Intro: Why Choose Stash Investing?

With online accessibility increasing and new investing apps popping up left and right, managing your finances is becoming more convenient than ever.

For new investors, however, there’s no denying that navigating through financial jargon can quickly become discouraging.

Not only is the verbiage confusing, but the process of signing up for an investment app is often complicated by high investment requirements and tons of financial products to choose from.

A popular option for new investors is Stash, an investing app that seeks to “empower a new generation of investors.”

What is Stash? Simply put, the Stash Invest app is on a mission to transform the complicated, jargon-filled investment process into one that is simple, accessible, and affordable.

Our Stash investing review will focus on answering common consumer concerns about basic functionality, safety, and security of the Stash Invest app, including:

- What is Stash investing?

- How does Stash work?

- Is Stash safe?

- Is Stash Invest legit?

- Is Stash Invest worth it?

For newcomers to the world of investment apps—or for those who simply want to explore other options—our Stash investing review will help you determine if investing with Stash makes sense for your financial goals and needs.

Stash Investing Review | What is Stash?

Founded in 2015 and backed by over $78 million in funding, Stash investing offers investing access and advice to an often-overlooked market—smaller, individual investors.

As co-founder and CEO Brandon Krieg explains in an interview with CNN Money,

“Stash is the solution for millions of Americans traditionally ignored or taken advantage of by big investing firms…Almost all of our customers are first-time investors.”

The Stash investing app has been featured in a variety of financial publications, including Fast Company, Forbes, TechCrunch, and more.

What is Stash investing? One way to answer this is to look at the types of investors that it attracts.

With a stern focus on accessibility, simplicity, and affordability, investing with Stash is uniquely tailored to:

- Millennials

- New investors

- Low-volume investors

- Military families

With the addition of Stash Retire, some potential users asking, “What is Stash?” will be happy to know that Stash can now be used to save for retirement through tax-advantaged accounts.

Ultimately, the best way to answer the question, “What is Stash investing?” is to get down to the basics of how Stash works.

Don’t Miss: Best Portfolio Management Software | Ranking | Top Investment Management Tools

Stash Investing Review | How Does Stash Work?

Those wondering, “How does Stash work?” will be relieved to know that investing with Stash is a simple process.

The online sign-up process can be completed in just a few minutes by inputting your email address, creating a password, and indicating whether you have mobile access through Android or iPhone.

Although users can find general information about Stash investing through the website, investing with Stash is done strictly through the Stash Invest app.

Our Stash investing review found that the Stash Invest app is available for free on Android and iPhone, making it easy to start investing with Stash.

All-in-One Change Management Tools

Top Rated Toolkit for Change Managers.

Get Your Change Management Tool Today...

Stash Investing Basics

After taking a Stash investing quiz to determine your optimum risk profile, users receive access to over 30 Exchange-Traded Funds (ETFs).

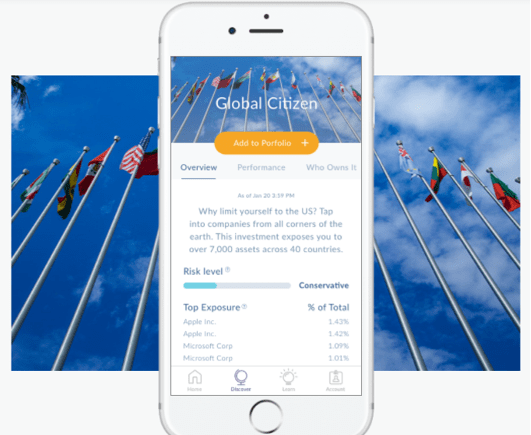

This is what really sets Stash investing apart—rather than group ETFs with confusing financial jargon, each fund is given a fun, descriptive nickname to describe the industries within it.

Thus, investing with Stash means choosing collections that reflect your personal values and unique financial interests. A few examples of available ETFs include:

- American Innovators

- Blue Chips

- Clean & Green

- Defending America

- Global Citizen

- Water the World

Here enters a big difference between Stash investing and other investment apps: Stash is not a robo-advisor.

Instead of automatically choosing investments, the Stash investing platform will provide recommendations and advice, which users must take initiative to either follow or disregard.

For additional information, our Stash investing review found that their Quick Start Guide is a great resource to help new users adapt to the platform.

Stash Investing Pricing

Although the Stash invest app is free, investing with Stash is not entirely without cost. Accounts under $5,000 have a fee of $1 per month, while accounts over $5,000 will have an annual fee of 0.25 percent.

Still, our Stash investing review found that the overall pricing structure makes Stash investing incredibly affordable. This includes:

- $5 account minimum

- No withdrawal fees

- No add-on commissions

- No trading fees

- First month free

Stash Retire

Our Stash investing review found a new service for those interested in investing with Stash, called Stash Retire.

Introduced in June and July of 2017, Stash investing is offering Roth IRAs as a long-term investment tool.

With as little as $100, users can start investing with Stash for their retirement savings—or at the very least until they turn 59 ½.

Related: Quicken Review – Three Versions of Quicken (Which One is Right for You?)

Stash Investing Review | Is Stash Safe?

One of the biggest concerns to address is whether the Stash Invest app is safe and secure. To answer the question, “Is Stash safe?” we took an in-depth look at how the Stash Invest app keeps your financial information secure.

There are a few methods that Stash investing employs to ensure that all information is safe and secure, including:

Encryption

The Stash Invest app uses 256-bit encryption to keep investing with Stash as secure as possible.

Everything from personal information to transaction history is protected by Secure Sockets Layer (SSL), meaning that you can safely use Stash investing without worrying about compromising your data.

Identity Verification

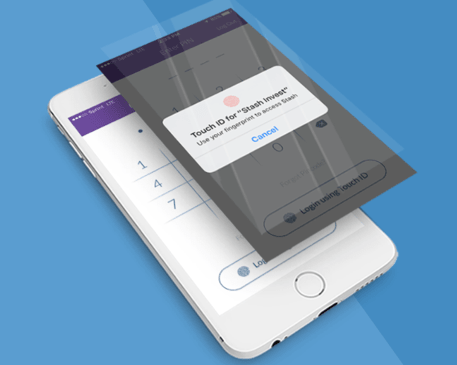

All Stash investing accounts require a user ID, a password, and a PIN.

To increase security, you can opt to log in through fingerprint technology or your PIN, though using your fingerprint is the best way to ensure that your account information stays private.

Session Timeouts

If your account is inactive, your session will automatically end. While signing in again may be frustrating, it’s important to remember that this prevents unauthorized access to your Stash investing accounts if you accidentally leave your phone unattended.

With a combination of encryption, multiple identify verification methods, and periodic session timeouts, our Stash investing review can confidently answer “Is Stash safe?” with yes, Stash is safe and secure to use.

Popular Article: Detailed Wave Accounting Review – Is Wave Safe? Wave Accounting vs QuickBooks

Stash Investing Review | Is Stash Legit?

Along with “Is Stash safe?” a good question to ask is, “Is Stash legit?”

Although Stash is not yet a publicly traded company, the Stash Invest app has plenty of financial backers behind it. In fact, the company has raised over $78 million in funding since 2015.

What about proven results from users who have started investing with Stash? According to Fast Company, as of January 2017, the Stash Invest app had 360,000 users.

Additionally, 40 percent of those investing with Stash were actively using the auto-deposit feature to set aside an average of $20 each week.

If this average continues, auto-deposit users alone could potentially bring in $150 million in AUM for 2017—an impressive figure for such a new company.

With a strong user base of regular investors, it’s hard to argue against the legitimacy of Stash investing.

As previously mentioned in our Stash investing review, the Stash Invest app has been mentioned in a wide range of well-regarded publications, a fact which certainly supports the legitimacy of the company.

With millions of dollars in funding, a strong user base, and national recognition, users can rest assured that yes, Stash investing is legit.

Read More: Top Day Trading Tools (Review of the Best Trading Software and Apps)

Free Wealth & Finance Software - Get Yours Now ►

Conclusion: Is Stash Invest Worth It?

Is Stash Invest worth it? For experienced investors, the simplistic interface offered by Stash investing will likely be frustrating, rather than welcoming.

On the other hand, if you’re new to investing and are looking for a simple, engaging approach, then Stash investing is certainly worth a try.

Not only does the Stash Invest app come with a colorful, user-friendly interface, but the unique categorization of ETFs by nicknames eliminates confusion from unnecessary financial jargon.

Keep in mind, however, that the $5 minimum balance can be deceiving.

You’ll have to continually add money to your Stash investing account to avoid having that initial investment get eaten away by the $1 monthly fee. In fact, Stash recommends investing $5-$10 each week.

It’s also worth mentioning that investing with Stash is best done by paying close attention to personalized investment advice and educating yourself with their online learning center.

While the Stash Invest app provides all the necessary tools, Stash investing isn’t automatic. Ultimately, it’s up to you to choose the best investments for your financial goals.

Image sources:

- https://www.stashinvest.com/

- https://www.stashinvest.com/security

AdvisoryHQ (AHQ) Disclaimer:

Reasonable efforts have been made by AdvisoryHQ to present accurate information, however all info is presented without warranty. Review AdvisoryHQ’s Terms for details. Also review each firm’s site for the most updated data, rates and info.

Note: Firms and products, including the one(s) reviewed above, may be AdvisoryHQ's affiliates. Click to view AdvisoryHQ's advertiser disclosures.