Intro – Best Banks in Texas

AdvisoryHQ recently reviewed the top banks in Texas. Each bank that was reviewed demonstrates an excellence in quality, provides exceptional service, offers a wide-range of products, and affords a high-level of convenience to its customers.

Included in this list is LegacyTexas Bank.

Below we have provided a detailed review of LegacyTexas Bank and the specific factors we used in our decision-making process.

LegacyTexas Bank Review

LegacyTexas is often named as one of the best banks in Dallas, serving North Texas and the surrounding region.

It was founded in 1952 and maintains more than $8 billion in assets. LegacyTexas also operates 45 branches in the state, with headquarters in Plano.

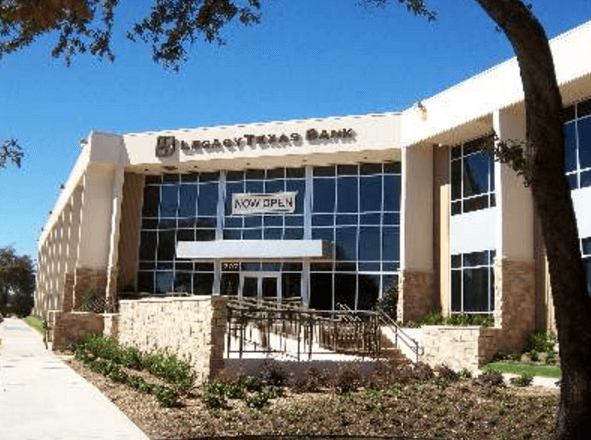

Image Source: LegacyTexas

It is distinguished as one of the largest locally-based banks in the North Texas area and provides commercial, business, and consumer banking. LegacyTexas also offers financial services including mortgages and insurance, and the bank operates LegacyTexas Title.

Key Factors That Enabled Us to Rank This Bank as a Top Texas Bank

When comparing banks in Texas, the following are the key criteria that distinguished LegacyTexas, compelling us to include it on this list.

Fraud Prevention

LegacyTexas places emphasis and attention on preventing fraud and keeping customers secure. They have many innovative fraud prevention tools in place for both personal and business accounts.

Some of their fraud prevention features include Positive Pay and Account Reconciliation, which are targeted to the needs of business and commercial account holders to help them match information on checks they’ve written to what’s presented for payment.

Users provide details about checks written, and then LegacyTexas compares that to the checks submitted for processing. If the checks don’t match, they’re flagged, and the customer decides if they’ll be paid or returned.

Free Checking Advantages

Several types of unique checking accounts are available to customers of LegacyTexas. Some of these options include Money Market Checking and Maximum Checking, which is a free, interest-earning account.

Also available from LegacyTexas is the free checking account, which offers the basics and doesn’t carry monthly fees. Regardless of what checking account set-up a customer chooses, they have access to the following benefits and perks:

- Unlimited, free use of the LegacyTexas Online Banking system

- Free mobile app

- Remote deposit options

- Free check images

- Free online statements

- Free email alerts

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

LegacyTexas Rewards

When looking at the best banks in Dallas, and throughout the state, rewards programs are often available. The Legacy Rewards program adds value to the lives of customers by allowing them to make day-to-day purchases and then turn them into cash.

To participate in the program, customers use their LegacyTexas MasterCard debit card at participating retailers, and then cash back rewards are deposited into their checking account at the end of each month.

There’s no obligation, no cost to be part of the rewards program, and there’s no limit to the offers participants can take advantage of.

Financial Calculators

Available for free to not only LegacyTexas customers, but also all website visitors, is a range of personal financial calculators.

These tools are designed to provide a simplified way for users to gain a more accurate view of their finances, plan for the future, and maintain a greater sense of control of their money.

The financial categories are divided into the following categories: Auto, budgeting, debt, home equity, mortgage, and savings.

Within these broad categories, users can search for specific, applicable calculators, such as a calculator to compare monthly car payments by term and one to track your household cash flow.

To browse exclusive reviews of all Top-Rated Banks in Texas, please click on any of the links below:

- Amegy Bank (ZB Corporation)

- Bank of America

- BBVA Compass Bank

- Branch Banking & Trust (BB&T)

- Capital One

- Comerica Bank

- First Financial Bank

- First National Bank Texas (FNBT)

- Frost Bank

- LegacyTexas Bank

- PlainsCapital Bank

- Prosperity Bank

- Regions Bank

- Southside Bank

- Wells Fargo Bank

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.