2017 RANKING & REVIEWS

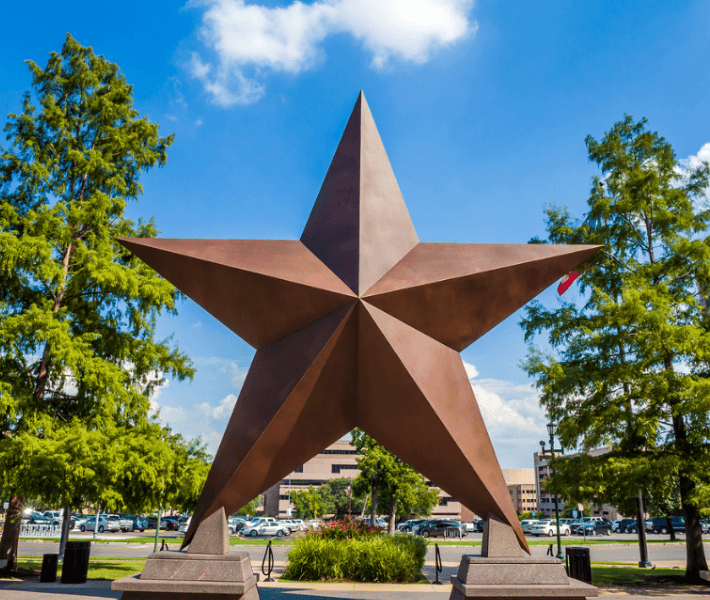

TOP RANKING BEST BANKS IN TEXAS

Intro – Highlighting the Top 15 Best Banks in Texas, U.S.

Many consumers make the mistake of believing that the bank they choose doesn’t matter. They may think all banks are essentially the same, but in today’s modern and innovation-driven marketplace, this isn’t the case.

A bank is a place that is meant to keep money and assets securely; however, it’s also much more than that.

When consumers select the right bank for their needs, they may have access to financial planning resources, tools and guidance, as well as conveniences such as mobile banking and online services.

Award Emblem: Top 15 Best Banks in Texas

Selecting the Top 15 Banks in Texas

Top-quality banks in Texas tend to offer customer rewards and loyalty programs, so it’s possible to earn as you spend on day-to-day necessities.

You can actually save a significant amount of money when you choose from one of the best banks in Texas (Dallas, Houston, San Antonio, etc.) that charges lower fees and interest.

From security to financial planning solutions, the above qualities represent some of the essential areas we explored when creating this in-depth ranking of the best banks in Texas.

This ranking covers all areas of Texas, from the best banks in Austin to the best banks in Houston.

Each bank on this list of top banks in Texas went through a stringent review process, and while some may be small, regionally-operated banks and others represent large, national names with branches in Texas, each demonstrates excellence in quality, service, products, and convenience.

AdvisoryHQ’s List of the Top 15 Best Banks in Texas

List is sorted alphabetically (click any of the bank names below to go directly to the detailed review section for that Texas bank):

- Amegy Bank (ZB Corporation)

- Bank of America

- BBVA Compass Bank

- Branch Banking & Trust (BB&T)

- Capital One

- Comerica Bank

- First Financial Bank

- First National Bank Texas (FNBT)

- Frost Bank

- LegacyTexas Bank

- PlainsCapital Bank

- Prosperity Bank

- Regions Bank

- Southside Bank

- Wells Fargo Bank

Click here for 2016’s ranking of the Top 15 Best Banks in Texas

Top 15 Best Banks in Texas | Brief Comparison & Ranking

Best Banks in Texas | Highlighted Features |

| Amegy Bank (Zions National Bank) | Professional development opportunities through the Amegy Women’s Initiative |

| Bank of America | Enhanced online banking features |

| BBVA Compass Bank | Multiple overdraft payment & protection programs available |

| Branch Banking and Trust Company (BB&T) | Robust mobile banking app for iOS & Android |

| Capital One | Affordable & dynamic savings options through the 360 Savings account |

| Comerica Bank | Diverse investment & wealth management services |

| First Financial Bank | Low fee savings accounts & competitive interest rates |

| First National Bank Texas | Comprehensive mortgage center for first-time homebuyers and current owners |

| Frost Bank | Secure online cash management portal for business customers |

| LegacyTexas Bank | Free cashback rewards program tied to debit card use |

| PlainsCapital Bank | Full suite of identity protection services within the Fraud Resource Center |

| Prosperity Bank | Comprehensive online bill pay feature |

| Regions Bank | Pre-approved line of credit for overdraft protection |

| Southside Bank | Dedicated trust and investment services team |

| Wells Fargo Bank | Programs geared for simple & effortless saving |

Table: Top 15 Best Texas Banks | Above list is sorted alphabetically

AdvisoryHQ’s Selection Methodology

What methodology does AdvisoryHQ use in selecting and finalizing the credit cards, financial products, firms, services, and products that are ranked on its various top-rated lists?

Please click here “AdvisoryHQ’s Ranking Methodologies” for a detailed review of AdvisoryHQ’s selection methodologies for ranking top-rated credit cards, financial accounts, firms, products, and services.

Detailed Review – Top Ranking Best Banks in Texas

Below, please find a detailed review of each bank on our list of top banks in Houston, top banks in San Antonio, and top banks in Austin. We have highlighted some of the factors that allowed these best Texas banks to score so high in our selection ranking.

See Also: Best Second Chance Checking Accounts | Ranking | Comparison Review of Top 2nd Chance Accounts

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Bank of America Review

One of the country’s most recognizable names in banking, Bank of America is a global company that strives to approach banking and financial services with personalization in mind.

This large-scale global bank works with 47 million customers, including individual consumers and small businesses. There are approximately 4,700 retail financial centers and 16,000 Bank of America ATMs around the world.

Key Factors That Allowed This Bank to Rank as One of the Top Banks in Texas

Below are some of the pertinent reasons Bank of America was included on this list of the best Texas banks.

Online Banking

Bank of America is a leader in online banking, and Keynote’s Banker’s Scorecard has rated this program as number one for more than seven years. Some of the features and capabilities of online banking from Bank of America include:

- Account management: check general account balance and activity, search statements and payment history, and create email and text alerts

- Pay and transfer: Pay bills and make transfers from anywhere you have an Internet connection

- Budget and track: Sign into your dashboard to have a simplified view of all accounts, set up budgets, organize and track spending, even for those accounts at other financial institutions

Don’t Miss: Best Banks for Students | Ranking | Comparison Review of Top Student Banks

Free FICO Score

Whether consumers are looking for the best bank in Houston, the best banks in Dallas, or the best banks in Austin, Bank of America tends to be well-rated in the industry and by customers.

It is continually adding new benefits and perks for its customers. One of its most recent additions is the availability of a free FICO Score, available to credit card customers.

Consumer credit card customers can receive a free monthly FICO Score from TransUnion, just by signing into online banking and enrolling in the program. It doesn’t impact the client’s credit score, and it’s easy to track scores on a month-to-month basis.

Credit Cards

Along with traditional banking services, such as checking and savings products, Bank of America offers a large selection of credit cards. This best Texas bank also offers guides, resources, and educational materials to help consumers select the right card for them.

Some of the types of credit cards offered by Bank of America include cash reward options, travel rewards, lower interest rate cards, and cards designed specifically to help users build their credit.

While Bank of America uniquely offers customized cards, some of the most popular specific card options include:

- BankAmericard Cash Rewards™ Credit Card

- BankAmericard Travel Rewards® Credit Card

- BankAmericard® Credit Card

- BankAmericard Better Balance Rewards® Credit Card

Related: Top Ranked Banks in America | This Year’s Lists | Best and Largest U.S. Banks

Savings Accounts

Consumers seeking strong savings options will have several choices at Bank of America, which is part of the reason this institution was selected for this ranking of the best banks in Texas.

Each of the savings account options is designed to help customers meet their personal goals and objectives.

These include the Rewards Money Market Savings Account, traditional savings accounts, and custodial savings accounts. For consumers who meet simple monthly requirements, there are no monthly fees on any of these accounts.

Popular Article: Best Banks in Florida | Ranking | Best Florida Banks in Jacksonville, Orlando, Miami, & Tampa

Wells Fargo Review

Wells Fargo has a long history spanning more than 160 years, as it was founded in 1852. Wells Fargo is one of the largest financial institutions and is affiliated with one in three U.S. households.

They also have employees in 36 countries around the world and maintain a client base of 70 million.

Forbes ranks Wells Fargo as one of the top 10 publicly traded companies in the world, and they’ve also been recognized by media outlets including Barron’s and Fortune magazines.

Wells Fargo ranks as one of the top banks in Houston and also a top rated best bank in Texas.

Key Factors That Led to Our Ranking of This Bank as One of the Top Banks in Texas

Some of the reasons Wells Fargo excels and was put on this list of the best banks in Texas are listed below.

Way2Save

Wells Fargo features the Way2Save® account, which is a savings account designed to make it simple and effortless for customers to save money. The account offers the option to set up daily or monthly automatic transfers that will go from your checking to your savings account.

You can also use My Savings Plan® to track how well you’re doing on your path to reaching your savings goals, and your savings account can link to your checking account to deliver Overdraft Protection.

It takes the thought out of saving money so that you’re doing it without even realizing it, and your account will grow quickly and painlessly.

Financial Reviews

Something compelling available from Wells Fargo is their complimentary financial review option. If you want to get an accurate picture of your finances, learn more about finances, or gain more control over your money, you can meet with a professional banker, free of charge.

Your banker will look at your finances and then help to prioritize your objectives and develop customized solutions to help you achieve those goals.

You can quickly schedule an appointment online, up to 15 days in advance and then you’ll receive a confirmation call from your banker, who will also use the time to see if there’s any information needed to prepare for the meeting in advance.

Go Far Rewards

A signature Wells Fargo program offering is Go Far™ Rewards, which is one critical reason this institution was selected as one of the top banks in Texas. The Go Far Rewards program includes a Wells Fargo credit card so you can earn rewards on almost all purchases and day-to-day spending.

The rewards can then be redeemed for traveling experience, products, entertainment, or charity donations.

In addition to using your rewards, you can also share them with other people through options like gifting and pooling.

My Retirement Plan Savings Calculator

As one of the premier Texas banks, as well as a top-rated bank in the entire U.S., Wells Fargo offers many tools, calculators, and educational resources.

One valuable tool is the My Retirement Plan® Savings Calculator, which is an online way to determine attainable savings goals and also actionable plans to achieve individual goals.

This varies from many other online retirement planning tools because it’s entirely customizable, and it also gives users actual steps they can take.

Free Wealth & Finance Software - Get Yours Now ►

To browse exclusive reviews of all top rated banks in Texas, please click on any of the links below:

- Amegy Bank (ZB Corporation)

- Bank of America

- BBVA Compass Bank

- Branch Banking & Trust (BB&T)

- Capital One

- Comerica Bank

- First Financial Bank

- First National Bank Texas (FNBT)

- Frost Bank

- LegacyTexas Bank

- PlainsCapital Bank

- Prosperity Bank

- Regions Bank

- Southside Bank

- Wells Fargo Bank

Conclusion — The Top 15 Best Banks in Texas

Banks are more than just a place to store money.

Rather, today’s banks have become one-stop financial institutions designed to help consumers save their money but also to secure it against fraud, to bring together several accounts in one place to better manage their money, and to offer a level of control and peace of mind to customers when it comes to their finances.

Many of these Texas banks offer robust products and services beyond simple checking and savings accounts, including mobile banking, online bill pay, investment and retirement planning, and loans.

Banks are incredibly relevant to the everyday lives of consumers, and we kept that importance in mind when creating this ranking of the best banks in Texas. Whether readers are seeking the best banks in Austin, or perhaps Dallas or Houston, they’re represented with this ranking.

These Texas banks also serve the needs of consumers in smaller towns throughout the state, and each demonstrates excellence in customer service, innovation, and available products.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.