Guide to the Best Car Loan Calculators (How to Find & Use the Best Car Payment Calculators)

Know that you need to cash in your old clunker of a car for a new one but not sure if you can really afford it?

Making good use of a car loan calculator or a car payment calculator can help you from becoming overwhelmed by financing during the purchasing process.

By taking your time to view various car loan calculator options at home before you head to the dealership, you can alleviate some of the pressure to purchase a car you know you can’t afford in the long run.

You can trade being saddled with an uncomfortable debt for an affordable, reasonable loan payment when you utilize a good car loan calculator. In order to help you purchase your next vehicle wisely, AdvisoryHQ has compiled this list of tips for finding and using a car loan calculator in advance.

Understanding and being able to use a car payment estimator prior to making a purchase is a critical skill for your financial health. Find out how to make the most of a car loan calculator next!

Know What You Can Afford

The first step to the successful use of a car loan payment calculator is to closely examine your current budget for what you can truly afford to spend.

A car payment estimator can tell you what the damage will be each month but cannot predict whether it fits comfortably into your monthly expenses.

Before you begin searching for the right car loan calculator for your needs, you should seek out a car loan calculator that specializes in affordability to determine if the figures fit within your budget.

While it obviously depends on your income bracket, there are a few general rules of thumb that experts recommend when you estimate car payment affordability. Many would recommend staying somewhere between ten and twenty percent of your monthly take-home pay. Money Under 30 recommends staying on the conservative side – using a car payment calculator to find a loan that would keep you at ten percent of your income or less.

Why is less sometimes better? Well, it allows you save more for luxury items you might be interested in, including vacations, pricy technology or that new kitchen remodel you’ve had your heart set on. Not to mention, if tough times arise, like unemployment or an unexpected illness, you won’t feel like you’re tied to your auto loan because you will have already used a car payment calculator to determine if you can afford it.

Other experts on personal finances, such as NerdWallet, recommend sticking with results of a car payment estimator that place you under twenty percent of your take-home pay.

Don’t forget to account for other loans or debt you may have. Your total debt payments should come out at less than 36 percent of your annual income.

Crafting a detailed monthly budget that shows how much is left in your bank account (if any) at the end of the month can help you utilize a car payment calculator to find options you can afford with a greater degree of accuracy.

Don’t Miss: Tips for Finding the Top Amortization Calculators & Schedules | Guide to Loan Amortization

Car Loan Calculator for Affordability

Not only is a monthly car payment calculator a critical addition to your budgeting and financing, but a car loan calculator focusing on affordability can help you to make good use of the information in the section above.

These types of programs are useful to use prior to other car loan calculators, so you know in advance which vehicles are above your desired or comfortable price range.

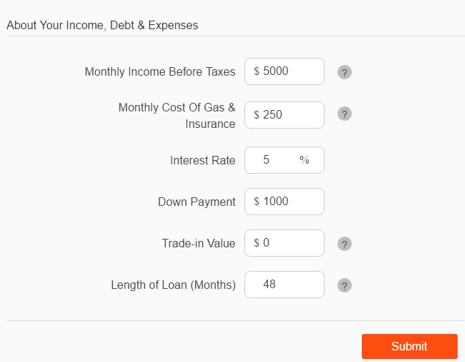

This car finance calculator from Money Under 30 will help you to determine what you can afford by using your monthly income amount. Based on your pre-taxed income, your anticipated fuel and insurance cost, interest rates, down payments, and loan length, its car payment calculator can determine what maximum loan amount you can comfortably afford.

Image Source: Car Affordability Calculator

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

In a different calculator from US News & World Report, you can enter your desired monthly payment, expected down payment and trade-in value, sales tax, interest rate, and loan term to determine what the total value of a car would be based on your desired payments. It can calculate car payment choices more specifically in the next tab over, making it a great option for both affordability and a car finance calculator.

The drawback to these options for a car monthly payment calculator for affordability is that it does not have the capability to take other debt into account.

Bear in mind that, while its affordable car payment calculator can give you guidelines on what you can afford, you will need to make sure that your other debts and obligations do not put you in an uncomfortable position that would require you to default on your auto loan.

Find Your Trade-in Value

In order to calculate car payment, a good car loan repayment calculator is going to ask you what you anticipate your down payment will be as well as the trade-in value on your current clunker.

How do you determine what the trade-in value will be so you can receive an accurate estimate from the car repayment calculator options you find or consider from our list of choices?

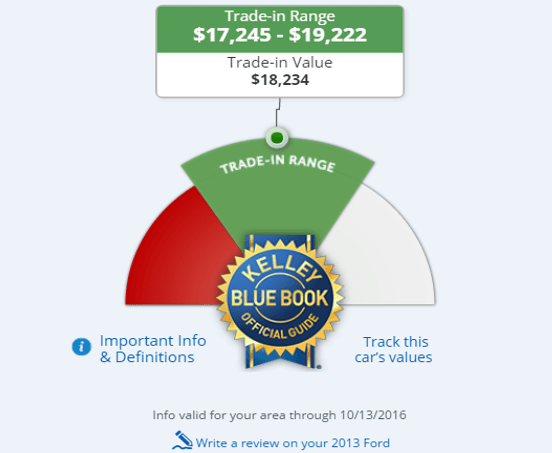

Many people will turn to the long-favored Kelley Blue Book in order to determine a rough appraisal of what their current car is worth. They have a function that allows you to estimate the value of your car just as a car loan calculator allows you to estimate your monthly payments.

With only a few pieces of information regarding your current car (year, make, model, mileage, and condition), Kelley Blue Book can produce an approximation of the value depending on whether you sell it privately or trade it in through the dealership.

No matter which way you choose to sell your current vehicle, its estimate is a great first step toward obtaining accurate information on a car loan calculator.

You can use its trade-in value to estimate car payment choices without ever having to leave your house. However, you should keep in mind that this is only an automatically generated number based on the information you provide.

If you don’t mind interacting with professionals in the industry, you can also consider taking your car to a dealership or to dealers, such as Carmax, for a quick appraisal on what your vehicle is worth.

Not only does this allow you to have a very realistic idea of what your car is worth, but you can compare several different values to make sure that you are getting the most you can for your car. The closer you can estimate your trade-in value of your current car, the more accurate your results will be with the car loan repayment calculator.

Save for Your Down Payment

One of the most important questions that determines car affordability and influences a car payment calculator is how much money you intend to put down at the time of purchase. There are many different opinions on the market regarding what you should expect to put down, and a car monthly payment calculator will also offer its own opinions of what you should consider.

Some experts recommend an upfront payment of as much as twenty percent of the value of the car, particularly for newer models. According to them, this can help to prevent you from becoming upside down on your payments in the future.

The reason for this is that a brand new vehicle loses 19 percent of its value by the end of your first year driving it. At that rate, you’ll quickly owe more than your car is worth.

When you calculate car payment, it might be worth your time to place different values in the down payment section to determine how it influences your monthly payment. A good car finance calculator will be quick and simple to use; it will allow you to make adjustments to the figures to come out with the information you need for making a wise financial decision.

A car loan payment calculator assists you with all of the “what-if” scenarios that could arise and helps you to purchase a better vehicle or to make your payments more comfortable on a regular basis.

That doesn’t mean that you can’t purchase a new car or use a car loan calculator to determine the best payment options for you now. It is simply a suggestion and recommendation to help you get the most of your car payment calculator and monthly payments.

Use Interest Rates on Your Car Finance Calculator

One of the biggest influencing factors on the accuracy of your car payment calculator is the use of accurate interest rates.

Interest rates can vary depending on the day, your credit score, the type of vehicle your purchase, and your choice of lender, among other things. However, a point or two in either direction can have a serious impact when you are trying to calculate car payment for affordability in your budget.

Many individuals prefer not to shop for loan terms at a dealership initially, hoping to avoid high-pressure sales tactics. For those who prefer not to interact with representatives but still seek an accurate way to calculate car payment, consider looking at interest rates with online lenders before leaving the house.

If you know where the best car rates stand (and what they’ll cost you according to a car finance calculator), then you will have an improved idea of where your monthly payments will land.

Consider using sources such as Lending Tree. It collects generic information about your needs and then matches you with lenders who offer products that fit your lifestyle and loan needs.

You can view the terms of these options and input their information into a monthly car payment calculator to better determine where your payments will stand.

Top Choices for a Car Payment Calculator

If all you’re searching for is a basic car payment calculator or a basic car loan calculator, you won’t be much interested in options that have more advanced features.

Plenty of people can benefit from even the most basic car loan repayment calculator, regardless of what features it has or questions it asks. In this section, we want to provide you with a couple of options for a very simple car loan payment calculator.

Up first, we have the Bankrate car payment calculator. When you use its car loan calculator to estimate car payment choices, you are asked just a few basic questions: your loan amount, your loan term, your interest rate, and the projected start date of your loan.

What makes the Bankrate car repayment calculator a top choice is the simplicity of the initial options with the ability to utilize more advanced features once you see your results.You can make the most of its car repayment calculator by choosing to view the amortization schedule.

This function allows you to see how the funds are allocated for your principal and your interest throughout the duration of the loan term. Its car loan calculators also allow you to see how much you would save if you made additional monthly, yearly or one-time payments.

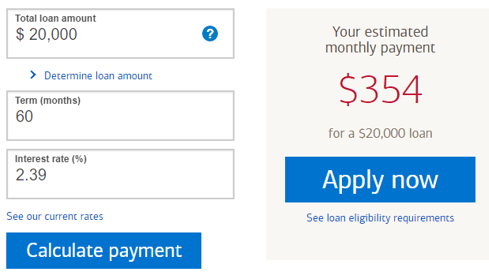

If the Bankrate car payment calculator still seems more advanced than what you are interested in viewing, take a look at the Bank of America car loan calculator. It asks you for the total loan amount, term, and interest rate before giving you a projected payment amount. One of the benefits to using its car monthly payment calculator is the ability to apply for an auto loan with it from the same screen.

Image Source: Bank of America – Auto Loans

More advanced options for car loan calculators are also available. While they all perform the same basic function as a monthly car payment calculator, these allow you to itemize where your down payment is coming from.

The car payment calculator from NerdWallet allows you to list your trade-in value and your down payment amount alongside the price of the vehicle itself instead asking what your anticipated loan amount will be.

The Auto Trader car finance calculator is equally impressive, with the ability to add your sales tax rate, your down payment amount, your trade-in value, and the amount owed on your trade to calculate car payment choices most accurately. If you owe on your current vehicle, this is an especially appealing choice.

Popular Article: How to Find the Best Real Estate Investment Calculators | Popular Rental Property Investment Calculators

Free Wealth & Finance Software - Get Yours Now ►

Making the Most of a Car Loan Calculator

If you’ve been considering purchasing a new vehicle for a while but aren’t sure if you can afford it, using a car payment calculator to estimate car payment for you is a step in the right direction.

When you calculate car payment upfront, you know what you can comfortably afford before you ever begin the shopping process. Knowing what you can afford and sticking to it while shopping is an important part of making the best choice when it comes to your car payment.

Keep in mind that most car loan calculators do not account for taxes, tags, and other miscellaneous fees that dealers and counties require. This can add as much as ten percent onto the cost of your loan, and you should remember that when viewing the results of your car loan calculator.

Carefully evaluate your current personal financial status to determine if trading in or selling your old car is the right choice for you.

A car finance calculator can be a great tool to help you decide if, when, and what you can afford when it comes time to purchase a new vehicle. You won’t want to forget these tips and tricks for finding the best car payment calculator and using it effectively.

Read More: How to Find the Best Mortgage Refinance Calculator with Taxes And Insurance

AdvisoryHQ (AHQ) Disclaimer: Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info. Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.