2017 RANKING & REVIEWS

THE TOP BANK LOAN CALCULATOR TOOLS

Finding the Best Bank Loan Calculators in 2017. But First, Why Would You Need a Loan Calculator?

There are quite a few reasons you might use a bank loan calculator, and many of these reasons will be covered in-depth in this ranking of the best loan calculator tools.

To begin below is a general overview of some of the functions of most standard bank loan calculator tools:

- A bank loan calculator can help consumers determine how much interest they will be paying monthly, annually, and throughout the entire term of their loan.

- A loan rate calculator is a good way to see how different interest rates can impact how much you pay for your loan and how long it will take you to pay it off.

- A bank loan calculator can serve as a comparison tool for consumers who are shopping around for the best lending offer.

- Using a loan amortization calculator can help current loan holders see how their payments affect how quickly they can pay off their loan, and some online loan calculator tools also provide amortization payment schedules.

- You can use a loan calculator to calculate a loan payment if you’re considering borrowing money.

Award Emblem: Best 6 Bank Loan Calculators

Again, these are just a few of the many ways you might use a loan calculator.

The following ranking and review of the best online loan calculator options covers a wide variety of tools that can be used for different purposes.

While many of the loan calculator tools on this ranking and review share similarities, they also have fundamental differences that can make one loan calculator more useful than another for a particular consumer.

What Is an Amortized Loan?

One key term throughout this ranking and review of the best bank loan calculator options will be “amortized.” What do these words mean?

Image Source: Pixabay

An amortized loan is simply one that has scheduled payments made at regular intervals, such as monthly. These payments include a combination of the principal and interest charges. A loan amortization calculator might break down how much you’re paying toward the principal each month, and what your finance charges are as well.

Most loans are amortized; examples of these loans include home loans, personal loans, and auto loans.

A loan amortization calculator is useful because the calculations of the loan itself can be complex. To begin, the balance of the loan is multiplied by the interest rate.

For example, an annual interest rate would be divided by 12 months, which would show the consumer their monthly interest rate. Then, calculations might include subtracting the interest for a period from the total monthly payments. That would show the amount of principal paid during that given period.

Often a loan amortization calculator will produce an amortization table, which shows balances and dollar amounts for every period.

See Also: Best Prepaid Debit Cards | Ranking, Including Prepaid Debit Cards With No Fees

AdvisoryHQ’s List of Top 6 Bank Loan Calculator Tools

List is sorted alphabetically (click any of the loan calculator names below to go directly to the detailed review section for that loan calculator):

- Amortization Calculator from Credit Karma

- Bankrate Loan Comparison Calculator

- Bankrate Personal Loan Calculator

- Loan Calculator from Calculator.net

- Mortgage Calculator from Smart Asset

- Wells Fargo Rate and Payment Calculator

Top 6 Best Bank Loan Calculators | Brief Comparison & Ranking

Bank Loan Calculators | Used For | Inputs | Best For |

| Amortization Calculator from Credit Karma | Viewing an amortization schedule on loans | Loan amount Interest rate Number of years | Seeing a payment and interest breakdown on an existing loan |

| Bankrate Loan Comparison Calculator | Comparing different loan offers | Loan amount Interest rate Term Amortization Fees Closing costs | Shopping loan offers and finding one that provides the best value inclusive of interest, fees, and closing costs |

| Bankrate Personal Loan Calculator | Figuring monthly loan payments on a personal loan | Loan amount Loan term Interest rate Loan start date | People considering a personal loan or anyone who wants to see the impact of additional payments |

| Loan Calculator from Calculator.net | An amortized loan calculator that also shows different payback options | Loan amount Loan term Interest rate Compound Payback schedule | Anyone who wants an amortized loan calculator or who’s considering an alternative payback loan option |

| Mortgage Calculator from Smart Asset | Calculating mortgage payments and how debt will change over time | Home value Mortgage balance Rate Remaining term | People shopping for mortgages or consumers who want to refinance an existing mortgage |

| Wells Fargo Rate and Payment Calculator | Calculating monthly payments and rates and comparing loan terms | Zip code Type of personal loan Amount of loan Term | This is a flexible bank loan calculator that can be used for a variety of purposes. |

What Are the Main Types of Loans?

When you’re searching for a bank loan calculator or a tool to calculate a loan payment, you’ll see that there are quite a few kinds of bank loans. Some of the primary loans that the loan calculator tools on this ranking can be used for include:

- Home Loans: Also called a mortgage, a home loan is provided by a bank to help consumers with the money they need to buy a home. It’s secured by the home itself, so if a borrower falls behind on payments, the home may go into foreclosure. Consumers might use a loan calculator for their home loan to see how they could shorten their loan term by making additional payments, or they could use an online loan calculator to compare different mortgage offers.

- Car Loans: Property also secures car loans, and consumers might search for an APR loan calculator to see how much they’ll pay in interest through the life of their loan since auto loans tend to have the highest interest rates of any type of loan.

- Personal Loans: Many banks also offer personal loans, which can be used to pay for expenses without a designated purpose being given to the bank. They’re often used to consolidate debt or make large purchases, such as home renovations.

These are the three primary types of loans, but this list certainly isn’t exhaustive.

Some of the other loans available from banks and other financial institutions include home equity loans, student loans, small business loans, and lines of credit.

Should You Pay Off Your Loans Early?

If you’re looking for a bank loan calculator or a tool to help you calculate loan payment schedules and options, you might be thinking about paying off your existing bank loans early. Using a loan calculator online can help you see what a difference paying a loan early would make it terms of finance charges, but there are other factors to consider as well.

When you use a loan calculator online or an amortized loan calculator, you’ll likely see how much money you can save by paying your loans off early. That savings on interest payments is probably the number one reason people work to pay loans off early.

In addition to financial benefits of using a bank loan calculator to create a pre-payment schedule, when you pay your loans early you also get the peace of mind that comes with knowing you’re debt-free.

While using a loan calculator online can show you the money you’ll save in interest by paying your loans early, there are some downsides to this approach as well.

The first one is that there are benefits of having debt. Many consumers don’t realize the advantages of carrying some debt, as long as they’re making responsible payments. Debt is good for building your credit history because it shows a pattern of making your loan payments on time.

Also, it can make more sense financially at times to make payments on your debt and retain cash flow rather than sink a huge chunk of money into a given item. That cash flow may be put to better use by investing it elsewhere, instead of paying a loan off all at one time.

Don’t Miss: Best Mortgage Payment Calculators | Tips to Find Top Calculators to Estimate & Calculate Mortgage Payments

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Bank Loan Calculator Tools

Below, please find the detailed review of each calculator on our list of the loan calculator options. We have highlighted some of the factors that allowed these online loan calculator tools to score so well in our selection ranking.

Amortization Calculator from Credit Karma Review

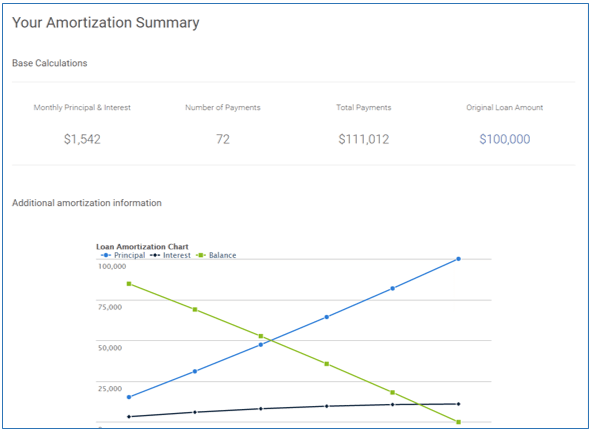

As described in the details above, amortization refers to a loan where the borrower gradually reduces their debt by making payments over a particular period of time. The Credit Karma amortized loan calculator is designed to show how debt on a bank loan would be reduced based on payments made over time.

Credit Karma is an online resource that provides tools and resources for people regarding personal finance. The site has more than 60 million members, and they provide credit reporting as well as information and offers for credit cards, car loans, and other personal loans. Credit Karma also features original articles and reviews of financial products.

Key Factors That Led to Our Ranking of This as a Best Loan Amortization Calculator

The Credit Karma Amortization Calculator is included in this review of the best loan amortization calculator options for the reasons listed below.

Features and Uses

The amortized loan calculator from Credit Karma is designed to show a reduction in debt, such as a mortgage, that happens as payments are made on the loan. This loan amortization calculator also shows a payment breakdown that includes:

- Interest paid

- Principal paid

- Loan balance over the life of a loan

The only input required with this loan amortization calculator is the loan amount, interest rate, and a number of years.

The results then show the base calculations as well as a handy loan amortization line graph chart, a principal payment chart, and a complete amortization schedule.

Benefits

The Credit Karma loan amortization calculator was selected for this ranking of the best loan calculator options for several reasons, including the graphs that are included in the results calculations.

These graphs, including a line graph and a principal payment chart, provide an effective visual representation of exactly what you’re paying over time, and they can show you how much interest you’re being charged through the life of your loan.

The full amortization schedule is also helpful, and it breaks down payment amount, interest paid, principal paid, and mortgage balance throughout the life of the loan as you specify it.

Many consumers are surprised with just how much of their payments go toward interest on a variety of loans, such as with a mortgage. When a consumer has a mortgage, they build little equity in the first few years as a result, and the fact that this loan amortization calculator highlights that makes it a useful tool.

Image Source: Credit Karma

Who It’s Good for

The loan amortization calculator from Credit Karma is flexible and suitable for anyone with any type of loan who’s making payments over time.

The input quantities are simple to understand, and this simple loan calculator lets you quickly see, in multiple formats, how your payments are affecting the principal of a loan of any type, and you can also see how much interest you’re paying every month and throughout the course of your entire loan.

Bankrate Loan Comparison Calculator Review

Bankrate is a financial website that serves as an aggregator of everything from relevant news and updates happening in the financial world to reviews of personal products and services. Bankrate is also known for the provision of some of the best financial calculators and tools, including a few different bank loan calculator options.

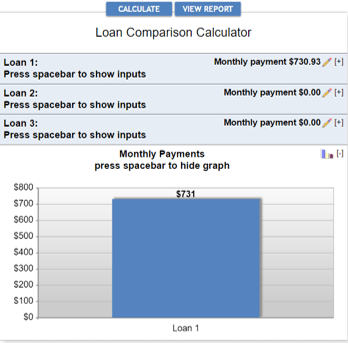

There are two online loan calculator names from Bankrate included on this ranking, the first of which is the Bankrate Loan Comparison Calculator. This particular loan calculator is designed as a way to input information about multiple loans and get a simple comparison.

Key Factors That Led to Our Ranking of This as a Leading Loan Calculator

The Bankrate Loan Comparison Calculator is included on this list of the best options for a bank loan calculator for the following reasons.

Features and Uses

The Bankrate Loan Comparison Calculator is one of the most unique names on this list of the best loan calculator options. It provides the opportunity for users to compare up to three loans in order to discern which one offers the most value.

This online loan calculator can be used to calculate and compare loan payment terms, fees, and other costs that come with a loan. The variables are compared side-by-side to make it easy to see which option will work best for your needs.

Users can also use the “view report” option to see more details about each of the loans they’re considering and how they stack up against one another.

Image Source: Bankrate

The Benefits

There are a few key benefits of this particular simple loan calculator that makes it one of the best options.

- This loan amount calculator lets users not just see how much interest they’ll pay; it also lets them make a side-by-side comparison of several loan options.

- Using this Bankrate online loan calculator provides the opportunity to see an in-depth report of results, including monthly loan payments for each loan and other potential fees.

- This loan rate calculator and loan amount calculator is also great because it provides not just detailed written reports but also a chart comparing loan terms to give users a visual idea of which option might be best for them.

- The opportunity to enter a wider variety of input than most other bank loan calculator options can be valuable because it gives you a very accurate picture of how much you’ll be paying for a loan over time. Inputs include loan amount, rate, term, and amortization as well as options for origination and commitment fees and any other fees and closing costs that might be included with a loan.

Who It’s Good for

When comparing this quick loan calculator to the other loan rate calculator and bank loan calculator tools on this list, it’s useful for people who haven’t yet gotten a bank loan but are still shopping around for offers.

It’s a simplified way to compare offers before making a decision, and it gives a clear, straightforward way to see which option is going to be best for you. You’ll be able to see which loan will provide you with the opportunity to pay the lowest overall amount of interest and also which loan will feature the lowest monthly payment.

Bankrate Personal Loan Calculator Review

A personal loan is considered unsecured because it’s not backed by something like a house or a vehicle. Personal loans are offered by banks, and they can be used to pay for a variety of things. The Bankrate Personal Loan Calculator is a simple loan calculator that provides calculations related to what a borrower’s monthly payments would be.

This is just one of the many bank loan calculator and loan amortization calculator options from Bankrate. Others include home equity, auto, and mortgage loan calculator tools.

Key Factors That Led to Our Ranking of This as One of the Best Interest Calculators

The features and benefits of the Fixed Payment Loan Comparison Calculator that led to its ranking of the best interest rates calculators are detailed below.

Features and Uses

This simple loan calculator is designed as a tool that lets users put in information about specific personal loans they might be considering as they compare lenders. The input information includes loan amount, loan term, loan interest rate, and the start date. They also enter their monthly payments.

The output that comes from this amortized loan calculator quickly shows what monthly payments would be for that particular loan.

There is also the option with this quick loan calculator to add extra payments on a monthly or yearly basis, to see what the impact would be.

An additional input option includes the ability to add a one-time payment. Once you enter that additional payment information to this loan calculator online, you’ll receive an updated payoff estimated date and an amortization table.

Benefits

The following list highlights some of the main advantages of using this tool to calculate loan payment options.

- Besides the fact that this is a unique loan calculator designed specifically for personal loans, this tool is included in this ranking of the best loan amortization calculator options because users can experiment with making additional payments to see how they would impact payments over time and the payoff date.

- The amortization table gives an in-depth view of each month and year that are part of your estimated payment schedule, as well as the payment amount, the principal paid, and the interest paid. It also includes the balance after each payment is made.

- Bankrate is great in terms of finding a loan amortization calculator or loan rate calculator because you can also shop the site for the loans and compare the day’s rates. It’s a one-stop shop if you’re looking for a loan.

Who It’s Good for

This amortized loan calculator is an excellent, simple loan calculator if you’re considering taking out a personal loan for any purpose and want to be clear on the breakdown between the principal you’ll pay and the interest.

It’s also good for consumers who already have a personal loan and are interested in seeing how paying off their loan more quickly could be beneficial financially.

Finally, other people who might want to consider this online loan calculator are those consumers who want to be able to compare specifics of loan terms on the same site where they’re using a loan calculator.

Popular Article: Which Is the Best Mortgage Calculator? Chase? Wells Fargo? CNN?

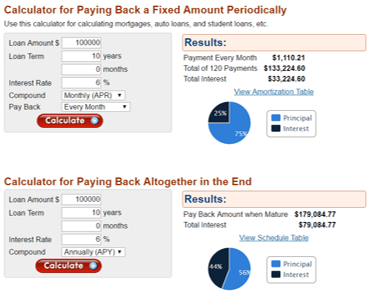

Loan Calculator from Calculator.net Review

As the name indicates, Calculator.net is one of the leading resources if you want to do anything from calculate a loan payment to calculate your BMI. Their financial calculators include not just APR loan calculator and loan amount calculator tools, but also interest calculators, retirement calculators, inflation calculators, and more.

In general, Calculator.net is an excellent resource if you want a loan calculator online because of the detailed results reporting and the clear, easy-to-understand instructions that come with each calculator.

Key Factors That Led to Our Ranking of This as a Best Interest Payment Calculator

The following details highlight some of the reasons this is a valuable way to calculate interest rates.

Features and Uses

This loan calculator is actually a collection of three loan calculators in one, and each of the online loan calculator tools is based on the different loan options there are. These include the following:

- Paying back a periodic fixed amount until maturity is the most common structure for a consumer loan from a bank. With this type of loan, which often includes mortgages, student loans, and more, the borrower pays part of the principal and part of the interest with a monthly payment.

- There’s also a quick loan calculator that shows the financial impact if a borrower were to pay back everything all at one time when the loan matures. That means the borrower would be responsible for paying the principal plus the interest in a bulk payment.

- The third option available with this loan amount calculator involves loans where the borrower pays back a fixed amount, which is usually the case with bonds.

Benefits

A main advantage of using this loan rate calculator is the ability to see different types of loans. Many loan calculator options available are only for amortization, but this loan calculator has three distinct options to choose from. Other advantages of this loan amount calculator include:

- You can view how much your payments will be when applicable, and also the total amount of interest you’ll pay, which can make for an excellent opportunity to compare loan options available to you.

- Another benefit of this tool to calculate loan payment options is the ability to view results in chart form, highlighting how much principal versus how much interest you pay on a particular loan.

- This simple loan calculator from Calculator.net also features the ability to view annual and monthly amortization schedule, showing beginning balances each month and year, the interest paid each month and year, and the ending balance for each.

- Finally, this amortized loan calculator is a good option because it provides a lot of supplementary information for consumers explaining interest rates, loan options, and more.

Image Source: Calculator.net

Who It’s Good for

There’s a lot of flexibility and versatility with this online loan calculator. It’s good for consumers who are trying to decide between different types of loan payment options, as well as anyone who wants a clearly organized amortization schedule, by monthly and by year.

It’s also good if you want an easy-to-understand graphic visual of how much interest you’re paying with a loan versus how much of your payments are going toward the principal on a monthly and yearly basis.

It can be used with any personal loan or bank loan since the only inputs are the amount, the term, the interest rate, the type of compounded interest, and the payment schedule.

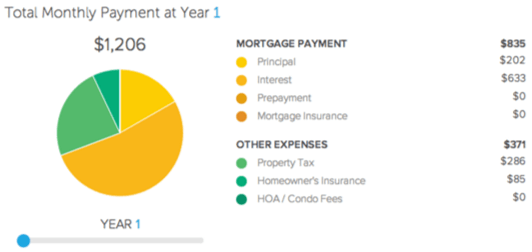

Mortgage Calculator from Smart Asset Review

SmartAsset.com is an online hub of financial information, tools, and calculators including the Mortgage Calculator on this ranking of the best APR loan calculator, amortized loan calculator, and bank loan calculator options. SmartAsset features tools that are personalized and interactive so people can make sound financial decisions.

This ranking includes many simple loan calculator tools related to general bank loans and personal loans, but it was also important to include a mortgage-specific loan calculator, since that is one of the most common loan products consumers get from banks.

Key Factors That Led to Our Ranking of This as a Best Bank Loan Calculator

Among interest calculators, this excels as one of the best options for an interest-only calculator for reasons in the following list.

Features and Uses

This quick loan calculator is a great tool for calculating mortgage information, and it provides some of the most detailed information and reporting of any bank loan calculator included in this ranking.

This APR loan calculator is also one of the most personalized tools on this bank loan calculator ranking. You begin by entering information to calculate loan payment options. This information includes the location you’ll be buying a home, as well as your credit score.

Other information that can be entered includes the percentage you’ll pay in homeowners’ insurance, any potential monthly prepayments you might make, and the value of your home, as well as your down payment.

The resulting reporting includes an estimation of how much your minimum income should be to afford the home loan you’re considering, as well as your monthly mortgage payment.

Image Source: SmartAsset.com

Benefits

As mentioned above, this particular loan rate calculator and loan amount calculator excels because of the detailed level of reporting it offers. It’s one of the best ways to calculate a loan payment for a mortgage online, but also to see other important details, such as whether or not you can afford a particular mortgage given your income.

Other advantages of using this quick loan calculator include:

- It produces a pie chart highlighting how much of a user’s monthly payment will go to their actual mortgage principal, and then gives a breakdown of what goes to home insurance, real estate taxes, and mortgage insurance.

- Taking into account factors like where you live, this online loan calculator also shows the equity you gain in your house with each of the payments you make. This will help you learn important things about a mortgage, such as the exact point at which you should have more equity than debt in your home.

- This is a great, simple loan calculator that lets you not just calculate loan payment terms, but also lets you see the real cost of home ownership so you can find a home that’s the right price for your budget.

Who It’s Good for

This APR loan calculator and loan amount calculator is ideal for anyone who wants to have a clear, concise way to understand the real costs of owning a home.

It’s a quick loan calculator that shows potential home buyers what their mortgage payments will look like each month, and also how their payments and debt will change throughout the course of their loan.

It’s a forward-looking way to calculate loan payments, and it’s great if you want to refinance your existing loan as well, since the benefits are similar to what you get if you were looking for a new home loan.

Free Wealth & Finance Software - Get Yours Now ►

Wells Fargo Rate and Payment Calculator Review

Wells Fargo is one of the largest and most recognizable banks in the U.S. They offer a variety of financial products and services for individuals, small businesses, and commercial clients. Some of the personal financial products include deposit accounts, loans and credit, insurance, investing, retirement, and wealth management.

In addition to actual products and services, Wells Fargo also features free tools like the simple loan calculator included in this ranking, called the Rate and Payment Calculator.

Key Factors That Led to Our Ranking of This as a Best Bank Loan Calculator

Among loan rate calculators, APR loan calculators, and amortized loan calculators, the following are specifics that indicate why the Wells Fargo Rate and Payment Calculator is included in this ranking and review.

Features and Uses

This simple loan calculator is used, as the name implies, to help consumers calculate their rate and payments on personal bank loans.

The input values for this loan rate calculator include your zip code, the loan or line type you want rates for, the amount of the loan you’re considering, and the number of months you plan to pay the loan back.

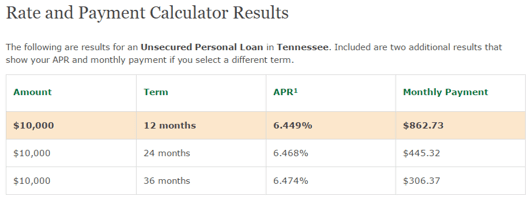

Once you enter that information, you’re taken to results that outline three different term options, so that you can see how the APR and monthly payment would vary for each.

Image Source: Wells Fargo

Benefits

The main benefit of this quick loan calculator is its simplicity. It’s one of the most straightforward and simple loan calculator options on this ranking.

Additional benefits of this APR loan calculator include:

- This loan rate calculator is excellent for comparing loan terms and seeing what a difference varying terms can have on your APR and your monthly payment. It’s the only loan calculator on this ranking of the best online loan calculator tools that focuses on comparing terms. For example, with a $10,000 personal loan and a relatively similar APR, if you choose a 12-month term, your monthly payment would be around $862, and if you were to choose a 24-month term, your monthly payment would go down to $445.32.

- Another interesting element of this loan rate calculator is the fact that you enter your geographic location. This kind of specificity in the input fields can help you get a closer estimate to what you would really pay.

- The Wells Fargo APR loan calculator is also great because you can go directly from the calculator to the application page for personal loans that meet your needs.

Who It’s Good for

This loan rate calculator is useful if you’re in the process of getting a personal loan, whether it be an unsecured personal loan, an unsecured personal line of credit, or a CD/savings secured line of credit. It can also be particularly valuable if you’re thinking of borrowing from Wells Fargo.

You can use it if you are unsure of what terms are going to work best for you regarding the length of your personal loan since this quick loan calculator lets you make a comparison across three different term options.

Related: How to Find the Best Mortgage Refinance Calculator with Taxes And Insurance

Conclusion — Top 6 Bank Loan Calculator Tools

The above ranking and review of leading bank loan calculators covers a wide variety of online loan calculators, each of which has its own distinctive features that make it useful and valuable.

For example, there are loan amortization calculator options on this ranking, a very simple loan calculator, and an APR loan calculator. This ranking also features more sophisticated calculators, such as the Mortgage Calculator from Smart Asset, designed to help you as you plan to purchase a home.

Regardless of the loan calculator that is most pertinent to your financial needs, all of the names on this ranking and review provide excellent features, user-friendliness and value.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.