RANKING & REVIEWS

TOP RANKING FINANCIAL APPS FOR MILLENNIALS

Intro: Millennials and Money Management Apps

From conversations about their social skills to their habits in the workplace, Millennials are one of the most talked-about generations in recent history.

One of the most popular topics of conversation comes from Millennial finance. With record-breaking student debt, it may seem as though Millennials and money may not have a positive relationship.

In fact, this generation is more invested in establishing solid financial skills than ever.

The close relationship between Millennials and technology creates unprecedented access to financial tools and investment opportunities through intuitive money management apps.

To acknowledge the strong connection between Millennials and technology, money management apps and personal finance apps have emerged as dynamic tools to facilitate Millennial investing, saving, and budgeting.

Award Emblem: Top 7 Best Financial Apps for Millennials

What makes a personal finance app for Millennials different than another money management app? The best financial apps for Millennials strive to make financial management easy, with intuitive interfaces, dynamic financial tools, and on-the-go accessibility.

In some cases, the best apps for investing and saving will strengthen the relationship between Millennials and technology, making financial management into a fun, engaging experience.

In this article, we’ll take a close look at the best financial apps for Millennials to use for a variety of financial goals, including the best apps for investing, budgeting, and saving.

AdvisoryHQ’s List of the Top 7 Best Financial Apps for Millennials

List is sorted alphabetically (click any of the app names below to go directly to the detailed review section for that personal finance app):

Top 7 Best Financial Apps for Millennials | Brief Comparison & Ranking

Best Financial Apps for Millennials | Cost | Highlighted Features | Best For: |

| Acorns | Beginner: $1/month Growth: $3/month Stash +: $9/month | Four years of free investing for college students | Automatic investment management |

| Digit | 100-day free trial $2.99 per month | Text commands allow for quick, responsive account maintenance | Building your savings towards a short-term goal |

| Mint | Free | Track and pay bills with Mint Bill Pay | Creating and maintaining a personal budget |

| Personal Capital | Free | Intuitive financial tools for budgeting, investing, and retirement | Experienced Millennial investors |

| Qapital | Free | Real-life savings goals and customized rules | Finding creative ways to increase your savings |

| Stash | $1 per month for accounts under $5,000 First month free 0.25 on accounts $5,000 or more | Value-based investing categories | New investors that also want retirement account options |

| You Need A Budget | 34-day free trial First year free for students $50 annually | Budgeting is based on a simple four-rule system | Creating and maintaining a personal budget |

Table: Top 7 Best Financial Apps for Millennials | Above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Financial Apps for Millennials

Below, please find a detailed review of each personal finance app on our list of best apps for investing and personal finance. We have highlighted some of the factors that allowed these best financial apps to score so high in our selection ranking.

See Also: Best Card Readers | Ranking | Top Magnetic, Portable, Payment, Bank Debit and Card Readers

Acorns Review

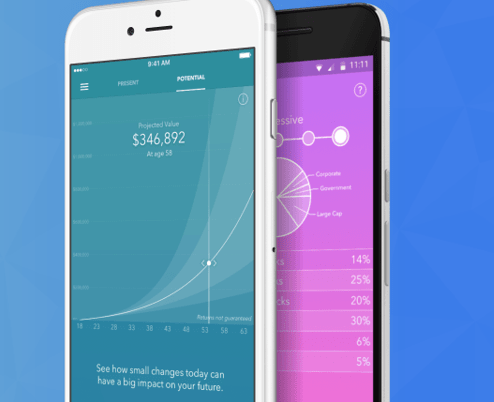

Acorns is steadily rising in popularity as one of best financial apps for Millennial investors, promoting cost-effective and convenient Millennial investments.

To facilitate investments for Millennials, Acorns takes spare change from every day purchases, rounds it to the next dollar, and invests in Exchange-Traded Funds (ETFs).

Millennial investors can also choose to send recurring or one-time transfers to the personal finance app. While micro investing may not yield immediate results, Acorns is a great personal finance app for Millennials to consider for growing their investments over time.

As a robo-advisor, investments for Millennials are automatically rebalanced as the market fluctuates, turning financial planning for Millennials into a largely hands-off process.

Ultimately, Millennial investing with Acorns is both simple and convenient—the money management app requires little maintenance, and the affordable fee structure makes it one of the best financial apps for Millennial investing.

Money Management App – Acorns Review

Additional Considerations

- College students get four years for free

- Found Money® program rewards users for shopping with certain brands

- Can access via app or desktop

- Automatic portfolio rebalancing

- Easy, hands-off investment strategy

Don’t Miss: Best Credit Card Readers | Ranking | Free, Top, Cheapest CC Readers

Digit Review

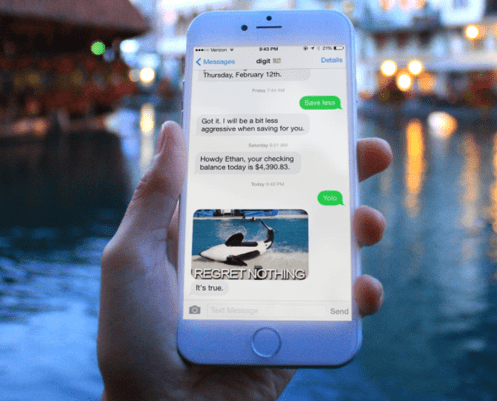

Digit is an automated personal finance app that seeks to improve Millennial finances by emphasizing the close connection between Millennials and technology.

This personal finance app makes saving easy by analyzing income and spending habits to automatically transfer small increments into a savings account.

The Digit money management app only transfers amounts that users won’t miss, which averages between $5-$30, 2-3 times a week.

Part of what makes this one of the best financial apps for Millennials is their unique approach to Millennial finance management. Rather than constantly open a money management app, Digit encourages users to utilize a set of text commands, saving both data and time.

This money management app also uses a keen understanding of the relationship between Millennials and technology with their new Goalmoji feature. Users can assign an emoji to a goal and text with that emoji to update, change, or monitor the savings balance.

Having an automated—and highly interactive—personal finance app is a great way for users to learn good financial habits and establish a solid method of financial planning for Millennials.

Personal Finance App – Digit Review

Additional Considerations

- No minimum balance requirements

- Unlimited transfers and withdrawals

- Create unique savings accounts for goals and bills

- Earn a 1 percent annual Savings Bonus based on average daily balance

Related: Best Mobile Credit Card Readers | Ranking | Portable Credit Card Readers for Phones

Mint Review

Mint is a simple and convenient money management app that allows users to create and monitor a budget, pay bills, and get a better picture of their overall health.

As one of the best financial apps for Millennials, Mint provides an all-in-one platform to track and pay bills.

Rather than log into multiple websites, this money management app allows users to see a complete picture of upcoming bills and receive due date reminders, making it easy to avoid late fees.

With Mint, you can stick to a suggested budget or create your own unique budget based on your spending and saving needs.

Best Financial Apps – Mint Review

The personal finance app will automatically assign credit and debit card purchases to relevant categories so you can easily identify and improve upon areas of overspending.

Despite its advanced budgeting tools, the Mint money management app is available for download and use completely free of charge—which is certainly good news for Millennial finances.

Additional Features

- Receive alerts for unusual spending or low accounts

- Monitor portfolio performance

- Receive investment advice and tips

- Can access via app or desktop

- Made by Intuit, makers of TurboTax and QuickBooks

Popular Article: Mint.com Review | What You Should Know About Mint Software

Personal Capital Review

With $5 billion in AUM and over 1.4 million users, Personal Capital is one of the best financial apps available on the market today.

While this money management app is not necessarily marketed towards younger Millennial investors, their free financial tools make Personal Capital a great option for “Old Millennial” investors. These include:

- Net Worth—See a complete picture of your finances

- Fee Analyzer—See how investment fees are impacting retirement funds

- Investment Checkup—View investment performance

- Retirement Planner—Realistic and effective retirement calculator

Although many of the tools from this Millennial finance app deal with investment management, users can also take advantage of advanced budgeting tools, like monthly spending targets and analysis by merchant, date, or category.

>> Click Here to Join Personal Capital Now! <<

Although Millennial investors will find that investment services do require a significantly higher minimum balance, Personal Capital offers a ton of value.

This best money management app uses award-winning technology and modern investment theories, making it one of the best apps for investing all around.

Additional Considerations

- Can access via app or desktop

- Budgeting and spending analysis through the Personal Capital Dashboard

- Free insurance guide for complete financial wellness

- Advisors available by phone, email, chat, or web conference

Read More: Best Retirement Planning Software and Tools for Individuals

Qapital Review

With a focus on making money management both easy and fun, Qapital is one of the best financial apps for Millennials to consider.

A large part of the appeal towards Qapital comes from the personal finance app’s ability to turn financial planning for Millennials into an engaging, unique, and highly personalized experience.

Instead of using generic goal descriptions, this money management app encourages users to create real-life savings goals, like sky diving lessons or a safari in Africa.

Users can also choose from a variety of automatic savings rules, making Millennial finance management into a fun, rewarding experience. A few examples of these rules include:

- Save every time you go to the gym

- Save towards a goal whenever Donald Trump Tweets

- Save for a rainy day whenever it rains

For more traditional savers, there are plenty of other rules to choose from, like rounding up your spare change and saving set amounts on specific days.

With the option for a Qapital Visa® Card, this money management app can also be used as one of the best financial apps for online banking.

There are no monthly fees, no overdraft charges, and immediate transfers between accounts are unlimited, making Qapital one of the best financial apps for Millennials.

Additional Considerations

- FDIC insured up to $250,000

- Instant access to funds when a goal is completed

- App allows for remote card lock

- No minimum balance requirements

Related: Top Money Management Software and Apps for All Devices (Rankings)

Free Wealth & Finance Software - Get Yours Now ►

Stash Review

Stash offers expert investing products that are perfect for Millennial investors that don’t have a ton of investing experience yet.

As one of the best financial apps for Millennials, Stash attracts Millennial finance management through unique, creative methods of value-based categorization.

Instead of using complicated jargon for over 30 Exchange-Traded Funds (ETFs), Stash uses nicknames. This enables Millennial investors to choose investments that align with their values, like water conservation, clean energy, technology, and even social media.

A few examples include:

- American Innovators

- Blue Chips

- Clean & Green

- Defending America

- Global Citizen

- Water the World

It should be noted that a potential downfall for Millennial investing is that the Stash personal finance app is not a robo-advisor. Stash will suggest investments for Millennials, but it’s up to Millennial investors to choose whether to follow their advice.

Still, Stash is a great choice for Millennial investing in terms of affordability and accessibility, particularly for new Millennial investors that want to dip their toes into investing.

Best Apps for Investing – Stash Review

Additional Considerations

- Elimination of complicated jargon is ideal for Millennial investors

- Customized portfolios based on personas like The Activist and The Trendsetter

- Can use Stash Retire to invest in retirement accounts

- +250 investment options, including ETFs and single stocks

- Only accessible via app

Don’t Miss: The Best Asset Tracking Software and Systems – Top Reviews

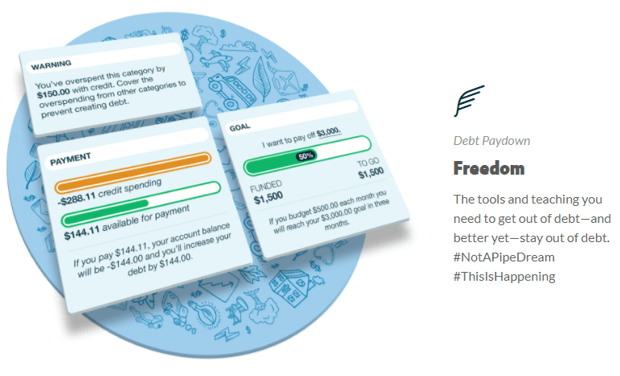

You Need A Budget Review

You Need A Budget (YNAB) is one of the best financial apps for Millennials to consider this year.

Its personality and enthusiasm makes it uniquely poised to appeal to Millennial finance, encouraging users to say “Good-Bye, Financial Crisis Roller Coaster!”

On average, YNAB helps users save $600 by their second month and more than $6,000 by their first year, making YNAB one of the best financial apps for Millennials who want to learn solid budgeting skills.

As a best personal finance app, YNAB uses a core set of rules to establish a foundation for simple, effective budgeting. These include:

- Give Every Dollar A Job—Prioritize your income

- Embrace Your True Expenses—Plan ahead to make large bills more manageable

- Roll With The Punches—Avoid stress by being flexible

- Age Your Money—Only spend money that is at least 30 days old

As one of the best financial apps, YNAB also provides a wide range of supplemental material to support Millennial finance management.

Their website provides free online workshops to teach best budgeting practices, along with a wide range of user support from webinars, newsletters, podcasts, videos, and detailed guides.

Investments for Millennials – You Need a Budget Review

Additional Considerations

- Available on app and desktop

- Focus on tracking and achieving financial goals

- Enhanced reporting through graphs and pie charts

- First year is free for students

Conclusion: Finding the Best Financial Apps for Millennials

Millennials and technology have a unique relationship, prompting many financial institutions to focus on creating the best financial apps for Millennials.

With a population of over 75 million, exploring the relationship between Millennials and money is not only lucrative, but necessary to ensure survival amidst tough competition for the best financial apps.

What makes a personal finance app for Millennials different than another money management app?

The answer may differ depending on your unique financial needs—but the best financial apps for Millennials typically come packed with intuitive features, affordable pricing, accessibility across all devices, and effective financial tools.

Some of the top Millennial finance apps even use creative methods of organization and interaction to make using a money management app into a fun, engaging experience.

As Millennial finance management continues to evolve, the best financial apps for Millennials will continue to change as well, creatively strengthening the relationship between Millennials and money.

Image sources:

- https://www.acorns.com/

- https://cdn.digit.co/images/press/yolo2.d19e51b4.jpg

- https://pixabay.com/en/brick-brick-wall-business-2449728/

- https://www.stashinvest.com/

- https://www.youneedabudget.com/features/#goaltracking

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.