2017 RANKING & REVIEWS

TOP RANKING BEST INCOME CALCULATORS

2017 Guide: Finding the Best Income Calculator for You

Consumers consistently have a need to understand their income, both in its net and gross form. Calculating net income on their own can be challenging and confusing, which is why several companies have developed income calculators.

With a program uniquely designed to capture your statistics quickly and effectively, it can calculate income after taxes with no math involved on your part. Though you will need all of the information available to enter into an annual income calculator.

Award Emblem: Top 6 Best Income Calculators

An after-tax income calculator or a gross income calculator can serve a variety of purposes, including:

- Allowing you to craft a realistic budget and monitor your monthly spending

- Knowing what your disposable income is when it comes time to apply for loans or mortgages

- Creating a realistic estimate of how much you pay or owe in taxes each year

- Comparing potential salaries between two different places of employment

- Incorporating potential raises

Without having to do the math on your own, you can use a monthly income calculator to get to the bottom of things. In our detailed ranking of the best income calculator programs, you can find the resources you need to calculate after-tax income.

See Also: Top HSBC Credit Cards & Business Cards | Ranking & Reviews

AdvisoryHQ’s List of the Top 6 Best Income Calculators

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that income calculator):

- ADP Salary Paycheck Calculator

- Bankrate Net-to-Gross Paycheck Calculator

- Free and Clear Monthly Gross Income Calculator

- GM Financial Monthly Income Calculator

- Paycheck City Net Pay Calculator

- The Required Salary Calculator

Top 6 Best Income Calculators | Brief Comparison & Ranking

Income Calculators | Best for | Function |

ADP Salary | Having a secure job already | -Creates a sample paycheck for an upcoming pay period -Net income calculator with federal/state withholdings and deductions |

Bankrate Net-to-Gross | Determining required gross income | -Determines gross income based on a desired net income |

Free and Clear Monthly Gross Income Calculator | Quick income calculation | -Calculates monthly gross income -Takes only a few minutes |

GM Financial Monthly | Determining monthly income based on salary | -Variety of inputs from W-2 or paystubs -Determines monthly salary based on current income and year-to-date earnings |

Paycheck City Net | Steady pay | -Uses data from your past paycheck to calculate net income |

The Required | Comparing salaries | -Enter desired take-home pay to find an annual, monthly, biweekly, or weekly gross salary amount |

Table: Top 6 Best Income Calculators | Above list is sorted alphabetically

Calculating Net Income

Most consumers struggle to comprehend the math behind an income calculator and wonder if they can trust it to produce a reliable answer. If you know how to calculate your own annual income after deductions and taxes, you’ll know whether a net income calculator works efficiently with the numbers you provide.

In order to determine your net income (without using an annual income calculator), you do first have to determine your gross annual income. This is easily determined when you receive a salary or keep a steady number of hours throughout the year. All you need to do is find the gross pay from the last pay period on your paycheck.

This number is then multiplied by the number of pay periods you have each year. Alternatively, you can also use a gross pay calculator to determine this number.

From there, you can tally up any deductions you may take from your pay, including retirement contributions and medical or dental expenses. These will be subtracted from the gross salary you came up with using a gross pay calculator or through your previous paystubs.

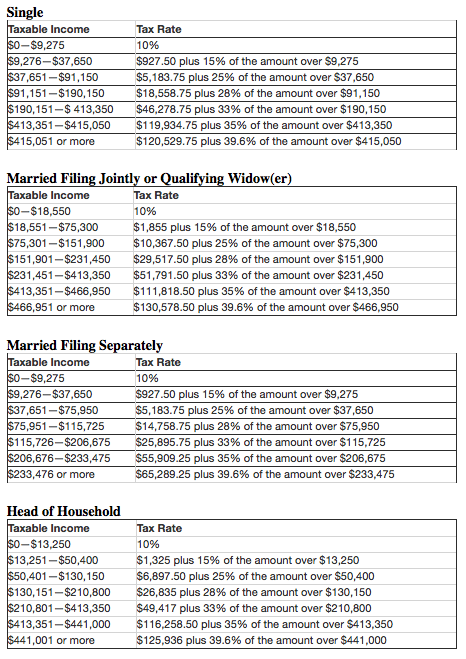

You can use the gross income that you calculated in the very beginning to determine what your overall taxes will be throughout the year. The IRS makes it easy to calculate after-tax income by listing the different income brackets and percentages owed to the federal government. You can see the chart below from the Internal Revenue System to determine what percentage of taxes you will owe.

Image Source: IRS

After subtracting this amount along with your deductions from your gross pay, you’ve come to the final step that brings you to your net income.

While this is the long way to calculate net income, you can also use a net income calculator or an annual income calculator to determine the same thing. The convenience of an income calculator makes it easy to try various scenarios without having to redo the math. A net income calculator is an efficient way to calculate after-tax income with ease.

Don’t Miss: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Income Calculators

Below, please find the detailed review of each calculator on our list of net income calculators. We have highlighted some of the factors that allowed these gross income calculators to score so highly in our selection ranking.

ADP Salary Paycheck Calculator Review

While it does come with a disclaimer that this net income calculator isn’t an exact science, the ADP Salary Paycheck Calculator makes calculating net income simple. With just a handful of questions that can be easily answered with your last paycheck, you can be on your way to using ADP’s net income calculator.

In order to fill out their brief questionnaire, you will have to have a copy of your most recent paystub. You’ll need your gross pay amount as well as the method and frequency. Combine this with your year-to-date pay to figure out what your next paycheck should look like.

Include any exemptions, federal withholdings, or state withholdings to calculate net income more accurately. Many individuals struggle to identify this information without a recent paystub handy.

You can also factor in deductions that are taken out of your pay with the ADP income estimator. They have premade sections for a 401(k) contribution or an HSA contribution, but their income calculator also allows you to make customized sections for other situations that arise.

Best for Having a Secure Job Already

The ADP income calculator works best for individuals who already have a secure job but want to keep tabs on what their next paycheck will be. Their monthly income calculator doesn’t work well without knowing what your current pay status is in great detail. The after-tax income calculator allows you to see what your projected paycheck should look like.

Alternatively, you can use this net income calculator to help you determine what your pay could look like with a new employer. You will have to be equipped with a lot of additional information in order to make it as accurate as possible though.

Bankrate Net-to-Gross Paycheck Calculator Review

One of our favorite features about the Bankrate Net-to-Gross Paycheck Calculator is the detailed glossary at the bottom of the page. For many, using a gross pay calculator or a net income calculator can mean learning an entirely new vocabulary. With their glossary at your fingertips, you know exactly what each question means on their gross pay calculator.

You need to know very little information to answer the questions on this Bankrate net income calculator. In fact, you only need to know your year-to-date income, filing status, allowances, and deductions.

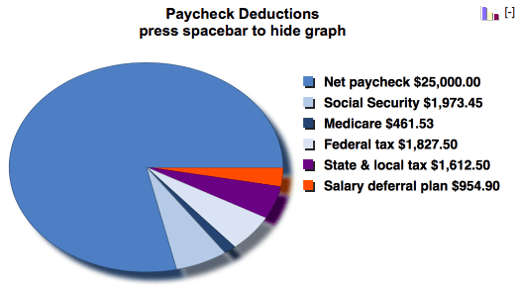

The information is promptly displayed in a neat graph that calculates the total amounts for each deduction and withholding. It allows you to view where the money comes from and which portion of your salary goes to which category.

Image Source: Bankrate

However, the most unique feature of the Bankrate Net-to-Gross Paycheck Calculator review is the ability to enter a “required net pay.” Their monthly income calculator enables consumers to enter their expected or desired pay and work backward from there to determine what gross pay they would need.

Best for Determining Required Gross Income

The Bankrate Net-to-Gross Income Calculator allows consumers to figure out their gross pay necessary in order to cover their expenses. This works best for those applying for a new salary position, estimating how much of a raise you would require to get to a necessary pay level.

This is great for advance planning and thorough budgeting for consumers who need help determining what their pay requirements are. It also assists you in developing reasonable expectations for your next job search. You can even use their annual income calculator to figure out a yearly income.

Related: How to Find the Best Mortgage Refinance Calculator with Taxes And Insurance

Free and Clear Monthly Gross Income Calculator Review

This monthly income calculator from Free and Clear allows you to quickly do the math on your overall gross income each month. Their unique design is geared toward consumers who know they will need to generate their monthly gross income calculator. It can also easily be used as a quick annual income calculator.

This income calculator doesn’t require more than a couple minutes or highly detailed information regarding your pay. The income estimator requires only your gross pay per pay period and the frequency with which you are paid.

The major disadvantage to this type of gross pay calculator is also in the simplicity of it. It doesn’t work to calculate income after taxes and it doesn’t take any deductions or withholdings into account.

Best for Quick Income Calculation

The income calculator from Free and Clear allows you to use brief tidbits of information to fill out their gross pay calculator. The biggest draw is the speed with which you can complete the questionnaire to come up with your overall gross pay.

This works best for consumers who need to know their monthly gross income (which can easily be multiplied by 12 for an annual income calculator). Free and Clear’s gross pay calculator is perfect for determining overall pay levels in order to apply for mortgages, auto loans, or other lending opportunities.

GM Financial Monthly Income Calculator Review

The GM Financial Monthly Income Calculator makes coming up with your monthly income simple, using a variety of options. Their monthly income calculator will not calculate net income, but it does come up with a gross number for your monthly income level.

You have several options for coming up with your monthly gross pay (which can be easily multiplied to transform it into an annual income calculator). The easiest method would be to use your W-2 information to move forward, and all you will need to enter is your year-to-date income.

Alternatively, you can also enter your monthly pay frequency, which requires just a few additional pieces of information. You will need your check date, pay period ending date, and your verified date of hire to use this method.

If you know your base pay (what you receive each pay period) and the frequency, a separate tab can perform this math for you. The number of methods available for determining your monthly income level make this an ideal option for an income calculator that can be used quickly and efficiently.

Best for Determining Monthly Pay Based on Salary

If you already know how much you’ve made up to this point in the year, the GM Financial Income Calculator works best to determine what your monthly income will be based on your current pay status and amount received to date. For consumers who keep their most recent paystub handy, the GM Financial income calculator is a top monthly income estimator.

It doesn’t function as a net income calculator but only to identify gross pay. It is a prime choice for those who need to come up with their anticipated pay for the coming month or to get a roundabout figure for pending loan applications.

Popular Article: How to Find the Best VA Mortgage Calculator with Taxes and Insurance | Guide

Paycheck City Net Pay Calculator Review

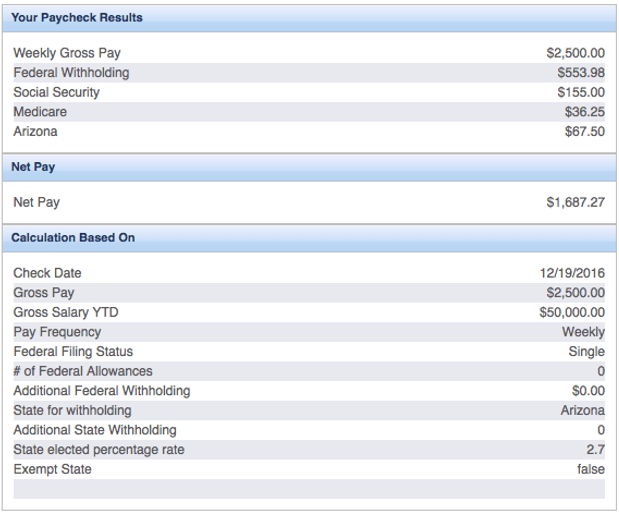

Consumers who are interested in an after-tax income calculator will want to check out the Paycheck City Net Pay Calculator. This net income calculator allows you to use historical data from your last paystub to project what your paycheck will look like for the upcoming pay period.

This program gives consumers the opportunity to enter their gross salary (enter it either annually or per pay period) along with your year-to-date earnings. Combine it with the use of federal withholdings and state withholdings for a comprehensive glance at what is taken out of your pay and how to calculate income after taxes.

You can even create your own deductions, choose from and labeling categories such as:

- Name

- Amount

- Type (percentage of gross or net pay, fixed rate, or hourly amount)

- Exemptions

The detailed report it generates gives you a handy resource to print and file for future reference. For those who keep a steady salary throughout the year, it allows you a quick reference point for what your taxes and withholdings are. It is clear to see exactly how they were able to calculate income after taxes.

Image Source: Paycheck City

Best for Steady Pay

The Paycheck City net income calculator is really the best choice for consumers who maintain a steady salary throughout the year. While you can choose to perform your calculations each pay period to predict what your paycheck will look like, their comprehensive report gives you an overview that works for budgeting when your salary is consistent.

Free Wealth & Finance Software - Get Yours Now ►

The Required Salary Calculator Review

The Required Salary Calculator works differently than some of the other choices for the best income calculator. This annual income calculator allows you to figure out how much you need to make (based on your own detailed budget) and work backward to figure out what your gross pay would need to be.

If you’ve been wondering what kind of salary can support your current lifestyle and expenses, the Required Salary Calculator can help. At the top, you’ll enter how much you need in take-home pay overall. Enter how many overtime hours you intend to work (at pay rates of 1.5 and 2 times your normal rate, or you can customize the rates) before moving on to your federal withholdings.

You’ll need to enter a handful of other information to accurately complete this income calculator. These questions include:

- Filing status

- Number of dependents

- Other monthly deductions

- Tax year

- Selecting various pay periods

From here, it breaks down your necessary earned income into yearly, monthly, biweekly, and weekly segments. You can compare your current paychecks to these numbers to see where you need to go from here to reach your lifestyle goals.

Best for Comparing Salaries

The Required Salary Income Calculator is an ideal starting point for consumers who want to compare salaries with an income estimator. This gross pay calculator will work backward after it finds what net income you ultimately are seeking. By knowing what you need to reach your lifestyle goals, you can more accurately assess whether potential job offers can provide you with enough funds to meet your financial goals.

This annual income calculator can be used as a benchmark for calculating where you need to be to reach steady financial footing. Whether you need to start job hunting, start working toward a raise, or decide between two places of employment, using this annual income calculator can help.

Read More: Which Is the Best Mortgage Calculator? Google vs. Trulia vs. Bank of America

Conclusion—Top 6 Best Income Calculators

Knowing how much money you make is critical to gaining financial peace and security. You won’t be able to put your mind (or your bank account) at ease unless you can calculate net income or gross income.

Image Source: Free Images

Whether you’re applying for a mortgage, an auto loan, or a new credit card, the question of how much money you make comes up on a regular basis. If you don’t know your annual salary offhand, an annual income calculator can come to the rescue. All you need to fill it out is a recent paystub or some information about your pay rates or budgeting needs.

You can use an after-tax income calculator to accomplish a variety of things from generating your monthly income to calculating what gross pay you need to meet your lifestyle and spending preferences. There is no end to the ways you can choose to use a net income calculator to calculate net income.

Which one will work best for you? This selection of the top six choices should give you a great starting point for a program that suit your preferences. By getting started today, you’re making a positive step in the right direction for your financial future.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.