Overview: Santander Bank Reviews

There is a mixed bag of Santander reviews published on the web, which makes it difficult to actually answer the question, “Is Santander safe?” To respond to this query accurately, it is important to understand three important concepts:

- Santander UK is a stand-alone subsidiary

- Clients of Santander UK are protected under the FSCS

- After the 2011 drop in Moody’s ratings, Santander reviews and ratings have improved significantly

This Santander review article provides detailed information on these concepts. It also explores the bank’s history and current standing by summarizing other Santander reviews on each end of the spectrum – from Santander mortgage reviews to Santander loan reviews.

Image Source: BigStock

See Also: Nationwide Bank Review – What You Need to Know! (Auto lending, Loan & Mortgage Reviews)

“A Bank for Your Ideas”: What Is Santander UK?

As with most large corporations, Santander UK is a collage of mergers, combinations, and re-branding. According to its website, the corporation began in 1849 as the National Freehold Land and Building Society. Various transitions took place, resulting in the formation of Abbey National plc, which was acquired by Banco Santander in 2004.

To better understand Santander bank reviews, it is essential to know that the UK branch is separate from the Spanish banking crisis. A little background on Santander UK and its parent company, the Spanish Santander Group (Barco Santander), dissolves some of this confusion.

Santander UK’s parent company, the Spanish Santander Group (Banco Santander), is rated:

- #31 on Forbes’ “The World’s Biggest Companies” (2015)

- #72 on Forbes’ “World’s Most Valuable Brands” (2016)

Santander Group currently has operations across North America, Europe, Latin America, and Asia.

I’m Not with Those People

Although branded and wholly owned by Barco Santander, this branch was born and raised in the UK. It operates autonomously. This means that, in the event of another financial crisis, it would be virtually impossible for the Spanish bank to suck out massive funds from its UK branch.

So, “Is Santander safe?”

This is not a simple answer. It is, however, pertinent to note that, after the Spanish banking crisis, Santander UK was rated as “more stable” than its parent company.

Don’t Miss: Bank of the West Reviews – Everything You Need to Know (Rewards, Wealth Management & Review)

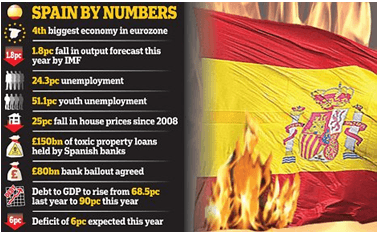

More on the Spanish Banking Crisis

Image Source: Positivemoney.org

A deeper understanding of the Spanish banking crisis (also known as the Great Recession in Spain) sheds light on why investors have asked, “Is Santander safe?” Reuters cleverly compared Spain’s financial dilemma to a “hangover” resulting from a decade-long building boom – which ended in 2008 – that left lenders with approximately 300 billion euros in loans to builders.

This amount was nearly 1/3 of the country’s gross domestic product.

Coupled with two recessions and a high unemployment rate, the possibility of defaulting on business loans and mortgage payments increased.

What is Santander’s relationship to the Spanish Banking Crisis? Santander UK’s parent company, Barco Santander, was founded in Spain and was affected by the Great Recession. It is important to note, however, that the Santander Group ploughed bravely through the Spanish crisis and emerged relatively unscathed.

Emilio Botín, who was the executive chairman of Barco Santander until his death in 2014, repeatedly stressed that Santander was not a Spanish bank. Santander is a strong, diversified company with market shares of 10% or more in 8 different countries, including the UK.

Euromoney.com even labelled Santander as the “most efficient large bank in the world” after its remarkable recovery from the banking crisis.

There was a panic during the Spanish financial crisis that drove many to Google “Is Santander safe?” out of concern for the money they’d invested in the UK branch. As in the aftermath of the Great Depression of the 1930s, people are still rebuilding their trust in banks – like Santander – after the effects of the Spanish banking crisis and the Great Recession as a whole.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

FSCS Protection . . . You’ll Probably Never Need Us

“You’ll probably never need us. But it’s nice to know we’re here.” –FSCS Slogan

In the unlikely event of a bank going bust, the Financial Services Compensation Scheme (FSCS) offers the following protection for Santander UK accounts:

- Individuals: up to £75,000

- Joint accounts: up to £150,000

In Martin Lewis’s (Moneysavingexpert.com) insightful Santander review, he explains that it is possible to diversify your banking to protect access to immediate funds in case of crisis. For example, some individuals may find it practical to keep only £75,000 or less in their Santander UK account so that they can withdraw those funds immediately during the FSCS 7-day period.

So far, the FSCS has “paid out more than £26 billion in compensation.”

Related: Moven Review – What You Need to Know! (Reviews)

Ratings on the Rise

Despite years of bad customer service ratings, Santander UK has worked hard to improve its services . . . and it shows.

Many Santander reviews provide evidence that the bank is aware of these problems and that it has taken visible steps to improve customer service. In a Telegraph Money survey, readers were asked if Santander had improved in the last four years. 77% of 1,700 voters said, “Yes!”

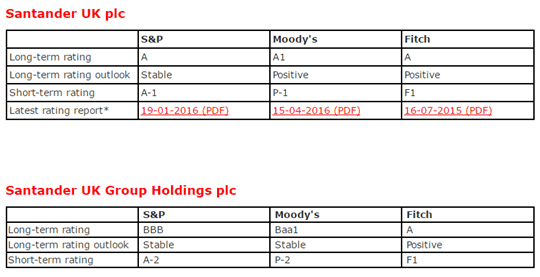

In 2012 specifically, Santander UK’s Moody’s ratings dropped dramatically. Since then, its ratings have improved substantially, and, on 13 April 2016, Moody’s upgraded Santander UK’s long-term deposit rating from A1 to Aa3.

Image source: Santander.co.uk

On the Santander online UK banking website, Santander highlights the acquisition of “4.8 million 1|2|3 World customers, adding 131,000 new customers since the beginning of 2016” and firmly states, “Customer satisfaction remained strong with continued improvement at the heart of [their] plan.”

Good work, Santander.

Our Perspective: AdvisoryHQ’s Santander Reviews

In our own Santander bank reviews at AdvisoryHQ, we’ve given Santander accolades in the following areas:

| Rating/List | Why | When |

| Best Banks in the UK | The substantial yield on the 1|2|3 Current Account Up to 3% AER | May 2016 |

| Best Current Accounts – UK | The 1|2|3 Current Account Up to 3% AER paid up to £20,000 with a £500 monthly minimum deposit | April 2016 |

| Best Stocks and Shares ISA Accounts – UK | Awarded for the Santander: | April 2016 |

| Best Cash ISA Rates – 2015–2016 (UK) |

| April 2016 |

| Top Junior ISAs | 1|2|3 Junior ISA | April 2016 |

| Best Savings Rates UK | 0.50% AER | April 2016 |

It is evident that Santander UK has pulled itself out of the proverbial muck and mire of the Great Recession and stands strong as one of Europe’s leading financial institutions.

Santander Mortgage Review

Santander UK’s website claims, “We’ve helped UK homeowners with mortgage gross lending of £7.1bn, of which £900m was to first time buyers.”

Despite this focus, there is a negative 1.3/5 Santander mortgage review rating on Reviewcentre.com (as of May 16, 2016). More importantly, websites like Telegraph Money have published widespread articles regarding “Santander’s apparent deliberate policy of forcing borrowers most at risk of failing into arrears to pay the highest mortgage rates.”

In 2014, finance editor Richard Dyson tells the story of a couple who contacted Telegraph Money, claiming that Santander was raising their fixed mortgage rate of 3.99pc to 4.74pc, which is a 20pc increase.

The family had been undergoing financial stress, due to the mother quitting her job in order to take care of her three children –one of whom was autistic. This rate was significantly higher than the ones currently offered to new customers, and the frustrated parents described Santander’s actions as “predatory.”

Finance journalist Nicole Blackmore expanded upon these issues in a more recent Santander mortgage review in Telegraph Money. She references 500 complaints from long-term customers who were trapped into high mortgage rates by Santander.

So, is Santander safe? Perhaps, your money is safe with Santander UK, but your existing mortgage rates may be affected by these policy changes.

Popular Article: Woodforest Bank Reviews – Should You Use Them? (Second Chance Checking & National Bank Reviews)

Santander Loan Review – Personal Loans

Santander offers a high-quality personal loan package to its 1|2|3 customers. Rates start at 3–5% APR on loans from £7,500 to £20,000 with:

- 12 to 60-month payback options

- Fast decision times

- A handy loan calculator

You can use its improved Santander online UK banking service to calculate your custom interest rate. In contraposition to negative Santander mortgage reviews, general personal Santander loan reviews trend on the positive.

Santander Current Account Review

Between April and June of 2014, 78,000 Britons switched to Santander. The biggest incentive was the 1|2|3 Current Account. This account offers:

- Cash back on certain household bills:

1% on water, council tax, and first £1,000 paid towards a Santander monthly residential mortgage payment

2% on gas and electricity

3% on home and mobile phones, some TV packages, and broadband Internet

- 3% monthly interest (for certain amounts)

- Special deals on a variety of Santander products

(see Santander.com for details)

In order to receive interest and cash back, clients must:

- Deposit £500 into the account every month

- Actively use 2 direct debits

(see Santander.com for details)

Here, at AdvisoryHQ, we included Santander 1|2|3 in our list of the Best Current Accounts in the UK. As of 17 May 2016, the Santander current account reviews on smartmoneypeople.com gave the bank 4.41/5 stars. The monthly account fees did increase in January of 2016, but the cashback option may make up the difference in specific cases.

Is Santander UK Right for Me?

The information in this Santander review is designed to assist you in making the best banking decisions for your particular needs. Yes, Santander is, in many ways, just as “safe” as other banks regulated by the FSCS.

It is your prerogative to select your bank of choice, and when doing so, here are some important questions you might consider:

- Is Santander the right bank for me?

- Do I feel safe keeping my funds in one bank, or should I diversify?

- If considering a mortgage, do I feel comfortable with the negative Santander mortgage reviews?

- Do I like Santander’s online UK banking service?

- Does the 1|2|3 Current Account fit my needs?

If you would like some assistance in answering these questions, we recommend contacting Santander UK directly for the most up-to-date information available.

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.