2017 RANKING & REVIEWS

THE TOP MUTUAL FUNDS AND THE BEST MUTUAL FUNDS TO INVEST IN

Finding the Best Mutual Funds in 2017

Before ranking and reviewing the top 10 mutual funds to be included on this list of the best mutual funds to invest in, knowing the different types of mutual funds can be valuable.

Award Emblem: Best Mutual Funds to Invest In

This ranking covers most types of mutual funds, and the following is a brief breakdown of some of the most common categories.

- Money-market funds: A money market fund is one of the most popular types of mutual funds to invest in, and they are no-load with daily dividends paid. Money market funds are relatively low risk, but the returns also tend to be lower compared to other types of top mutual funds.

- Index funds: An index fund is a type of top mutual fund that includes stocks or assets from a certain index, such as the Nasdaq or the S&P 500. Index funds tend to be considered a strong investment because not many funds outperform indexes.

- Bond funds: This is another one of the most common mutual funds to invest in; there is no maturity date, and they tend to have a relatively small minimum investment amount.

- Stock funds: Within the category of stock funds, there are several subcategories of mutual funds to invest in. Some of these include income funds, which pay dividends, blue-chip funds that are considered safe investments to provide income, and growth funds, which are based on small-cap and undervalued companies.

- Stock funds: With a stock fund, investors are putting their money in a mutual fund based on a certain industry, such as technology.

- Target-date funds: With a target date fund, which is one of the top mutual funds for retirement, investors choose a mutual fund that will become more conservative in the asset allocation as the target date approaches.

These are some of the best mutual funds to invest in, but this listing isn’t exhaustive.

The following ranking of the top 10 mutual funds includes a mix of different kinds, so there’s something included for most types of investors and their objectives.

See Also: Top Credit Cards for Poor Credit | Ranking & Reviews | Credit Cards for People with Poor Credit

AdvisoryHQ’s List of the Top 10 Best Mutual Funds to Invest in

List is sorted alphabetically (click any of the names below to go directly to the detailed review section for the best mutual fund):

- AllianzGI Structured Return Fund A AZIAX

- Baird Short-Term Bond Fund BSBIX

- DFA Emerging Markets Portfolio DFEMX

- Fidelity® NASDAQ Composite Index® Fund FNCMX

- Fidelity® Select IT Services Portfolio FBSOX

- Hussman Strategic Total Return Fund HSTRX

- JPMorgan SmartRetirement® Income Fund Class A JSRAX

- T.Rowe Price Dividend Growth Fund PRDGX

- Vanguard 500 Index Fund VFINX

- Vanguard Health Care Fund Investor Shares VGHCX

Image Source: Pixabay

Top 10 Best Mutual Funds To Invest In | Brief Comparison

Top Mutual Funds | Fund Type | Returns Over the Past Year | Expense Ratio |

| AllianzGI Structured Return Fund A AZIAX | Option Writing | 4.31% | 1.15% |

| Baird Short-Term Bond Fund BSBIX | Short-Term Bond | ||

| DFA Emerging Markets Portfolio DFEMX | Diversified Emerging Markets | ||

| Fidelity® NASDAQ Composite Index® Fund FNCMX | Index Fund | ||

| Fidelity® Select IT Services Portfolio FBSOX | Technology | ||

| Hussman Strategic Total Return Fund HSTRX | Tactical Allocation | ||

| JPMorgan SmartRetirement® Income Fund Class A JSRAX | Target-Date Retirement | ||

| T. Rowe Price Dividend Growth Fund PRDGX | Large Blend | ||

| Vanguard 500 Index Fund VFINX | Index Fund | ||

| Vanguard Health Care Fund Investor Shares VGHCX | Health |

Many consumers wonder whether or not it’s the right choice for them to find mutual funds to invest in. They wonder, “What are the advantages of mutual funds?”

What are the features of the top-rated mutual funds that make them so appealing to investors?

The following are some key advantages of mutual funds that make them a good option for a wide variety of investors:

- One of the primary advantages of mutual funds and a main reason so many people choose mutual funds to invest in is because of the level of diversification they provide. When you invest in one of the top mutual funds, you get the advantage of having a diversified portfolio selected for you, and to do that without investing in a top mutual fund would be expensive and time-consuming.

- Another one of the key advantages of mutual funds is that they tend to be less expensive than investing in individual stocks or bonds. You’re reducing transaction costs and commission fees by diversifying your portfolio through investing in a mutual fund, rather than individual options.

- Finally, another one of the top advantages of mutual funds is the ability to get the expertise and service of a professional manager at a much lower cost than other options. Top mutual funds are managed by professionals who often have years of experience with that particular fund, and they carefully research all stocks before buying or selling.

As with any investment product, there are potential risks that tend to come with even top mutual funds, but the advantages of mutual funds tend to outweigh the possible downsides in the eyes of many investors.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated credit cards, financial accounts, firms, products, and services.

Below, please find the detailed review of each best mutual fund on our list of the top 10 mutual funds. We have highlighted some of the factors that allowed these best mutual funds to score so well in our selection ranking.

Don’t Miss: Top Credit Cards in Australia | Ranking | Best Aussie & Australian Credit Cards

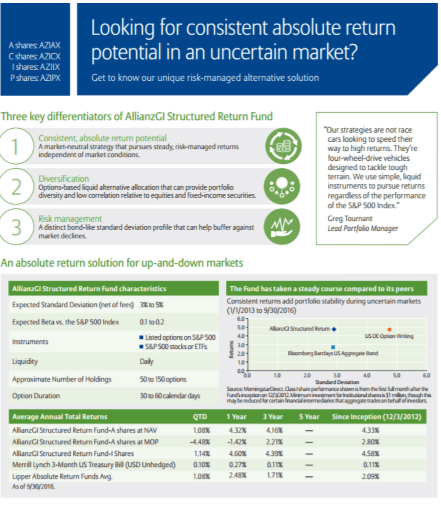

The AllianzGI Structured Return Fund A is offered by Allianz Global Investors, and the objective is long-term capital appreciation. In a general sense, this pick for one of the top 10 mutual funds combines elements of passive long-term exposure to U.S. equities.

Key features of this best mutual fund include a share class inception date of 12/3/2012, a net expense ratio of 1.14%, a gross expense ratio of 1.58%, and a maximum sales charge of 5.50%. It features an annual dividend frequency. Managers of this fund are Greg Tournant, who serves as lead portfolio manager, Stephen G. Bond-Nelson, and Trevor Taylor.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Funds

Features and benefits of the AllianzGI Structured Return Fund that led to its ranking as one of the top 10 mutual funds and a best mutual fund to invest in are detailed below.

Image Source: AllianzGI

Portfolio

The current asset allocation of AZIAX is focused heavily on U.S. stocks, with these representing 89.80% of the net portfolio.

Other elements making up the portfolio of this pick for one of the top ten mutual funds include cash, non-US stocks, and a generic “other.” It contains no bonds.

In a general sense, the goal of this pick for one of the top 10 mutual funds is to offer consistency and risk-controlled returns through market-neutral options. There is a low level of sensitivity toward fixed-income and equity markets.

The index call options are from the S&P 500 Index.

Performance, Cost, Ratings, and Risk

According to U.S. News and World Report, this best mutual fund has returned 4.31% over the past year, and 4.16% over the previous three years.

In terms of cost, the net expense ratio is below the category average, as are the management fees. The initial maximum sales fees are 5.5%, and there are no deferred fees.

Management fees are 0.6%. The initial minimum investment for this best mutual fund to invest in is $1,000.

According to Morningstar, the level of risk with this pick for one of the top mutual funds is relatively low, compared to other funds that are part of the same category.

Analysis

This pick for one of the 10 best mutual funds available from Allianz was included in this ranking because it is relatively low-cost and low-risk, with a low minimum investment requirement.

It’s also advantageous because it offers access to a wide variety of markets, which can shield investors against potential declines in the equity markets.

There are also options with this portfolio to protect yourself and take advantage of volatility, and since it’s not highly correlated to stocks and bonds, this best mutual fund to invest in also makes a good general addition to a portfolio regarding risk-return.

The fund managers define it as having three primary advantages, which are consistent return potential, diversification, and a risk management profile that protects against market declines.

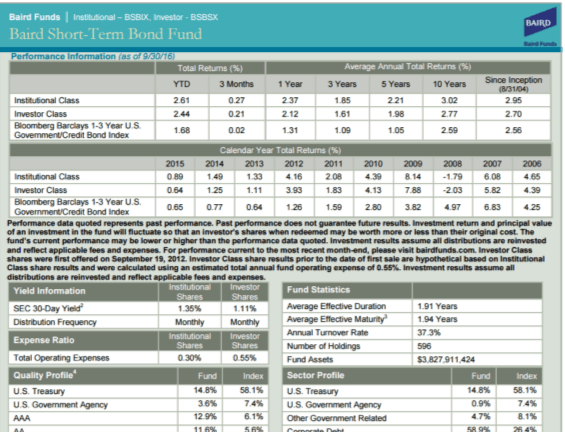

The Baird Short-Term Bond Fund (BSBIX) was included in this ranking of the top mutual funds and the best mutual funds to invest in because it represents a portfolio made up of short-term investments, which differentiates it from many of the other names on this ranking of the top ten mutual funds.

The Baird Short-Term Bond Fund is classified as duration-neutral, and despite the fact that it’s called short-term, what this means is that the investments making up the portfolio are short-term, while the overall perspective of the mutual fund is long-term.

The goal of a short-term mutual fund is to provide a level of low-risk investment with a return that is better than certain benchmarks.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Funds

The Baird Short-Term Bond Fund was included on this list of the best-rated mutual funds and the 10 best mutual funds for the following reasons.

Portfolio

As mentioned in the introduction of this particular best mutual fund, the goal of a short-term mutual fund is to beat the performance of a certain benchmark. In the case of the Baird Short-Term Bond Fund, the objective is to get an annual rate of total return that’s greater than the annual rate of return of the Barclays 1-3 Year U.S. Government/Credit Bond Index.

The fund’s typical investment allocation is made up of about 80% of three particular types of U.S. dollar-denominated debt securities.

These three debt securities are U.S. government and public sector entities, both asset and mortgage-backed obligations of issuers domestically and internationally, and corporate debt of companies in the U.S. and abroad.

According to the Baird overview of the Short-Term Bond Fund, the portfolio is only invested in debt securities that are rated as investment-grade when they are purchased.

Performance, Cost, Ratings and Risk

U.S. News and World Report ranks this best mutual fund well, which is one of the reasons it’s listed as a best mutual fund to invest in. Among mutual funds to invest in and top mutual funds, the Baird Short-Term Bond Fund has an overall score of 9/10 from U.S. News and World Report, and is ranked as number two in the category of “Short-Term Bond.”

Morningstar also gives this pick for one of the top 10 mutual funds a 4-star rating based on factors such as monthly performance, which includes sales charges and fees.

The inception date of the Baird Short-Term Bond Fund was 8/31/2004, and the management team includes Mary Ellen Stanek and Gary A. Elfe, among others.

The fund has returned 2.37% over the past year, and 1.85% over the past three years. Administrative maximum fees of this pick for one of the top ten mutual funds are 0.05 and management maximum fees are 0.25, with a net expense ratio of 0.30, below the category average.

The risk level of the Baird Short-Term Bond Fund is rated as Above Average by Morningstar, as compared to other funds that fall into the same category.

Analysis

The overall objective of the Baird Short-Term Bond Fund, one of the leading mutual funds to invest in, is to provide investors with an annual rate of return greater than the rate of return for the Bloomberg Barclays 1-3 Year U.S. Government/Credit Bond Index, as mentioned above.

The investment philosophy of this pick for one of the top mutual funds includes risk control and an approach that’s duration-neutral, due to the difficulty of predicting interest rates.

According to Baird, value continues to be added to this top mutual fund through moves such as sector allocation and security selection.

Image Source: Baird

Related: Top TD Credit Cards | Ranking & Reviews | TD Bank Travel, Rewards, Business, Cash Back Cards

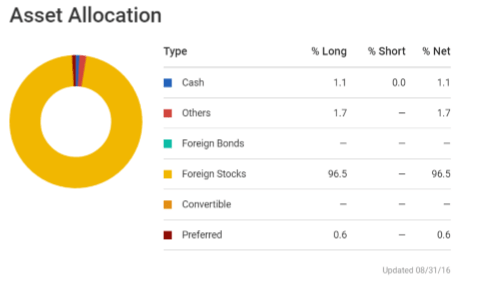

In a general sense, before exploring why the DFA Emerging Markets Portfolio is ranked as a best mutual fund to invest in, it’s a good idea to look at the advantages of mutual funds that fall into the category of “Diversified Emerging Markets.” These top mutual funds tend to have assets divided among many nations, and they focus on Asia and Latin America, which are classified as emerging.

These particular portfolios tend to invest at least 70% of all assets in equities. Then, at least 50% of total stock assets are usually invested in emerging markets.

Key Factors That Led to Our Ranking of This as One of the Top Mutual Funds

The DFA Emerging Markets Portfolio contains the following features and benefits that led to its ranking on this list of the top 10 mutual funds and the best mutual funds to invest in.

Portfolio

As compared to many of the other names on this list of top mutual funds and the 10 best mutual funds, the objective of the DFA Emerging Markets Portfolio isn’t trying to outperform the market. Instead, the goal of selection for one of the best mutual funds is to create highly targeted exposure to one market area.

The portfolio usually contains the biggest companies in emerging markets.

The fund contains more than 600 stocks, and these are primarily made up of holdings in sectors including finance, industrial materials, and energy.

Some of the biggest stakes of this pick for one of the top mutual funds are currently Samsung and India-based Reliance Industries.

No more than 12.5% of the portfolio is dedicated to any one country. Almost the entirety of this pick for one of the top 10 mutual funds is made up of foreign stocks.

Image Source: U.S. News and World Report

Performance, Costs, Ratings, and Risk

According to U.S. News and World Report, this best mutual fund on this ranking of the top ten mutual funds has returned 17.46 percent over the past year, making it one of the top performers on this list of mutual funds to invest in. While returns over the past year have been outstanding, the performance was at -0.18 percent over the previous three years and 3.49 percent over the past five years.

U.S. News and World Report ranks it as number 11 among Diversified Emerging Markets mutual funds, while it receives a 4-star rating from Morningstar, overall.

This is a no-load mutual fund, meaning there are no sales expenses, and CNN Money gives it a 0.67% expense ratio, while U.S. News and World Report says the expense ratio is 0.57, which is significantly lower than the category average.

There is a normal level of risk assumed with this pick for one of the best mutual funds to invest in. The investment philosophy doesn’t look at factors like economic outlooks and instead relies on models of the market. The primary area of risk associated with this pick for a top mutual fund is volatility in emerging markets.

Analysis

The DFA Emerging Markets Portfolio is good for investors interested in emerging markets. The philosophy behind the portfolio selection of this best mutual fund is called scientific investing: rather than looking at common factors such as predicting market moves, the managers look at growth ratios and values.

This is considered a Feeder Portfolio, and it has a master fund called the Emerging Market Series.

The ultimate goal is long-term capital appreciation.

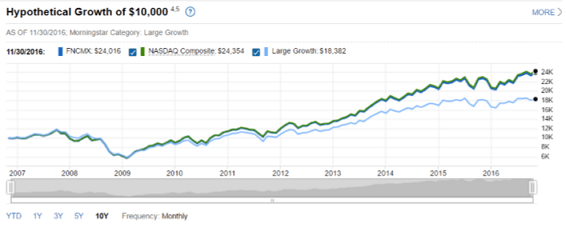

Before looking at the specifics of why the Fidelity® NASDAQ Composite Index® Fund is included in this ranking of the top 10 mutual funds and the best mutual funds to invest in, we’ll cover what an index fund is. An index fund provides many of the advantages of mutual funds in general, with some of its own unique features. An index fund describes a mutual fund that has a portfolio that matches the elements of a market index. In this case, that market index is the Nasdaq.

The advantages of mutual funds described as index funds include broad exposure to the markets, low turnover, and relatively low expenses. Fund management is passive, which is a key reason they have lower expense ratios than other types of mutual funds.

Key Factors That Led to Our Ranking of This as One of the Best Mutual Funds

Reasons the Fidelity® NASDAQ Composite Index® Fund is ranked as a top mutual fund and one of the best mutual funds to invest in are detailed below.

Portfolio

The portfolio holdings of this composite index fund include big corporations. Some of the companies currently included in the portfolio of this selection of one of the best mutual funds include:

- Apple Inc

- Microsoft Corp

- Amazon.com Inc

- Facebook Inc A

- Alphabet Inc C

- Alphabet Inc A

- Intel Corp

- Cisco Systems Inc

- Comcast Corp Class A

The portfolio is made up primarily of domestic stocks, with a minimum percentage of foreign stocks. The top 10 holdings make up 35.47% of the total portfolio as of 9/30/2016.

Image Source: Fidelity

Performance, Cost, Ratings, and Risk

As a best mutual fund to invest in, the inception date of this index fund is 9/25/2006. Its one-year growth is 5.43%, three-year growth is 10.64%, and five-year growth is 16.51%.

The Fidelity® Nasdaq® Composite Index Fund has a five-star Morningstar Rating, calculated based on a Morningstar Risk-Adjusted Return measure that looks at monthly performance.

The net expense ratio is 0.29%, and the gross expense ratio is 0.42%, while the initial investment minimum is $2,500.

The level of risk is rated as high by Morningstar.

Analysis

The overall objective of this pick for one of the top 10 mutual funds is to provide an opportunity to invest in a fund with returns that are similar to the performance and pricing of the Nasdaq Index.

At least 80% of assets are usually invested in common Nasdaq stocks. The investment philosophy is based on statistic sampling to design a portfolio that closely resembles the profile of the entirety of the Nasdaq index.

Popular Article: Top SunTrust Credit Cards | Reviews | SunTrust Cash, Business, Travel, Rewards & Secured Cards

Some mutual fund portfolios are based on asset allocation only from one particular sector, and that’s the case with the Fidelity® Select IT Services Portfolio. A technology portfolio may include assets from domestic or international companies, and some of the most common focuses of technology-based mutual funds include computers, semiconductors, and software.

The Fidelity® Select IT Services Portfolio is one of the top-rated mutual funds in the technology sector, and one of only a few sector-specific best mutual funds included in this ranking of the best mutual funds to invest in. This best mutual fund on this ranking of top 10 mutual funds focuses on service providers in the technology industry.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Funds

Among the top mutual funds, the following are specifics of why the Fidelity® Select IT Services Portfolio is included in this ranking of the 10 best mutual funds.

Portfolio

As of 9/30/2016, the top 10 holdings that are part of this pick for one of the best mutual funds make up more than 62% of the total portfolio.

Some of these top holdings include:

- Visa Inc CL A

- MasterCard INC CL A

- Cognizant Tech Solutions

- Accenture PLC-CL A

- Alliance Data Systems Corp

- EPAM Systems Inc

- PayPal Holdings Inc

The sub-industry diversification as of 10/31/2016 includes the following with this top mutual fund:

- Data Processing and Outsourced Services: 64.13%

- IT Consulting and Other Services: 29.32%

- Internet Software and Services: 4.30%

- Research and Consulting Services: 1.35%

- Human Resources and Employment Services: 0.51%

- Application Software: 0.29%

Performance, Cost, Ratings, and Risk

This top-rated mutual fund’s date of inception is 2/4/1998, and as of 11/30/2016, it has one-year average annual total returns of 0.59%. For three years, that figure is 9.87%, and for five years it’s 17.69%. Cumulative total returns daily YTD are 5.91%, monthly YTD is 4.51%, and at three months is 1.17%.

U.S. News and World Reports rates this as one of their top mutual funds in Technology and gives it an overall score of 9.3 out of 10. Morningstar gives this pick for one of the top ten mutual funds a four-star rating.

According to Fidelity, along with a minimum initial investment of $2,500, this pick for one of the top 10 mutual funds has a gross expense ratio of 0.81% and a net expense ratio of 0.81%. There are no distribution or service fees with this best mutual fund.

Finally, in terms of risk, Morningstar rates the fund as being Above Average compared to other funds in the technology category.

Analysis

This is one of the top 10 mutual funds with a general objective of helping investors achieve an appreciation of capital. 80% of asset investment is from IT services, and this can include both domestic and foreign companies.

This is often ranked well regarding long-term investment opportunities, and according to Lead Portfolio Manager Kyle Weaver, there are going to keep being opportunities within the sphere of IT services.

Some of the factors that could move stock values include the regulatory environment, as well as developments affecting issuers and economic events.

The Hussman Strategic Total Return Fund is one of the top 10 mutual funds and a best mutual fund to invest in if you’re interested most in U.S. Treasury and government body securities. The general objective is long-term total return from capital appreciation.

In general, the Hussman Funds and approach are based on diversification, and they are no-load mutual funds. The options from Hussman Funds are ideal for investors who want capital protection even in down market conditions and long-term returns. Two of the most important considerations when identifying asset allocation for the top mutual funds from Hussman include valuation and market action.

Key Factors That Led to Our Ranking of This as One of the Best Mutual Funds to Invest in

Among top mutual funds, the following outlines key reasons the Hussman Strategic Total Return Fund is a best mutual fund to invest in.

Portfolio

The asset allocation of this pick for one of the leading mutual funds to invest in is based on the goal, which is long-term total return based on capital and income appreciation. The portfolio is primarily made up of fixed-income securities.

This can include things like U.S. Treasury bonds and notes, as well as U.S. government agency securities, which primarily consist of mortgage-backed securities.

The portfolio of this selection for one of the top ten mutual funds also includes corporate debt that’s designated as investment-grade and has a rating of at least BBB.

The duration of the portfolio ranges between 1 and 15 years, and according to the fund managers, no more than 30% of assets will go to Treasury zero-coupon bonds or Treasury interest strips.

Performance, Cost, Ratings, and Risk

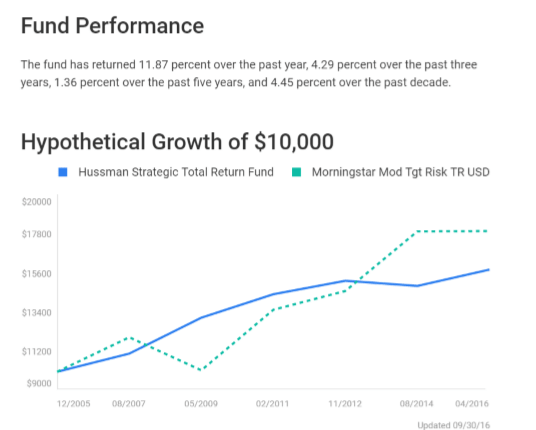

According to U.S. News and World Report, the Hussman Strategic Total Return Fund has seen returns of 11.87% over the past year, and this no-load best mutual fund has a 4.29% return over the past three years. Over the past 10 years, the return rate is 4.45%.

It is ranked #3 in the category of Tactical Allocation by U.S. News and World Report.

Along with strong performance opportunities, this is ranked as one of the top mutual funds and a best mutual fund to invest in because of the low costs. There is no front-load fee and no redemption fee, and the expense ratio is only 0.79%.

The level of risk is rated as Average by Morningstar, and some of the key areas affecting risk level with this best mutual fund to invest in include foreign investments, emerging market, and sector risks.

Image Source: U.S. News and World Report

Analysis

This pick for one of the best mutual funds to invest in and one of the top ten mutual funds is based on an investment strategy centered around fixed-income securities. In some instances, the manager may invest up to 30% of net assets outside of the domestic fixed income market, in an area such as utilities or the energy sector.

The primary investment strategies driving this pick for one of the top mutual funds include managing interest rate duration of the holdings in the portfolio, as well as managing exposure to changes in the yield curve.

In general, U.S. News and World Report defines this as a Tactical Allocation portfolio, meaning allocations are moved between asset classes to provide appreciation in capital.

Read More: Discover Student Card vs Wells Fargo College Credit Card vs U.S. Bank Student Card vs BankAmericard Cash Rewards for Students

The JPMorgan SmartRetirement® Income Fund is classified as a Target-Date Retirement mutual fund. This is the only one of this type included in this ranking of the top-rated mutual funds and the best mutual funds to invest in. The concept of a Target-Date Retirement mutual fund was touched on briefly in the introduction of this ranking of the 10 best mutual funds.

Essentially, these mutual funds have a target date for retirement, and the investment decisions are based on that target date. The closer the investor comes to reaching the target date, and in theory preparing for retirement, the more conservative the allocation approach becomes.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Funds

Among the numerous mutual funds to invest in, the following are specifics of the JPMorgan SmartRetirement® Income Fund that led to its ranking on this list of the top ten mutual funds.

Portfolio

As of 11/30/2016, some of the portfolio holdings of this particular pick for one of the best mutual funds include:

- Core Bond Fund, Class R6: 21.0%

- Disciplined Equity Fund, Class R6: 9.9%

- High Yield Fund, Class R6: 8.3%

- U.S. Government Money Market Fund, Class Institutional: 8.2%

- Corporate Bond Fund, Class R6: 6.0%

- Inflation Managed Bond Fund, Class R6: 5.0%

Portfolio allocation is primarily focused on fixed income and equity allocations, and there are smaller percentages of money market, specialty, and exchanged trade allocations.

The strategic allocation of this pick for one of the best mutual funds on this ranking of top-rated mutual funds focuses on U.S. fixed income, U.S. large cap equity, and cash and equivalents.

Performance, Costs, Ratings, and Risk

U.S. News and World Report ranks this as one of the best mutual funds in the category of Target-Date Retirement, with a specific ranking as number six in this category. According to statistics, the fund has a 7.02% return over the past year, and 4.19% over the previous three years. The performance over the last 10 years is 4.65%.

Morningstar rates it as a four-star mutual fund overall, and also gives it four stars in terms of 5-year and 10-year groupings.

Lipper ranks this pick for one of the best mutual funds as a top performer in the 5-year and 10-year categories.

The expense cap expiration date for this selection for one of the best mutual funds to invest in is 10/31/2017, and the expense cap is 0.19%. The total operating expenses are 0.77% currently, and the net expenses are 0.62%.

Analysis

The goal of the JPMorgan SmartRetirement® Funds are to provide investors with a simplified, diversified approach to investing for their retirement. These target date funds are focused on providing income replacement with risk-adjusted returns throughout the set period of time.

This professionally managed portfolio is not only designed for people approaching retirement, but also investors already in retirement.

This pick for one of the best mutual funds and one of the 10 best mutual funds is managed by the JPMorgan Multi-Asset Solutions team, and the investment philosophy is guided by concepts of strategic and tactical asset allocation.

The T. Rowe Price Dividend Growth Fund is unique even as compared to the other names on this list of the best-rated mutual funds and the top 10 mutual funds because it provides current income as dividends. Dividend funds offer the opportunity to generate anywhere from modest to high-level current income.

As well as being used as a source of income, these top mutual funds can also be used for further investment, and they are often preferred by people who are already retired. Some of the features of dividend mutual funds include a lower level of risk, but they can be taxed as income.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Funds

Specific features of the T. Rowe Price Dividend Growth Fund, one of the best mutual funds, and one of the best-rated mutual funds, are detailed in the following list.

Portfolio

The majority (91.6%) of the portfolio holdings of this pick for a best mutual fund are put in domestic stocks. Then, 5.6% is in cash options, and foreign stocks account for 2.8%.

The top holdings in this pick for one of the best mutual funds include:

- Becton, Dickinson & Company

- Comcast, Special Class A

- Danaher

- GE

- J.P. Morgan Chase & Co.

- Microsoft

- PepsiCo

- Pfizer

- UnitedHealth Group

- Visa

As of 11/30/2016, this best mutual fund had 108 holdings in total. The top 10 largest holdings account for 21.33% of the Total Net Assets.

Performance, Costs, Ratings, and Risk

The distribution schedule with this pick for one of the top mutual funds to invest in includes dividends paid quarterly and annual capital gains. The fund has returned 17.1 percent over the past year according to U.S. News and World Report, and 11.14 percent over the past three years. Over the past five years, it has returned 16.08 percent.

It’s ranked as one of the best Large Blend mutual funds by U.S. News as well, and it receives an overall score of 9.4 out of 10.

In terms of pricing, this is a no-load fund, and the expense ratio as of the end of 2015 was 0.64%. There are no transaction or redemption fees with this pick for one of the top-rated mutual funds, and the minimum to open an account is $2,500.

The risk level is low with this option, because of its basis on stocks that pay dividends. This provides a buffer for investors, even if markets are down.

Image Source: U.S. News and World Report

Analysis

The objective of this pick for one of the top-rated mutual funds is to provide not only income from dividends but also capital growth in the long-term. The strategy relies on investment of a minimum of 65% of total assets in stocks. The focus of the stocks are those options that have a proven history of paying dividends, or companies that are believed to have the potential to have higher dividends in the future.

Dividends help this best mutual fund cushion the potential for volatility, and also to avoid some of the loss experienced if the market declines.

This is a best mutual fund to invest in for people searching for an increase in their income that comes over time, and it can be used with both regular and tax-deferred accounts.

Related: Navy Federal Credit Cards vs USAA Credit Cards | Which Offer Is Best? NFCU Credit Cards or USAA Credit Card Offers

The Vanguard 500 Index Fund is often one of the first places investors look, particularly if they want an S&P 500 index fund. This fund, as the name implies, tracks the S&P 500 index, and as of October 6, 2016, this pick for one of the best-rated mutual funds had assets of nearly $260.33 billion. These assets were invested in 511 holdings, which will be detailed a bit more below.

Vanguard was one of the first companies to launch index funds, which have become so popular among investors today, and the Vanguard 500 Index Fund was established in 1976, making it the oldest on this list of the best mutual funds to invest in and the top ten mutual funds.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Funds

The Vanguard 500 Index Fund is in this ranking of the best mutual funds and the top-rated mutual funds for reasons like the ones highlighted below.

Portfolio

At any given time, the Vanguard 500 includes allocation across around 500 of the biggest domestic companies. These companies are from diverse industries, and according to Vanguard, they make up about ¾ of the stock market value in the U.S.

The Vanguard 500 is highly diversified, and the allocations are targeted toward tracking the performance of the S&P 500, which measures returns of large-capitalization stocks.

Equity sector diversification as of 11/30/2016 includes:

- Consumer discretionary: 13.30%

- Consumer staples: 9.30%

- Financials: 14.60%

- Health Care: 13.70%

- Industrials: 10.50%

- Information Technology: 20.80%

Specific companies representing the largest holdings as of 11/30/2016 include Apple Inc., Microsoft Corp., Alphabet Inc., Exxon Mobil Corp., Johnson & Johnson, Amazon.com Inc, and Berkshire Hathaway.

Performance, Cost, Ratings, and Risk

The pick for one of the best-rated mutual funds and a best mutual fund to invest in showed returns of 15.27% over the past year and 11% over the past three years. That goes up to 16.20% over the previous five years.

Average annual returns after year one are 7.92%, 8.92% at three years, and 14.28% at five years.

The Vanguard 500 Index Fund is not just one of the best mutual funds and one of the 10 best mutual funds because of performance, but also because of its price. It’s considered very low cost, with an expense ratio of 0.16%, as compared to the average rate of expense ratios of similar funds.

The general account initial minimum is only $3,000, and there are no purchase or redemption fees.

Morningstar rates this as a four-star Gold-level best mutual fund to invest in.

The level of risk and the types of risk that could affect this selection for one of the top ten mutual funds include general stock market risk, as well as investment style risk, which refers to the potential downsides of large-cap stocks.

Analysis

The Vanguard 500, a selection for one of the top mutual funds, is considered to have a passive management strategy.

This means the investment approach tracks the performance of stocks of large domestic companies. The goal is to replicate the stocks in the index so that it follows the performance level of the S&P 500.

This was the first index fund introduced into the market for individual investors, and it’s considered one of the best ways to get exposure to the U.S. equity market in a low-cost way.

Don’t Miss: Chase Slate® Credit Card vs Capital One Platinum Card vs PNC Bank Credit Card vs BankAmericard® Credit Card

Like so many of the top mutual funds available from Vanguard, the Vanguard Health Care Fund Investor Shares has a long history spanning back more than 25 years as one of the leading actively managed funds available. The goal is to provide investors with a low-cost way to access exposure to both domestic and foreign companies that are involved in a variety of aspects of the health care industry.

Along with the diversification and focus on the healthcare industry, this was also included in this ranking of the top ten mutual funds because it is a low-cost investment option.

Key Factors That Led to Our Ranking of This as One of the Top 10 Mutual Funds

The Vanguard Health Care Fund was included as a best mutual fund to invest in for several reasons, with details highlighted below.

Portfolio

As of 11/30/2016, this pick for one of the top ten mutual funds and a best mutual fund to invest in includes 77 stocks and a median market cap of $39.9 billion. The price/earnings ratio is 28.0x, and foreign holdings account for 20.3% of the portfolio.

Equity sector diversification includes the following breakdown as of 11/30/2016:

- Biotechnology: 15.60%

- Health care equipment: 10.40%

- Pharmaceuticals: 44.90%

- Managed health care: 14.40%

- Healthcare distributors: 3.90%

Some of the key companies that represent the largest holdings of this best mutual fund include Bristol-Myers Squibb, UnitedHealth Group, Allergan, Merck & Co., and Eli Lilly & Co.

Performance, Cost, Ratings, and Risk

The Vanguard Health Care fund has returned 5.16% over the past year, 15.79% over the past three years, and 19.76% over the past five years.

As mentioned in the introduction to this pick for one of the top 10 mutual funds on this list of the best-rated mutual funds, this option also scores well because it’s low cost with an expense ratio of 0.36%, as compared to the average expense ratio of similar funds, which is 1.33%.

It requires a $3,000 initial investment for a general account, and there are no purchase or redemption fees.

Morningstar gives this top mutual fund a four-star Gold rating, and U.S. News and World Report ranks it as the number five mutual fund in the Health category.

The level of risk is primarily associated with the single sector focus of the fund, and the industry concentration of the allocation. The healthcare industry can be affected by a number of factors, including politics, the economy, and the regulatory environment.

Analysis

Many investors are looking toward the opportunities provided by investing in health care because of the aging domestic population as well as the changing regulatory environment, and the Vanguard Health Care Fund offers a simple, diversified, and low-cost way to do that.

This top mutual fund tends to provide strong returns, even during down markets, and the focus with the holdings is on pharmaceutical companies and big names in health care.

As compared to many other health-related mutual funds, this option has more diversity in terms of geography and also a lower comparative turnover.

Popular Article: Chase Sapphire Preferred® Card vs Amex Everyday® Credit Card vs Chase Freedom Unlimited? Credit Card vs QuicksilverOne From Capital One

Conclusion—Top 10 Best Mutual Funds to Invest in

The above ranking of the top 10 mutual funds and the best mutual funds to invest in is designed to achieve a couple of objectives. First, it gives a broad overview of the advantages of mutual funds in the general sense.

Then, it’s also a useful guide not just to the best mutual funds, but also different types of mutual funds. It provides descriptions and information both on the specific top-rated mutual funds included on the list and on broad categorical descriptions that can be used by consumers to help them make more informed decisions as they select top mutual funds.

Finally, this ranking of the 10 best mutual funds highlights the advantages of mutual funds and serves as a way to determine the primary features you should look for as you select the best mutual funds, including things like performance, expense ratio, portfolio allocation, and risk level.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.