2017 RANKING & REVIEWS

TOP RANKING BEST MORTGAGE CALCULATORS

What Will Your Home Cost You?

Buying a house is one of the most significant investments you’re likely to ever make. It represents a long-term financial commitment that can end up with serious consequences if you can’t afford it. Before buying, all consumers should know how to estimate their monthly mortgage payment.

Most consumers lack the math skills and know-how to calculate their monthly mortgage payment on their own. This is where a mortgage calculator can come into play.

Award Emblem: Top 6 Best Mortgage Calculators

A mortgage calculator can account for important costs that accompany owning a home, including your taxes, insurance, and private mortgage insurance. You can find an amortization calculator for mortgage to determine your payoff rate, an FHA mortgage calculator for a Federal Housing Administration loan, and so many more.

How will you know which of the mortgage rate calculator choices is the best one?

In our detailed review and ranking, we’ve included some of the top mortgage calculator choices that are popular among consumers. Each option is free to use, is simple to fill out, and can save you a future of financial hardship.

Before you make your big home purchase, take the time to test out a few of these monthly mortgage payment calculator choices. They may reveal critical information that you need before you sign on the dotted line.

See Also: Top Credit Cards with No Annual Fee | Ranking & Reviews | Best No Annual Fee Credit Cards

AdvisoryHQ’s List of Top 6 Best Mortgage Calculator | Brief Comparison & Ranking

List is sorted alphabetically (click any of the calculator names below to go directly to the detailed review section for that mortgage calculator):

- Bankrate Mortgage Calculator with Taxes and Insurance

- CNN Money Mortgage Payment Calculator

- FHA Loan Calculator from LendingTree

- Mortgage Calculator with Monthly Payments from Bank of America

- The Mortgage Reports Mortgage Calculator

- Zillow Mortgage Calculator

Top 6 Best Mortgage Calculators | Brief Comparison & Ranking

Best Mortgage Calculators | Expenses Included | Highlights |

| Bankrate Mortgage Calculator with Taxes and Insurance | -Taxes -Insurance -Prepayments | -Allows for prepayment costs -Glossary of terms |

| CNN Money Mortgage Payment Calculator | -Taxes -Insurance -HOA -PMI | -Automatically calculates PMI -Mortgage rate calculator -Assumptions standard for insurance and taxes |

| FHA Loan Calculator from LendingTree | -Taxes -Insurance -HOA -MIP | -Calculates for FHA mortgages |

| Mortgage Calculator with Monthly Payments from Bank of America | -PMI | -Includes estimated closing costs -Compares fixed-rate and adjustable-rate mortgages |

| The Mortgage Reports Mortgage Calculator | -Taxes -Insurance -HOA -PMI | -Affordability mortgage calculator choices included -Full amortization schedule and graph |

| Zillow Mortgage Calculator | -Taxes -Insurance -HOA -PMI | -Can take off cost of taxes, insurance, and PMI -Full detailed report included |

Table: Top 6 Best Mortgage Calculator Options | Above list is sorted alphabetically

Costs of Homeownership

When considering the true cost of homeownership, you must consider the costs beyond your monthly mortgage payment. If you purchase a home at the high end of affordability for your family, you may not be able to cover the additional costs of maintenance and the other bills that can truly add up.

Image Source: Pixabay

Experts recommend considering the full range of costs, represented by the term PITI. You will be paying for your:

- Principal

- Interest

- Taxes

- Insurance

All four of those costs can add hundreds of dollars to the monthly bill expected by your mortgage lender. When you’re investigating the use of a potential mortgage calculator, it should be focused on providing a cost estimate for all four items.

A financial mortgage calculator without PITI doesn’t give consumers an accurate prediction of their total mortgage costs.

Furthermore, a mortgage rate calculator can assist you with getting a clearer overall picture of what’s to come with interest payments. This type of calculator allows you to see sample interest rates based on the information you provide. Your interest rate can drastically affect your monthly mortgage payment in positive or negative ways.

Deciding on a mortgage calculator can also mean taking a look at the requirements set out by your lender. If you will be required to pay for additional private mortgage insurance (PMI), this cost should be factored into a mortgage rate calculator as well. This can be required based on the amount of your down payment.

Consumers who put down less than 20% of the value of the home as a down payment are typically subject to PMI. This could last through the duration of the loan or may be dissolved when your principal payments reach the full 20% required. An amortization calculator for mortgage will be helpful in determining when you meet this requirement.

Clearly, a top mortgage calculator should consider more than simply your monthly principal and interest payment. Entering into your mortgage educated about the expenses is critical to your financial well-being. Our mortgage rate calculator choices can help you get there.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Mortgage Calculators

Below, please find the detailed review of each calculator on our list of monthly mortgage payment calculator choices. We have highlighted some of the factors that allowed these financial mortgage calculator options to score so highly in our selection ranking.

Don’t Miss: The Best Home Equity Calculators & Equity Line of Credit Calculator Websites

Bankrate Mortgage Calculator with Taxes and Insurance Review

The Bankrate Mortgage Calculator with Taxes and Insurance provides every aspect that homeowners will need when using a mortgage rate calculator. It allows you to account for the cost of your home, differing loan terms, various interest rates, and more.

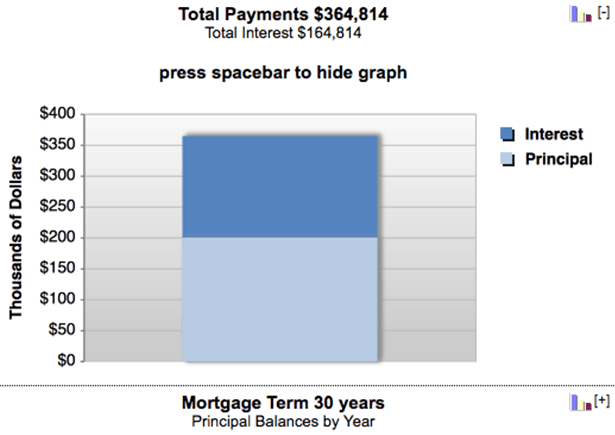

With this information put into their mortgage rate calculator, you can see your total payments displayed in an easy-to-read bar graph. It separates your principal payment from the taxes and insurance. This mortgage calculator even tallies up the total amount that you will spend over the lifetime of your loan.

Image Source: Bankrate

For more information on when and how your loan will be paid off, their mortgage calculator can put together an amortization schedule. Displayed either annually or monthly, it gives consumers a quick glance at how their payments are allocated throughout the loan term.

Ease of Use

The Bankrate mortgage calculator does prove helpful for consumers who already have a reasonable expectation for the costs of homeownership. It can add in the cost of your annual property taxes and home insurance, but you must know what number to input.

This can create more work on your end, but it does give you a starting point for researching those costs for any home you potentially purchase.

However, it does allow you to use their mortgage prepayment calculator as well. Any prepayments that you make are factored into a separate section and accounted for. Their mortgage prepayment calculator can allow payments to be categorized as monthly, yearly, or simply one-time payments.

Consumers who do not plan to put down a full 20% will also miss including private mortgage insurance on their mortgage calculator.

Those new to the mortgage process will also love the easy definitions provided at the bottom of the page. Uncertainty over what each line item means disappears with their thorough glossary.

CNN Money Mortgage Payment Calculator Review

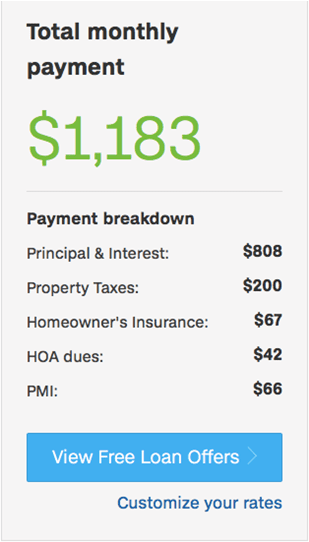

The CNN Money Mortgage Payment Calculator is nothing if not thorough. This mortgage insurance calculator provides a cost for every aspect of homeownership, even above and beyond PITI.

For consumers who want the most thorough monthly mortgage payment calculator, the CNN Money Mortgage Calculator is one of the best choices. This mortgage borrowing calculator will allow you to include different loan terms, home prices, mortgage rates, and down payments.

From there, it makes assumptions about the cost of your annual property taxes, your homeowners’ association dues, and your insurance premiums. It can calculate mortgage payment on a monthly basis based on percentages and average costs of various items. If you know the actual cost of these expenses, their mortgage insurance calculator will simply be that much more accurate.

Ease of Use

While you will initially need to input your own numbers to calculate mortgage payment interest rates, you can also make use of the CNN Money mortgage calculator as a mortgage rate calculator. To the right, slightly below your expected monthly payment, it allows you to check today’s rates.

The easy customization of this mortgage comparison calculator allows you to stack up various loan offers and then retest them in the mortgage calculator. You can even view loan offers from a link directly located within their mortgage rate calculator.

For consumers who know that they will not be able to put down the full 20% that most lenders prefer, the CNN Money mortgage calculator automatically factors in PMI based on the cost of the home. Those lucky enough to avoid PMI in situations such as these will have a more difficult time with this mortgage calculator. You will need to subtract the line item for the standard PMI feature used when the down payment is less than required.

Image Source: CNN

Using the monthly mortgage payment calculator is relatively easy, though, even if you need to adjust. The costs are clearly written out with breakdowns on each line. This can allow you to understand the total mortgage payment quickly and easily.

Related: How to Find the Best Mortgage Refinance Calculator with Taxes And Insurance

FHA Loan Calculator from LendingTree Review

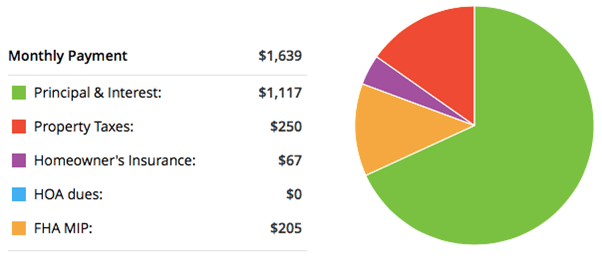

Utilizing the FHA Loan Calculator available through LendingTree can give you a unique interpretation of your monthly payments based on this loan type. Slightly different in cost and expected payments, an FHA mortgage calculator is necessary for those who are considering this type of loan.

Based on your zip code, home price, and the minimum down payment expected from an FHA loan, LendingTree can begin to compute your monthly mortgage payment. One of the best features on this mortgage rate calculator is the ability to input your credit score, which has a direct effect on the rates you receive.

While this could pose a problem for individuals who do not know a vague range for their current credit score, it is a helpful tool for others.

This mortgage insurance calculator also takes into account your MIP, or mortgage insurance premium. This is similar to the private mortgage insurance required by lenders under a conventional loan. However, MIP is typically paid upfront on a yearly basis.

LendingTree automatically include this at the current standard rate of 1.75% of the value of the home.

Ease of Use

The FHA mortgage calculator from LendingTree does offer one of the most colorful graphs around for displaying the information you most need to view. It can break down your principal, interest, taxes, and insurance alongside HOA dues and the MIP rates.

Image Source: LendingTree

We like that LendingTree also includes a quick glance at potential rates for both a 30-year and a 15-year FHA loan at the bottom of their page. Sample mortgage lenders are displayed to give you an idea of what today’s rates could be.

You’re welcome to get a free rate quote by clicking through the links as well.

The categories beyond the basic cost of the home itself are based on the assumptions provided by LendingTree’s FHA mortgage calculator. Individuals can modify these assumptions if they have a more accurate number they want to provide to the mortgage calculator.

Mortgage Calculator with Monthly Payments from Bank of America Review

The mortgage calculator with monthly payments from Bank of America may not give you access to the full PITI that experts recommend, but it is useful to take a look at before you buy.

Answer just three simple questions (purchase price, down payment amount, and zip code) for access to a wide range of mortgage options displayed side by side. This mortgage comparison calculator allows you to view expected interest rates on six different mortgage types:

- 30-year conventional

- 20-year conventional

- 15-year conventional

- 5/1 ARM

- 7/1 ARM

- 10/1 ARM

While many of the top mortgage rate calculator choices include only conventional loans, Bank of America makes it easy to see what your payments could be for all six. If you’ve been considering going with a variable or adjustable rate mortgage instead of a conventional loan, this mortgage comparison calculator is a good first step toward investigating that possibility.

Ease of Use

The mortgage comparison calculator from Bank of America is relatively easy to use with just those three questions in play. From there, it can give you a rough estimation of the mortgage payment, mortgage insurance cost, interest rate, APR, and points for the various loan types.

It also gives you a realistic estimate of the closing costs associated with each of the loan types. The financial mortgage calculator from Bank of America is designed to give consumers a realistic expectation for the upfront costs of homeownership as well as the monthly costs.

Use this mortgage borrowing calculator if you are on the fence for which type of loan would work best for your budget and lifestyle. It may not give you the ability to tweak their assumptions for insurance and taxes, but it does give you a better idea of the various costs you could incur. You can use assumptions for property taxes and homeowner’s insurance from other mortgage calculator choices when using Bank of America’s option.

Popular Article: Which Is the Best Mortgage Calculator? Chase? Wells Fargo? CNN?

The Mortgage Reports Mortgage Calculator Review

When it comes to a repayment mortgage calculator, The Mortgage Reports Mortgage Calculator allows you to come up with a cost based on the value of the home, your income, and your desired monthly payment.

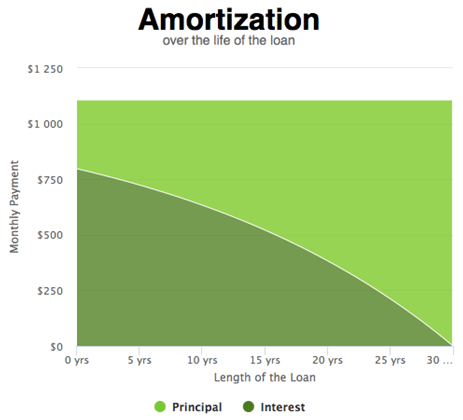

To evaluate the cost of a home with their repayment mortgage calculator, it automatically provides you with assumptions for your insurance, taxes, and private mortgage insurance. Slightly below this is an amortization calculator for mortgage, highlighting an amortization table to demonstrate the allocation of your payment each year.

Image Source: The Mortgage Reports

This graph gives you a clear idea of how much of your monthly payment goes toward your principal and interest as the loan progresses. However, those who want more detailed information can view the full report for a monthly breakdown.

You can also use this as a mortgage rate calculator to easily obtain current rates based on your personal information.

Ease of Use

If you’re still in the preliminary stages of investigating homeownership, the other mortgage calculator choices from The Mortgage Reports may be a better option for you. Easily calculate how much home you can afford based on your annual income and debt-to-income ratio.

Alternatively, you can also input the monthly payment that you know fits into your budget along with your expected down payment. This information combines to tell you the maximum house value you can afford within these parameters.

The various choices available through The Mortgage Reports mortgage calculator are what easily qualify it as one of the top repayment mortgage calculator choices. It features flexibility and extended educational resources to help consumers make wise purchase decisions when it comes to their next home.

Read More: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

Zillow Mortgage Calculator Review

If you’re already hunting for homes on Zillow, you’re only a few clicks away from their top-rated mortgage calculator. You get several options on the Zillow mortgage calculator, allowing you to see the full PITI cost as well as subtracting some of those features for a more basic glimpse at your mortgage payments.

Their mortgage rate calculator provides an estimate of a current mortgage rate, but it also allows you to click through to view current rates. You can take advantage of this feature to get the most accurate repayment mortgage calculator.

From there, you can opt to allow this mortgage calculator to show the assumed cost for your property taxes, home insurance, and private mortgage insurance. It is automatically set up to calculate mortgage payment based on these assumptions.

However, consumers who are mostly focused on their principal and interest can leave these options by the wayside if necessary.

Ease of Use

The Zillow mortgage calculator is relatively simple to use. It provides a neat graph that makes it easy to see what percentage of your payments are allocated to what expense. Unfortunately, it does not give you a section for prepayments, excluding it from the list of top mortgage prepayment calculator choices.

The full report feature is handy for those who want to print or view all of the numbers in one handy document. You’ll see your monthly mortgage payment calculator at the top, followed by:

- An amortization graph

- A principal vs. interest graph

- A full amortization schedule

If there are any details you want to know concerning your mortgage calculator, you’re likely to find them on this detailed report. It is clean and easy to read, allowing you to get the most information in a quick glance.

Conclusion—Top 6 Best Mortgage Calculators

Purchasing a home entails making one of the largest financial commitments you’re likely to ever make. According to recent statistics, those who financed their home typically borrowed 90% of the home value. This can add up to some significant monthly payments with additional costs, including private mortgage insurance.

You should know how to use a mortgage calculator or a mortgage rate calculator to get all of the information you need prior to making a purchase.

Knowing what you can afford and where those payments will fit into your monthly budget is critical. Unless you have the knowledge and time to calculate potential payments by hand, using one of the top-rated mortgage calculator choices we’ve compiled here can make it quick and easy to get the information you need.

Evaluate what information you most need to access with a mortgage calculator. While some are best used as a repayment mortgage calculator, others serve as a basic mortgage borrowing calculator. Knowing the difference and understanding your own needs can assist you in selecting the right one.

Of course, if you have a few minutes to spare, you may want to take a closer look at several to view all the assumptions and options available to you.

We’re confident that these mortgage calculator choices can help you to make a wise decision when it comes to the purchase of your new home. How much will it cost you? It’s time to find out with these mortgage rate calculator choices.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.