2017 RANKING & REVIEWS

TOP ONLINE PAYDAY LOAN LENDERS

Why Would a Consumer Need to Find Payday Lenders Online?

Before exploring the best online loan companies and the best payday loan sites, we’ll first begin this ranking and review by exploring the ins and outs of payday loans, who uses them, and what features they commonly have.

It’s important to understand these details before you can select the right online payday direct loan lenders or even the best resources to match you with the top payday loans online.

To begin, when you’re searching for online payday loan companies, you likely want a short-term loan, in a small amount of money.

Repayment of that loan is often due on your next payday, thus the name, although terms may vary pretty significantly between different payday lenders online.

Payday loans may also be called payday advances, short-term loans, cash advance loans, or payroll loans. They can also simply be called a cash advance.

Award Emblem: Best Online Payday Loan Lenders

There are any number of reasons a consumer might need to work with online payday loans direct lenders as well as the best payday loan sites that match customers with direct lenders, including having an emergency expense or to cover basic living expenses.

Some of the emergencies that might require finding payday loan lenders online include car repairs, medical expenses, or even to pay off another debt that you’ve previously accrued.

In some cases, consumers might look for the best online loan companies or the leading online payday loan direct lenders if they’ve maxed out their credit cards and no longer have credit available to them.

Another reason online payday loan lenders are popular with consumers is if they’ve been turned down for bank loans because of their credit and financial history.

While working with online payday loan direct lenders can be advantageous, particularly if an unexpected situation arises, these lending products are not without potential downsides.

The following ranking and review of the best payday loan sites and the best online loan companies will explore both the positives and negatives of payday loans and will also highlight the most reputable online payday loan companies.

See Also: Caliber Home Loans Reviews—What You Need to Know Before Using Caliber

AdvisoryHQ’s List of the Best Online Payday Loan Lenders

This list is sorted alphabetically (click any of the below names to go directly to the detailed review for that company).

What Do Online Payday Loan Lenders Do?

As mentioned above, online payday loan companies offer small amounts of short-term funding to borrowers.

A borrower will often write a personal check for the amount they’re borrowing and the finance charges, or they may provide electronic access to their bank account, and this amount is held and used to repay the loan.

Online Payday Loan Lenders & Companies

Typically, the online payday loans direct lenders will keep that check or the account information until the consumer’s next payday, and then it all has to be paid at one time.

If a consumer instead needs to wait until the next pay period, they can pay just the interest or finance charge.

These are small loans, and most of the payday lenders online will offer amounts ranging from $100 to $1,000.

Payday loans and online payday loan direct lenders are carefully regulated by state governments, so loan maximums and terms can vary significantly from state-to-state. Finance charges may range from $15 to $30 per $100 borrowed, which amounts to an incredibly high APR.

What Is the Difference Between Online Payday Loan Companies and Storefront Lenders?

This ranking and review focuses on online payday loan lenders, but as a consumer, you may be wondering what the differences are between these companies and brick-and-mortar payday lenders with storefronts.

The first thing to realize is that not all of the payday lenders online are online payday loan direct lenders. This means that you may go to a website that acts as a type of funnel to the direct lenders or a lead generator.

You would fill out an application, which would then be sold to online payday loans direct lenders.

Another thing to consider is state licensing laws. While the best online loan companies are going to operate in adherence to all state laws, not all online payday loan companies will do that. Before selecting the best online loan companies, ensure that they do follow state laws.

For many consumers, the advantage of working with payday loan online lenders as opposed to storefront lenders is that it’s more convenient, easier to shop around and compare terms, and they don’t have to be face-to-face with someone, which can be less intimidating, particularly if you’re in a situation where you need cash quickly.

While a storefront lender may require the exchange of written checks, with online payday loan lenders, everything is done electronically. This means a loan is directly deposited into the borrower’s bank account, and then that amount is electronically withdrawn on the borrower’s next payday.

In some cases, online loans may automatically renew every payday, so consumers should be aware of this potential. The best online payday loan lenders and resources to match consumers with top payday loans online will provide a warning if this is part of their policy.

What Are the Disadvantages of Online Payday Loan Lenders?

The pros of online payday loan lenders include the fact that you receive cash almost instantly, you can quickly apply online, and in some cases, if you have a history with a lender, you can get higher loan amounts.

Additionally, when you work with the best online loan companies, you aren’t subjected to a credit check for approval in many cases. All you need in most instances to work with online payday loan lenders is proof of employment and a bank account.

As with anything, there are cons to working with online payday loan companies, however.

One of the biggest downsides to this type of borrowing are the high interest rates. Payday lenders online and at brick-and-mortar stores charge incredibly high rates that are much higher than you would pay with basically any other type of loan.

In addition to the interest, there are often many other fees tacked onto payday loans, and the amount you owe can grow very quickly if it’s not paid back on time.

Also, while a credit check may not be required to obtain the loan, if you don’t pay the loan back on time, it can be a mark against your credit.

Finally, some payday lenders online and storefront lenders have been faced with increasing regulations from state governments because they’re seen not only as predatory lenders but also because of the practices they use to collect funds from a borrower.

It’s important to be aware of these potential downsides before searching for payday loan online lenders and online payday loan companies.

Methodology for Selecting the Top Payday Loans Online and the Best Online Loan Companies

What methodology does AdvisoryHQ use in selecting and finalizing the companies, services, and products that are ranked on its various top-rated lists, including this list of the best online payday loan lenders and the best payday loan sites?

Please click here to see “AdvisoryHQ’s Ranking Methodologies,” a detailed review of AdvisoryHQ’s selection methodologies for ranking top rated companies, products, and services.

Top Online Payday Loan Lenders

Firms | Websites |

| 100DayLoans | https://www.100dayloans.com/ |

| CashAdvance.com | https://www.cashadvance.com/ |

| First Choice Capital Resources | http://creditforums.com/ |

| LendUp | https://www.lendup.com/ |

| PersonalLoans.com | https://personalloans.com/ |

Table: Best 6 Online Payday Loan Lenders & Companies | above list is sorted alphabetically

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Detailed Review—Best Payday Loan Sites and Online Payday Loan Companies

After carefully considering online payday loan lenders, we compiled the following list of the top six best online loan companies. As you continue reading, you’ll find detailed reviews of each of our picks, as well as an outline of the factors used in the decision-making process.

100DayLoans Review

The first thing consumers should know about 100DayLoans.com is that this site is not one of the online payday loan direct lenders.

Instead, this site, which is operated by Blue Global Media, serves as a type of liaison between consumers and lenders who want to find the best possible loan for their needs.

Blue Global Media works to connect borrowers with the right financial solution, and they adhere to responsible lending standards.

Image Source: 100DayLoans.com

The 100DayLoans service is not available in all states, and 100DayLoans doesn’t make credit decisions, nor do they charge any fees to the consumer.

Key Factors That Enabled This to Rank as a Source for the Best Loans Online

Reasons 100DayLoans was included on this list of the best payday loan sites are listed below.

OLA Accreditation

100DayLoans is one of the best payday loan sites, and they are accredited by the Online Lenders Alliance (OLA). The OLA seal signifies to consumers that a company is operating in-line with the highest standards of conduct and is always striving to create the best experience for customers.

OLA-accredited companies are also known to be compliant with laws and focused on consumer protection.

OLA member companies believe all consumers should be fully aware of any risks that could be involved with working with payday lenders online, and part of the OLA mission revolves around educating consumers about the online lending industry. OLA also provides a variety of educational resources and assistance to consumers, in line with this mission.

Transparency

When a consumer visits 100DayLoans, one of the best payday loan sites, they’re likely to notice the complete transparency offered by this company.

For example, 100DayLoans’ site makes it clear that not everyone will qualify for a loan, and many applicants may only qualify for short-term lending options up to $1,000, although there is the potential to qualify for funding up to $10,000.

100DayLoans also makes it very clear that they’re not the ones making credit decisions or charging fees, and they encourage borrowers to be responsible. They highlight the expense of short-term loans and the fact that they shouldn’t be used as a long-term financial solution.

They also highlight the potential consequences of late or missed payments, and they advise consumers that their partners will never ask for an advance payment, and a lender should never be paid in advance for a loan.

Transparency and informing consumers were important considerations when creating this list of the best payday loan sites and the best online loan companies.

Simplicity

The process and experience that comes with applying for any financial or lending product can be one that’s time-consuming and challenging. Consumers often find they’re applying with many different companies, only to be rejected. They may also apply to various companies that end up being the wrong lending solution for them.

100DayLoans’ strength is in its simplicity. Consumers can apply one time, and they’re connected with leading lenders through innovative technology that searches the vast lending network in real time.

The application process is simple with only two steps, and there’s the utmost in security thanks to the use of encryption technology and other stringent safeguards.

Rather than waiting hours or days to see if you qualify, consumers who use 100DayLoans can receive a response in as little as 90 seconds.

Higher Possible Loan Amounts

With many payday lenders online and even the best online loan companies, there is often a cap for short-term payday loans set at $1,000. This isn’t necessarily the case with 100DayLoans.

Because of their unique search technology and extensive network of lenders, some borrowers may qualify for loans up to $10,000. Of course, not every borrower will be eligible for this much funding, but 100DayLoans is a strong option for someone who needs a loan that’s larger than the standard amount offered by payday lenders.

As the name implies, in some cases borrowers may also get loans with longer terms attached to them, so it’s a good option for consumers searching for more options and availability.

Don’t Miss: Best Home Equity Line of Credit Loans | How to Get the Best Home Equity Loans & Rates

CashAdvance.com Review

CashAdvance.com is one of the best online loan companies and a provider of top payday loans online, having been offering short-term loans since 1997. CashAdvance.com has served millions of customers, and the company strives to operate with a philosophy based on being up front, honest, and ethical.

Their mission is to avoid pushing consumers into a loan they don’t want and instead help them find the loan they want and need.

The Cash Advance service itself is free, and the only time the consumer pays is if they agree to a lender’s terms. Like 100DayLoans, Cash Advance isn’t one of the online payday loans direct lenders but is instead like a marketplace for short-term loans.

Key Factors That Led Us to Rank This as One of the Best Payday Loan Sites

When finding the best loans online, the following are some reasons CashAdvance.com is ranked as an excellent resource.

Extensive Lender Network

Not all of the online payday loan companies are created equally. In fact, there can be pretty significant differences in how a company lends money, how much they lend, their repayment terms and more. For many consumers, this underscores the importance of being able to compare the best loans online and find the best online payday loan direct lenders for their individual needs.

Cash Advance makes this easy. They are not a direct lender—they connect borrowers to a very large network. When a borrower submits a loan request, it’s reviewed by the lender network, and only those best online loan companies are going to contact the potential borrower.

It saves the consumer a lot of time and effort and ensures they’re finding the right product for them.

Customer Experience

At Cash Advance, there is a lot of focus not only on providing a connection to the best loans online, but this selection for one of the best payday loan sites also features an excellent customer experience.

Cash Advance strives to create an experience that’s convenient, safe, and personalized. There is an in-house customer service team available to help site visitors at any time during their loan experience.

Cash Advance also delivers a range of educational tools and resources designed to help consumers make the best financial decisions. These resources can also be used to help consumers evaluate possible loans and lenders before making a decision.

Cash Advance receives many excellent customer reviews because of the experience they consistently strive to create, where their interests are at the heart of everything.

Online Lender Alliance

Cash Advance is part of the Online Lender Alliance, which shows their dedication to only linking consumers with the leading online payday loan lenders and the best online payday loan companies. The Online Lender Alliance requires members abide by a set of defined best practices, which include:

- All loan terms must be fully disclosed, and information should be presented in a clear, easy-to-understand way to help consumers make smart financial decisions.

- Cancellation policies should be reasonably offered.

- Companies that are part of OLA shouldn’t engage in unfair, abusive, or deceptive marketing tactics.

- The companies should be in good standing with all laws and regulations.

- The best payday loan sites that are part of OLA are required to protect customer data with an in-depth privacy policy and leading-edge website security.

- All payments should be authorized and processed in adherence with federal laws.

- Customers should always be treated with fairness and respect.

State Information

As mentioned in the introduction to this ranking of the best online payday loan lenders and the resources for the best loans online, state laws are important in short-term lending. State laws dictate everything from the interest a payday loan company can charge to the amount a company can lend.

Some online payday loan companies may not adhere to state regulations, which can be problematic for consumers, but Cash Advance takes state laws very seriously.

Cash Advance is one of the best payday loan sites because they feature regular updates on all state laws related to short-term loans, and site visitors can visit the State Info page of the website to find all of the information they need about their particular state, including terms, availability, and maximum loan amounts.

CashNetUSA Review

CashNetUSA is one of the online payday loan direct lenders on this ranking of the best payday loan lenders online. That means consumers visit their website, apply for a loan and then the funding and repayment are directly from and to CashNetUSA.

This leader among online payday loan direct lenders is available in 30 states currently, and they are part of Enova International, Inc. which provides products around the world including NetCredit, Headway Capital, and QuickQuid, which is a short-term loan company for UK residents. Enova International is a public company listed on the New York Stock Exchange.

Key Factors That Enabled This to Rank as One of the Best Payday Loan Lenders Online

Key reasons CashNetUSA is one of the best payday loan online lenders are listed below.

Direct Lender

While some consumers may prefer the convenience and options afforded by working with a company like 100DayLoans, which connects them with many payday lenders online, there are advantages to working with online payday loans direct lenders as well, and that’s what CashNetUSA is.

When a consumer works with online payday loans direct lenders, that lender manages every area of the loan process.

This includes approval, funding, and repayment. This takes some of the uncertainty out of the borrowing process, and it eliminates the possibility of being connected with a lender that isn’t reputable.

With CashNetUSA, consumers can explore every aspect of the company and their specific process before even applying, giving a certain peace of mind to the whole experience.

Flex Loan

The signature product available from this leader among online payday loan lenders and online payday loan companies is their Flex Loan. The Flex Loan is designed to offer more flexibility and a greater range of repayment options than what’s offered by many other online payday loan lenders.

The Flex Loan requires the consumer apply only once, and they can then request cash advances as frequently as they want, as long as they don’t exceed their available credit limit.

The repayment options include making gradual minimum payments on time or repaying the balance in full to reduce interest.

Fast Funding Schedule

The very thing that makes a payday loan an attractive option for many consumers is that they need them quickly. They may have an emergency situation, and the length of time it takes to apply for and receive a conventional bank loan simply won’t work for their timetable.

This is an area where CashNetUSA excels and a big reason they were included in this ranking of the best online payday loan lenders.

CashNetUSA is a top resource for the best loans online because they’re not only flexible but also fast. The typical funding schedule would include next-day funding if an application is approved before 9 p.m. If approved after 9 p.m., the loan will likely be funded on the following business day.

The application process also takes just a few minutes, and in many cases, the approval decision is issued instantly.

TrustPilot Reviews

When searching for the best payday loan sites and the top payday loans online, using a third-party resource like TrustPilot can be invaluable. TrustPilot is a resource for consumers to leave honest reviews and feedback on their experiences working with a company.

CashNetUSA has an “Excellent” rating of 9.4 out of 10 with TrustPilot, and they have nearly 2,000 reviews from actual customers. 86.3% of reviewers gave CashNetUSA a 5-star rating.

Some of the things customers cite as being excellent about working with this leader among payday loan lenders online include their customer service, transparency when it comes to fees and terms of agreements, and the easy access they provide to funds.

Related: Best Bad Credit Mortgage Lenders for Bad Credit Borrowers (This Year’s Mortgage Lenders and Programs)

First Choice Capital Resources Review

Operating not as one of the online payday loans direct lenders, but instead as one of the best payday loan sites connecting consumers to multiple lenders, First Choice Capital Resources (FCCR), features lending partners that don’t call and ask for advance payments. All lending activities offered by FCCR are fast, safe, and secure.

FCCR’s services are not available in all states, and it’s important to realize that the states who can receive service may change without notice, so consumers should frequently check to make sure their state is still eligible.

Key Factors That Allowed This to Rank as One of the Best Places to Find Top Payday Loans Online

Among payday lenders online and the best payday loan sites, the following are some reasons FCCR was included in this ranking.

Clear Credit Rating System

While many payday lenders online don’t require a credit check for their products, some of the loans applicants may source on FCCR are longer term loans, or they may apply for more funding. In this instance, their credit check may be considered during the application process.

With longer-term installment loans and a required credit check, FCCR Loans makes it clear what the credit standards are. Based on their criteria, a score of 720 and above is considered excellent, good is 650–719, average is 600–649, and poor credit is less than 600.

The transparency provided by FCCR Loans makes it easier for consumers to understand what is expected of them and helps them make the best financial decisions.

Transparency of Loan Terms

One of the biggest problems consumers have when they find payday lenders online and work with online payday loan companies is that they don’t fully understand the consequences of not paying back the loan on time. FCCR Loans strives to eliminate this issue by clearly outlining the importance of paying back the loan on time.

They highlight the fact that agreeing to the terms of a payday loan means the consumer is agreeing to pay it back in the amount and time period expressed. FCCR Loans also lists the penalties and fees that are likely to arise as a result of late or non-payment, including interest rate adjustments, fees, collection practices, credit score impacts, and renewal policies.

It’s important for the best payday loan sites to make sure they’re explicitly detailing all of the components of payday loans to their customers, and FCCR Loans does an excellent job of this.

Loan Varieties

In addition to linking consumers to payday loans, FCCR also features the option for customers to be matched with companies that provide installment loans. This level of variety is necessary, particularly for consumers who are searching not just for payday loans, but for the best loans online, in general.

Installment loans are repaid through a pre-determined number of payments, and the duration of the loan can vary significantly.

Installment loans tend to have lower interest rates than payday loans, which can make them appealing to borrowers.

Ongoing Service

One of the ways FCCR is different from other payday loan online lenders and online payday loan companies is the fact they offer ongoing service, as well as comprehensive product offerings.

What this means is that in addition to offering an initially large pool of lenders, they’re constantly adding new lenders to the network.

If a consumer doesn’t initially qualify for a loan product, as new lenders are added, they may eventually be approved. Also, FCCR Loans is a free service for borrowers, and they can use it as often as they want, and at any time they choose.

LendUp Review

The mission of LendUp is defined as providing anyone with a path to better financial health. This leader among payday loan lenders online strives to do things differently by giving customers in eligible states universal access to credit that expands over time, while simultaneously improving their credit score.

LendUp is actually unique from almost all of the other online payday loan lenders in their approach and their quest not just to provide short-term funding to borrowers, but to really help them change their financial situation.

Key Factors That Enabled Us to Rank This as One of the Top Online Payday Loan Lenders

LendUp was included in this ranking of the best payday loan lenders online for some of the following reasons.

Four Ideals

While online payday loan lenders often have a bad reputation with consumers, LendUp is working to change this perception with the idea that quality credit creates opportunity. They want to offer choices and opportunities to people who don’t ordinarily have them, and with this, they have products that reflect four original ideals.

These ideals include:

- Ladders: LendUp wants to provide an actionable path so that consumers can move up and earn access to more money

- Not Chutes: The business model of this leader among payday loan online lenders is that customers should succeed. There is a sense of collaboration that helps them do just that.

- Transparency: When searching for the top payday loans online, transparency is always essential, and LendUp creates products that are easy to understand, and all information is shared up front, including cost and APR.

- Building Credit Matters: LendUp doesn’t require good credit, but their products reward behaviors that can lead to better credit scores over time.

Business Model

According to LendUp, their unique business model is working. With many payday loan lenders online, the concept is the same. That approach is that repeat borrowers who may have an excellent repayment history are still charged the same interest and fees as first-time borrowers with no company track record.

At LendUp, responsible repayment and financial decisions are rewarded with incentives, including giving repeat borrowers greater access to more loans at lower interest rates. Eventually, borrowers may even be able to earn the option to get credit-reporting loans.

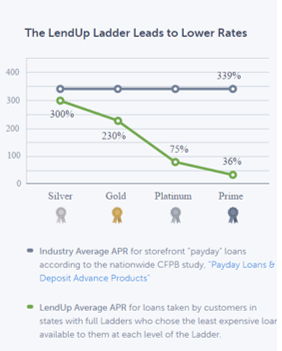

The result is that customers save money. The LendUp average APR for loans taken by customers in states with full ladders is much lower than the industry average APR for storefront payday loans.

Image Source: LendUp

The LendUp Ladder

The LendUp Ladder is the signature program available to consumers who rely on LendUp instead of other online payday loan lenders. This leader among online payday loan companies provides the Ladder program, which lets borrowers earn points. Those points then let them “move up” the ladder and get access to more money at lower rates.

The Ladder includes incentives such as 125 points for beginning your first loan. Then, each time a borrower takes one of the free education courses offered by this top pick among payday loan online lenders, they earn another 125 points.

When a loan is repaid on time, the borrower earns 1,000 points, and when their loan is extended, they receive 500 points.

Borrowers can also earn additional points for creating and submitting a testimonial video or recommending friends who might also like to work with this top pick among online payday loan lenders.

Education Courses

As mentioned above this top pick among online payday loans direct lenders features points-earning opportunities for consumers who take online education courses. In addition to the opportunity to earn points, these courses are valuable in and of themselves and highlight how LendUp is different from many other payday loan lenders online.

Each of the courses includes an easy-to-follow video followed by a quiz.

Some of the courses available through the LendUp Education portal include:

- Credit Building Unveiled

- Know Your Credit Rights

- The True Cost of Credit

- Roadmap to Your Credit Report

- How to Protect Yourself Online

- Pay Yourself First

- Better Budgeting

- Benefits of Your Credit Card

Popular Article: Top Mortgage Lenders—List of US Largest Mortgage Lenders (Reviews)

Free Wealth & Finance Software - Get Yours Now ►

PersonalLoans.com Review

Among online payday loan lenders and online payday loan companies, PersonalLoans.com is often ranked as one of the best. PersonalLoans.com is not one of the online payday loans direct lenders on this list and is instead an online matching service.

Users of PersonalLoans.com may qualify for loans of anywhere from $1,000 to $35,000, and the process is fully based online and is also simple. The ultimate goal of PersonalLoans.com is to provide consumers with fast, easy financing assistance by linking them with reputable lenders.

Key Factors That Enabled Us to Rank This as One of the Leading Places for the Best Loans Online

When reviewing the best online loan companies, whether that be the best payday loan sites or top online payday loan direct lenders, the following are some main reasons PersonalLoans.com was included on this list.

Basic Requirements

One of the biggest reasons consumers may turn to online payday loan companies and the best payday loan sites is because they can’t qualify for a traditional loan. The lending requirements at a bank may be too stringent, and their concern is often that they won’t qualify for any type of financing.

When using PersonalLoans.com, this isn’t the case.

The requirements are simple, and most lenders will accept borrowers without checking their credit score.

The requirements to utilize this leader among online payday loan companies and a resource for the best loans online include:

- Age/ID/residency status

- Income

- Bank account

In some cases, while credit scores aren’t necessary, lenders may require that borrowers show a pattern of responsibility, so there can’t be any active or current bankruptcies, for example

Clearly Defined Rates and Fees

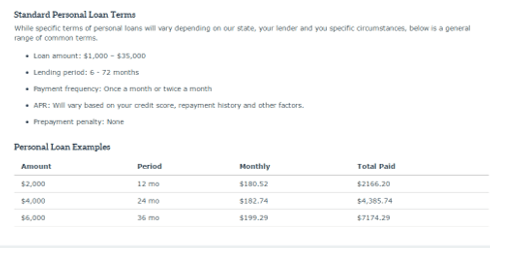

When consumers rely on PersonalLoans.com above many other payday loan online lenders and payday loan sites, they’re going to get the benefit of transparency and clearly defined rates and fees, with information provided up front, so there aren’t surprises.

They also frequently remind consumers they’re under no obligation to accept a loan if they don’t find the terms to be satisfactory.

They explain how repayment works, what is expected of the borrower, and the factors that can impact the cost of a personal loan. They also outline a general range of standard terms.

Image Source: PersonalLoans.com

Different Loan Types

Not all payday loan online lenders or matching websites offer different types of loans, but PersonalLoans.com does, which is something that makes them unique from other online payday loan companies and online payday loan lenders.

One type of loan a consumer might be matched with on PersonalLoans.com is the peer-to-peer loan, which does require a credit score verification, but the loan ranges are $1,000 to $35,000.

Borrowers may also be matched to personal bank loans, but what most people come to PersonalLoans.com for is the Personal Installment Loan. This is a fast, convenient lending product that requires an application with only basic personal and financial information.

Once a borrower accepts the terms they’ve been offered, the loan is deposited into their bank account.

Responsible Lending

As one of the best payday loan sites and a leading place to find top payday loans online, PersonalLoans.com is dedicated to responsible lending. They put in place guidelines and requirements to prevent consumers from being taken advantage of by unfair or illegal practices which may occur in the personal loan industry.

Their code of conduct includes the following:

- Customers are well-informed about the details of the process of borrowing money and their responsibilities, as well as the consequences of failing to pay back a loan

- Customers are assessed to determine whether they’ll be able to pay back a loan

- Clear and transparent information is provided to customers, and they’re treated with courtesy and respect

- PersonalLoans.com is a company that holds itself to the highest standards of service and customer satisfaction

- All lenders this payday loan site works with is reputable and follows responsible lending practices

Read More: Top Best Reverse Mortgage Lenders | This Year’s Ranking and Comparison

Conclusion—Top 6 Best Online Payday Loan Lenders and Best Payday Loan Sites

Payday loans can be a tricky area of personal finance, which is why it’s so important to work with only the best payday loan online lenders or use only the best online loan companies to find a direct lender. Payday loans can carry high fees and interest rates, but they can also be useful or even necessary in an emergency situation or to cover living expenses.

The above list of the best online payday loan lenders and the matching sites that link consumers to the best loans online excel in key areas including honesty, transparency, and responsible lending.

Each of the names on this list of payday loan online lenders and the best payday loan sites also offers great customer service, and they walk consumers through each step of the process, so they’re not blindsided by misconceptions about the terms or details of their loan.

Related: Top Best Online Loan Lenders and Companies

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.