applicants to roll PMI into their USDA mortgage loans. This will allow the applicant to have a better chance of keeping payments low. USDA loans for homes help approved USDA mortgage applicants to avoid unwanted and unexpected expenses.

You often have options to fund up-front private mortgage insurance costs with USDA loans.

If you are not putting down a certain amount of money for your down payment, you will more than likely be required to pay a higher insurance cost in the form of PMI if that down payment is less than 20 percent of the cost of the home. That’s why it’s vital to pay as much down as possible to avoid the extra expense. However, the USDA understands this is not feasible for many families residing in the United States. That’s why the option to finance PMI up-front expenses will allow you to pay this as part of your USDA home loan to keep up-front costs down and more affordable.

When you get a USDA mortgage for USDA rural development or USDA homes, you can often find a home with a big yard.

In other words, you don’t have to only look at a home in a traditional rural, country location. Many homes that have a big yard may still qualify for the loan as well. The USDA recognizes multiple definitions of what it means to live in a rural area and based it on the need for the USDA loan. Luckily, the USDA home loan can include USDA homes in nonmetropolitan areas. That means certain small towns and villages can still qualify for a USDA rural home loan. For example, the Florida city of Naples has a few areas east of Interstate 75 that qualify as rural USDA homes, as of 2016.

There’s no penalty to pay your USDA mortgage early.

Unlike some conventional loans that charge you for paying your home loan early, USDA rural development loans can be paid off early without paying a penalty fee.

You can use USDA rural development loans for minor repairs.

If you need to fix up the home, you are planning to purchase, a USDA rural development loan can help finance the repair. This helps reduce the financial burden of funding repairs that may be needed to update USDA housing and can often be costly.

These are just a few benefits that getting USDA home loan mortgages can provide. Now, let’s look at the different types of USDA home loan mortgages currently available for individuals.

Related: New American Funding Reviews | What You Need to Know (Pros, Complaints & Rates)

Different Types of USDA House Loans for Individuals

You will be surprised to know that USDA housing loans can be abundant. Here are a few USDA mortgage loans and USDA rural development loans to think about that are a part of the USDA Rural Development program:

Multi-Family Housing Direct Loans

This type of USDA home loan has a main factor that the tenant must be age 62 or older. The maximum years to pay back the loan is 30 years. This loan can also be used to improve a homeowner’s current land or for buying new land for building a home.

Rural Energy for America Program Renewable Energy Systems & Energy Efficiency Improvement Loans

Source: USDA Home Loan

This loan is to assist applicants who are looking to pay to upgrade their property to be more energy efficient. This loan can only be used to purchase equipment or make improvements to make the location energy efficient and use renewable energy systems. One thing to note is that the property must be located in area that has a population greater than 50,000 people. You can use the loan site to see if your address does qualify. In addition, this loan is for applicants whose agricultural produce makes up of 50 percent of their gross income.

Single-Family Housing Direct Home Loans

This USDA direct loan is also referred to as the Section 502 loan. This USDA direct loan is designed for applicants that were unable to obtain loans from other sources due to not meeting requirements. Those that apply must understand that the home they purchase with the loan must be their primary residence. The home they are looking at must be 2,000 square feet or less and cannot have any in-ground swimming pools. Also, like other USDA loans, no down payment is needed.

Single-Family Housing Guaranteed Loan Program

This USDA guaranteed loan program provides a 90-percent loan note to approved lenders. Unlike the Single-Family Housing USDA Direct Loan, this USDA guaranteed loan does not come directly from the government. It comes from government-approved lenders instead. This USDA guaranteed loan can also be used for a variety of options unlike the other loans, such as using for repairs and making the location more energy-efficient. However, the applicant must find and be approved by the lender to get this USDA guaranteed loan.

Popular Article: Spot Loan Reviews—Get the Facts Before Using (Pros, Complaints, & Review)

Single-Family Housing Repair Loans

Source: USDA Home Loan

This loan is also called Section 504, and this loan is for low-income applicants who are in need of money to repair their current locations. This loan can also be used to modernize applicants’ homes. Additionally, the loan is available to elderly persons that want to remove safety hazards from their properties.

This loan will require applicants to show proof that you were unable to obtain a loan elsewhere. The applicant must show proof that the home is their primary location. The loan can go up to $20,000. You can even get up to a $7,500 grant at the same time to give you a total of up to $27,500 for repair assistance if you meet all the qualifications.

USDA Loan Eligibility Basics

USDA Loan Qualification: Income Eligibility

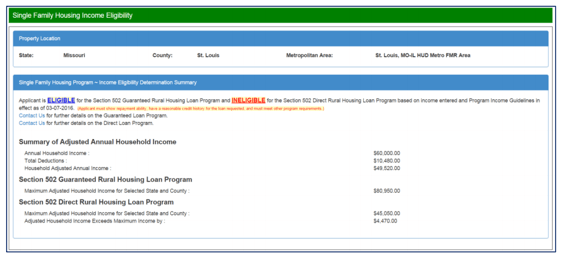

The USDA has made a simple eligibility test to see if your income meets the USDA loan eligibility requirements for the USDA mortgage loan.

By going to the USDA Rural Development program eligibility site and filling out the required information, you will see a screen like the image below to help you determine if you are eligible for the program, as well as the reason why or why not. Since requirements can change at any time, it is best to check the website to see if you are eligible.

Source: USDA Home Loan

USDA Loan Qualification: Location Eligibility and How to Find USDA Homes

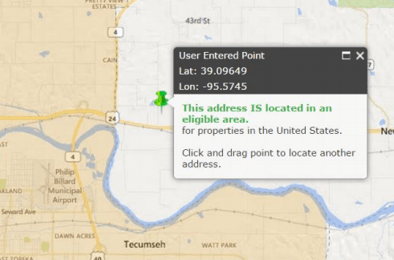

If you’re looking for USDA rural housing or USDA homes, then you want to look at the USDA rural development map.

The USDA rural development map helps you to find USDA housing qualified to participate in the USDA rural development loan program so that you are not wasting time guessing or trying to find a home that may qualify for the program.

Seeing if a location you are interested in qualifies for a USDA home loan can also be simple with the USDA rural development map. To use the USDA rural development map, go to the Property Eligibility tab while using the USDA Home Loan Eligibility site and enter in an address in the search box to see if it qualifies.

As seen in the image below, a pin will indicate whether or not the property you selected qualifies as USDA housing:

Source: USDA Home Loan

What makes this feature even easier for applicants is that they can move the pin around on the map to a new location to see if that area is also USDA home loan eligible. The site also allows you to print the location you find so that can you keep it for your records.

Read More: Top Bad Credit Mortgage Lenders for Bad Credit Borrowers (Mortgage Lenders and Programs)

Free Wealth & Finance Software - Get Yours Now ►

Final Thoughts: USDA Home Loan & Rural Developement Loans

If you’re ready to buy a home in a rural area but have no clue where to begin looking for home loans that cover rural areas and meet your financial needs, then you can start with this USDA mortgage home loans guide.

You can quickly go to the USDA website and see if you do qualify for a USDA home loan by filling out information during the eligibility test. Additionally, you can use the map to see if the area you’re looking to purchase a home is also a USDA home loan eligible rural area.

Quickly review what loan you think best suits your needs and recheck the site to ensure you meet all the qualifications.

Remember that the USDA mortgage loans are mainly on a first-come, first-served basis and sometimes have application deadlines. Therefore, it’s best to do the application as quickly as possible once you find the USDA home loan that best suits your needs.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.