Betterment vs Vanguard: Getting Started with Investing

Everyone is eager to grow his or her money, but not everybody cares or has the time to learn how to do it. As a result, people often plop their money where they’re sure it’s safe: their savings account.

Putting your money in a savings account is much like stuffing it in your mattress: it’s relatively safe so long as something doesn’t happen to the bank (or your house), but it isn’t really doing much.

A desire to do something productive with their money has earners considering options like Betterment investing or a Vanguard advisor.

Image Source: Betterment Investing

Vanguard investments pioneered low-cost mutual funds. Its founder, John C. Bogle, had come to an interesting conclusion over the course of his study of the markets. He found that actively managed funds only beat out passive stock picking about a quarter of the time. The philosophy at the time was that mutual funds were profitable based on the expertise of the fund managers who did the picking and that expertise was meant to justify the fees that were charged, whether the fund performed well or poorly.

Instead, Vanguard investments focused on creating and selling index-tracking funds. Instead of beating the market, they would match them. Tracking funds significantly cut costs since there was not as much money being spent on paying an army of Vanguard advisors. Instead, they would simply buy all the securities on a specific index in the hopes of matching those returns.

This was a smart strategy considering that, in the grand scheme of things, most serious investment goals are not affected by market volatility. Someone saving for retirement can weather short-term fluctuations in their assets’ prices, so long as they have chosen companies with overall solid performances. Tracking popular indices, as Vanguard’s funds do, provides great assurance of this; companies only end up on such indices if they exhibit good performances on average.

See Also: Top Robo-Advisors (Reviews) | A Changing Trend in the Robo-Investment Field

Betterment vs Vanguard: The New Kid on the Block

Vanguard investments have been around since the 1970s, and currently manage $3 trillion worth of assets. It has established a reputation for providing solid and trustworthy investing advice for its clients, and its success is an indication of that. It has managed to take a bite out of Wall Street’s revenues from heavy trading and fees, and that mouthful is only set to get bigger.

Yet in the same way that Vanguard’s investments via passively managed funds disrupted the legacy system of actively managed mutual funds, new players from the financial technology industry are attempting to do the same thing. Household names like PayPal have already changed the way we exchange money, and now FinTech platforms like Betterment investing, known as “robo-advisors,” are attempting to do something similarly disruptive to investing.

Betterment investing is meant to perform a similar function to Vanguard investments – just cheaper and with more accessible entry. It also seeks to differentiate itself from institutions like Vanguard by positioning itself as a more personalized alternative to the popular investment company.

Typically, FinTech companies have marketed themselves as an alternative to the outdated or untrustworthy legacy systems of traditional financial institutions, but clearly this differentiation is not as effective against an industry icon like Vanguard.

Betterment states that while “Vanguard makes great stuff…Betterment makes great stuff for you.” Betterment returns to its sub-industry’s differentiating factor: the technology that underlies its financial services, which it uses as an example of how it makes investment advice available to all of its users.

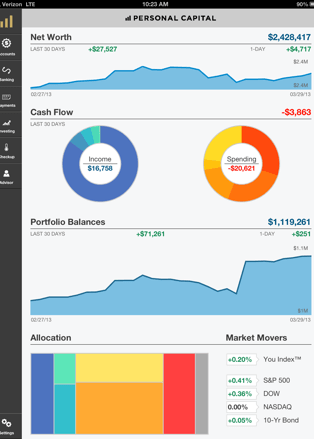

Image Source: Tracking Your Net Worth

Betterment vs Vanguard: How Does Betterment Work?

Despite fierce competition in the robo-advising sphere, one service has managed to differentiate itself from the rest: the Betterment investing platform.

Betterment has three billion dollars in assets under management. While Betterment pales in comparison to Vanguard in that respect, it is still rightfully impressive considering Betterment was only founded in 2008.

The Betterment investing platform stands out for a number of reasons: it’s affordable, it has easy entry, and its investing strategy is personalized and goal-oriented. Like many of the robo advising investment apps on the market, Betterment uses exchange-traded funds (ETFs) and does not charge commission or transaction fees to its users.

Betterment investing is great for individuals who are eager to start investing but either do not know enough (or are not inclined to learn more) about the markets. It is an investing platform that lets investors stand back while the platform does the work for them. Aside from regularly contributing money to grow their Betterment returns, investors can walk away from the app and know their money is being managed.

The Betterment investing strategy uses Modern Portfolio Theory (MPT), which places importance on diversifying your assets to minimize risk. An individual’s Betterment portfolio can take advantage of up to twelve different ETF asset classes that are chosen based on the person’s time horizon and risk tolerance.

Users also have a number of Betterment investing options. Betterment returns are not limited to personal investing. The platform supports a number of different investment accounts and activities:

- Individual and joint investing accounts

- Traditional IRA

- Roth IRA

- IRA rollovers

- Trusts

Keep in mind that while it is possible to roll over retirement accounts to your Betterment investing account, transfers can only be apples to apples: traditional IRAs can only be rolled over to traditional IRA Betterment accounts, and Roth IRAs can only be rolled over to Roth IRAs Betterment account.

Don’t Miss: Best Online Financial Advisors (Human Advisor, Robo-Advisor, and Hybrid)

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Betterment vs Vanguard: Getting Started

When users first visit the Betterment investing tool, it asks users three easy questions:

- How old are you?

- Are you retired?

- What is your annual income?

These three questions allow the Betterment investing software to show the user what investing vehicles they should prioritize (i.e. emergency fund, retirement, general investing) and in which order. The platform also recommends which amount of their portfolio should be invested in stocks and which amount in bonds. Users can later adjust this with an easy slider tool to shift the allocation in one direction or the other.

This goal-based investing provides a more realistic, sustainable strategy. Users can set up multiple accounts with Betterment investing for an emergency fund, a retirement account, or an investment account specifically geared toward saving for a house or a trip. This target-based savings paradigm is a feature that has made Betterment greatly successful.

Betterment vs Vanguard: Fees and Minimum Investments

Image Source: Vanguard Investing

One of the popular features of the Betterment investing service is that it requires no minimum deposit. Whereas Vanguard has minimum deposits (that vary depending on the investment vehicle you choose), Betterment allows beginners to start with as little as they like.

This does not mean that there are no Betterment fees. They are simply more appealing and designed to let you get into the investing game easily. For instance, while Betterment does not have a minimum deposit, users with account balances of less than $5,000 dollars have a management fee of 0.35%. Additionally, those with a balance of less than $5,000 who do not set up monthly auto-deposits of at least $100 are charged $3 a month.

The pricing further adjusts based on how much an individual holds with Betterment’s investing service. Based on the amount, the fee can go down to as little as 0.15%.

Related: Betterment vs. Wealthfront vs. Vanguard – Ranking & Review

Vanguard vs Betterment: Different Fund Types

Regardless of which service you choose after comparing Vanguard vs Betterment, some individuals may still be confused about the financial products that serve as the backbone of these companies. You may be asking: what on earth is the difference between mutual funds and exchange-traded funds? Or even, what is an index fund? And can there be a mutual fund that is an index fund?

What Are Mutual Funds?

A fund is a collection of money and mutual refers to a relationship between two or more people. A large number of individuals contribute money to a fund, and fund managers, in most cases, use this money to pick stocks and bonds. Investors can sell their “piece” of this larger fund at the end of the day and receive the net-asset value (NAV). Vanguard investment company’s new approach to mutual funds is what they are most famous for.

What Are Exchange-Traded Funds?

Exchange-traded funds operate in much the same way, except they can be traded on the stock market like other securities. FinTech companies like Betterment’s investing program use exchange-traded funds. The fundamental difference between exchange-traded funds and mutual funds is that intraday trading is possible with exchange-traded funds, while it is not with mutual funds.

There is a common misconception that exchange-traded funds are all index funds. This is not necessarily true, although they are popularly discussed in this context.

What Is an Index Fund?

The concept of a fund that tracks an index was perpetuated by Vanguard investments founder John C. Bogle and became the foundation for his eventual success. Essentially, a fund that tracks an index buys all the securities on a reliable index and aims to match the market instead of beating it. Since these indices are usually reliable samples of the overall stock market, there is not as much risk as simply picking a few stocks and hoping to gain big returns.

A non-index fund has a fund manager who charges a fee for their services. Actively managed funds are scrambling to keep customers who can no longer justify paying both when they gain and when they lose, especially when there’s a lower-cost alternative like the indexed mutual and exchange-traded funds offered by companies like Vanguard investments.

Popular Article: Best Online Investment Companies | Review and Ranking for Online Investing

Vanguard Personal Advisor Services vs Betterment

As a large investment firm, Vanguard makes financial advisors available to its clients. In keeping with their low-cost investing model, the Vanguard personal investor service mixes the technology of the FinTech world with the human interaction of the traditional world of financial advice.

The Vanguard software handles much of the grunt work of your portfolio, but users have access to a Vanguard financial advisor who oversees their account and helps with selections and asset allocation. However, Vanguard Personal Advisor Services vs Betterment have a steeper buy-in. Those wishing to use it are required to have a minimum account balance of $50,000. That said, those who can afford it would benefit from a fee that is only 0.30% of the total assets under management each year.

In this way, for those looking to start investing with a small amount, Betterment may be the more affordable option. Individuals hoping to start investing for retirement, but who cannot put aside a large chunk of cash just yet, will find that in a Betterment vs Vanguard LifeStrategy comparison, Betterment is the more affordable option, at least in the beginning. The Vanguard LifeStrategy fund is meant for investors who have a long-term goal, such as retirement, and carries a minimum contribution of $3000. Then again, Betterment, like other robo-advisors tend to use indices generated by companies like Vanguard, so it’s important to note that if you were leaning toward Vanguard, and can afford it, Betterment may simply be an unnecessary middleman.

Both investment portals have experienced success and happy reviews from users. The ultimate decision comes down to affordability. While Betterment users express happiness with the platform and its ease of use, when it comes to reputation and results, the Vanguard investment company has established a reputation for putting its clients first with sound, realistic financial planning.

Read More: Betterment Review – Returns, Fees, and All You Need to Know

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.