Intro – Best Banks in Texas

AdvisoryHQ recently reviewed the top banks in Texas. Each bank that was reviewed demonstrates an excellence in quality, provides exceptional service, offers a wide-range of products, and affords a high-level of convenience to its customers.

Included in this list is Comerica Bank.

Below we have provided a detailed review of Comerica Bank and the specific factors we used in our decision-making process.

Comerica Bank Review

Comerica Bank is one of the best banks in Dallas, and that’s where the company headquarters is located. This financial services institution offers options that are segmented into three categories: business, retail banking, and wealth management.

Image Source: Comerica Bank

Comerica’s long history began in 1849, and since then it has continued to grow. It now maintains an active presence throughout Texas as well as Arizona, California, and Florida.

Key Factors That Enabled This Bank to Rank as a Top Bank in Texas

The list below highlights some of the many reasons Comerica was selected as one of the best banks in Dallas, as well as the entirety of Texas.

Mobile Banking App

In today’s modern and technology-driven world, having a reliable mobile banking app is an essential part of the services offered by a financial institution. The Comerica mobile banking app includes the following features and capabilities that make it a first-class product:

- Users can quickly check their balances and transaction history

- Rapidly transfer funds between Comerica accounts

- Pay bills and eBills

- View balances without logging into the Mobile Banking App using Quick Balance

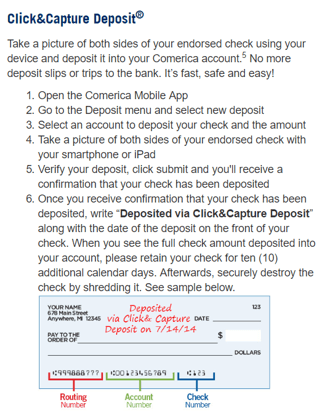

- Deposit checks with Click&Capture Deposit

- User Person to Person Transfer to send money

- Locate Comerica ATMs and banking centers near you

- Log in using your Personal or Small Business user ID on the same device

Photo courtesy of: Comerica

You can also customize your app with mobile alerts ranging from daily balance and low balance updates to large withdrawals and direct deposit alerts.

Bill Pay

Comerica offers a service called Web Bill Pay, which makes it very convenient and easy for clients of the bank to stay in control of all their bill paying and finances.

With the Web Bill Pay options, on-time payments are guaranteed, and with most Comerica checking accounts, there are no monthly fees.

This service features industry-standard encryption technology for security; payment processing is fast, and most bills can be paid the following day. You can view and manage all of your activity through the Payment Center, receive automatic bill reminders, get confirmation numbers for each bill paid, and receive eBills.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Home Equity Benefits

Along with personal and business banking products and services, Comerica also features the signature Home Equity FlexLine®, which lets you borrow against the available equity in your home.

One advantage of the Comerica product, compared to competitors, is flexibility: you can transfer any part of a variable-rate loan into a fixed payment option at any time during the draw period.

It’s a secured line of credit, so it boasts lower rates than traditional unsecured loans, and your payments may be tax-deductible.

You’re approved for a total line of credit but only pay interest on the amount you’ve drawn. Conveniently, your monthly FlexLine payments can be taken directly from your Comerica checking or savings account.

Investment Options

As one of the top banks in Texas, when you’re a customer of Comerica, you can also take advantage of investment and wealth management services.

Comerica IRAs are tax-deferred or tax-free earnings used for retirement, and Comerica offers several different IRA options, including Traditional, SEP, SIMPLE, and Roth IRAs.

Education savings plans include the ability to invest in the Coverdell Education Savings Account or a 529 Plan, and other services include brokerage and insurance offerings.

To browse exclusive reviews of all Top-Rated Banks in Texas, please click on any of the links below:

- Amegy Bank (ZB Corporation)

- Bank of America

- BBVA Compass Bank

- Branch Banking & Trust (BB&T)

- Capital One

- Comerica Bank

- First Financial Bank

- First National Bank Texas (FNBT)

- Frost Bank

- LegacyTexas Bank

- PlainsCapital Bank

- Prosperity Bank

- Regions Bank

- Southside Bank

- Wells Fargo Bank

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.